- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- earned income from the discount of qualified ESPP and ROTH contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

I waited over 2hrs from IRS help and got nowhere but a disconnected line.

From what I understand from an earlier discussion below, the discount from a qualified dispostion of qualified ESPP counts as earned income that counts as "compensation" towards a ROTH contribution. I.e. is

the following still true?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

As long as the amount is reported to you in box 1 of a W2 then it absolutely still counts as compensation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

Thank you! but my ESPP was over 10 years old and I don't think I ever received a W2 from my former employer which may no longer be in business. I have to create a W2 myself?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

No. You have to contact your former employer and request that they issue one to you. If they are out of business you may be out of luck.

If it is not reported on a W2 then it does not count as earned income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

@RobertB4444 I didn't get the ESPP discount added to my W-2. I am getting this question in this form "Compensation Income from Employee Stock Transactions" asking if this is earned income. Will that be "no" then, because it wasn't added to W-2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

Just to clarify, in which form are you getting this question? ESPP discount "is" earned income regardless of whether it is included in the W2 wages or not. It would be reported in this screen

You would start off by going into Personal Income/

then all the way at the bottom, hit Misc. income

then "Other income not already reported on a Form W2 or 1099

then on next screen, Did you receive "Other Wages," hit yes

then hit Continue, continue, continue until you get to this screen

Next screen, enter Source of Other Earned income, select "Other'

and then back to the 1st screen

in which you'll put the Description which is Espp discount and amount.

Then click "Done"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

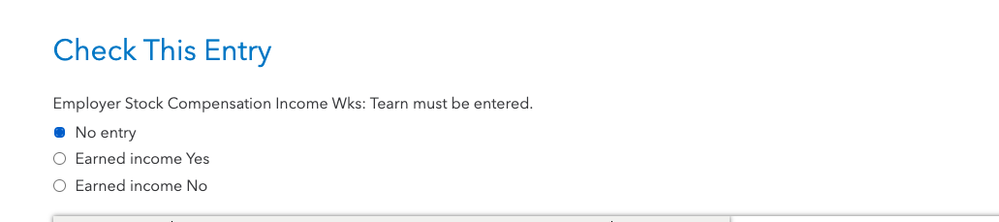

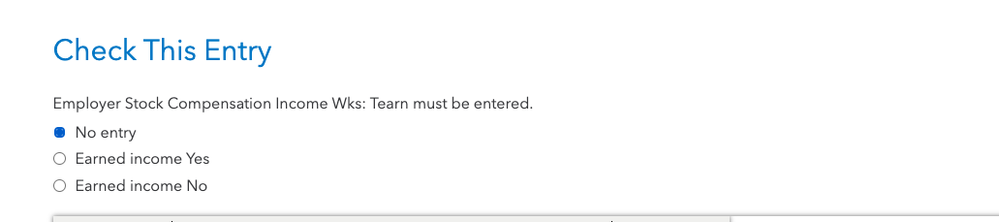

So I am using the web version of Turbotax and I put the ESPP via the 1099-B where I adjusted my cost basis and then selected the discount not included in W-2 option. All was good and well and then in the federal review it asks me this:

This shows up under this form "Summary of Compensation Income From Employee Stock Transactions:

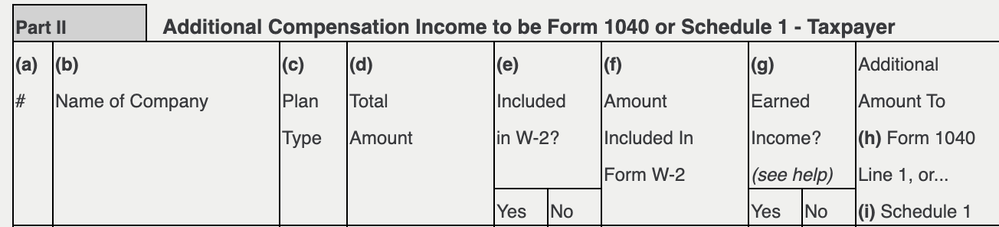

I think this is the section where it needs this information:

It already has amount 0 in the (f).

I am not sure what does the "Earned income?" mean here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

Does the Espp discount show up under that earned income column?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

@AbrahamT I have plan type (c) as ESPP, then the total discounted amount in (d), 0.0 in (f) and then the total amount again in (h)

The Earned income column has two options Yes and No (and not amount). This is the same as what it wanted me to select at the top of page:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

In that case, you would select Yes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

I understand that for me it would be earned income.

Just for my understanding, when can it be non-earned income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

ESPP discounts are always earned income as they are considered compensation. The confusion comes from the sale of ESPP stock which can either be capital gains or regular income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

Not really sure what this means "The confusion comes from the sale of ESPP stock which can either be capital gains or regular income." for me as the money on that page is the discount I was given.

I will just say earned income yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

earned income from the discount of qualified ESPP and ROTH contribution

That is the right answer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ir63

Level 2

keeponjeepin

Level 2

les_matheson

Level 2

Tax_right

Level 1

puneetsharma

New Member