- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Estimated Taxes interview error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Taxes interview error?

Can someone tell me why 2019 software asks for Federal withholdings two times when estimating for 2020?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Taxes interview error?

2019 TurboTax software asks for Federal withholdings only once in TurboTax Desktop. If you are using TurboTax Online you could post a picture of the screens.

Based on the date, you may no longer need estimated tax for 2020 at this time. However, click here for information about what you may owe for 2020, if you anticipate that in your situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Taxes interview error?

Thanks for the reply and yes, I had to rely on the paper form to do the estimate which is unfortunate. Turbotax 2019 Mac desktop did ask me twice for withholdings - once next to my earnings based on my W2 and at the end of the interview. It should also probably tell people a little more specifically what they should put in from their YTD figures on their pay stubs as a best estimate. Please have someone check that double entry (I am a CPA but not a tax person). Turbo's answer to my estimate was also way off of what Form 505(and related worksheets) said with the same information. Interested to see what the basis for this was.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Taxes interview error?

I have a similar problem. The Turbotax 2020 interview is giving me obviously erroneous results for estimated taxes for 2021. I have an SEP-IRA for which I am required to take minimum required distributions. Those distributions were suspended for the 2020 tax year, leaving me with a large refund for 2020. But when I added in that amount for my 2021 estimate, Turbotax told me my estimated income for 2021 would be much lower than for 2020. Something is seriously wrong in the calculation or the interview. I am using the Desktop version on a Mac.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Taxes interview error?

Your SEP-IRA should be entered as a positive number under Enter 2021 Other income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Taxes interview error?

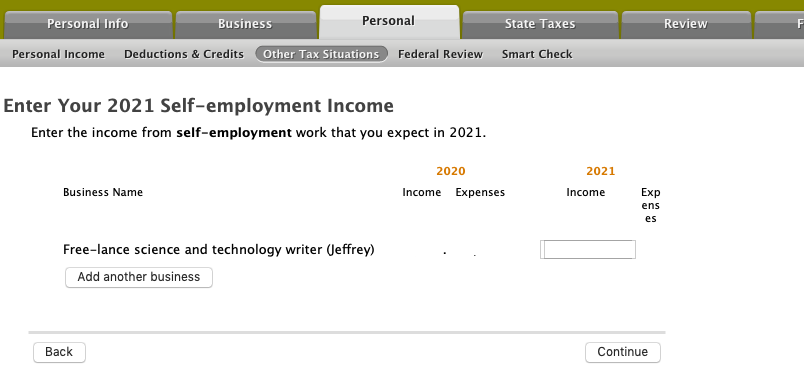

I tried entering a positive number into the self-employment, but the Easy Step interview does not show both Income and Expense boxes, and when I entered a positive number into the only box displayed (see below) TurboTax interpreted it as a negative number. (I had numbers in the 2020 side by removed them for privacy). I was able to get correct figures into the Forms interface, but not into the EasyStep instructions. You need to fix the EasyStep. (It would also help to include on the W4 page instructions that mentioned Estimated Taxes. show that the Easy step instructions are for Estimated Taxes as well as for form W4. Although the "other tax situations" page does say W4 and Estimated Taxes, when I went through EasyStep I came directly to the W4 page which does not mention estimated taxes, leading me to skip it because I pay quarterly. Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

STAWB

Level 2

JRPATEL-AHMEDABAD

Level 1

Stolat

Level 2

Rates Payer

Level 3

velvetmonster

Level 2