- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- DO I NEED EXEMPTION NUMBER TO AVOID HEALTH INSURANCE PENALTY FOR NJ STATE TAX

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DO I NEED EXEMPTION NUMBER TO AVOID HEALTH INSURANCE PENALTY FOR NJ STATE TAX

I am full year tax resident of NJ state, and my wife came to USA for the first time in august. I am filing a joint return, I had insurance for myself, and my wife had insurance from august. so, do i need to file exemption for my wife to avoid penalty for not having insurance for 7 months?

if answer to above question is yes then i have a following question:

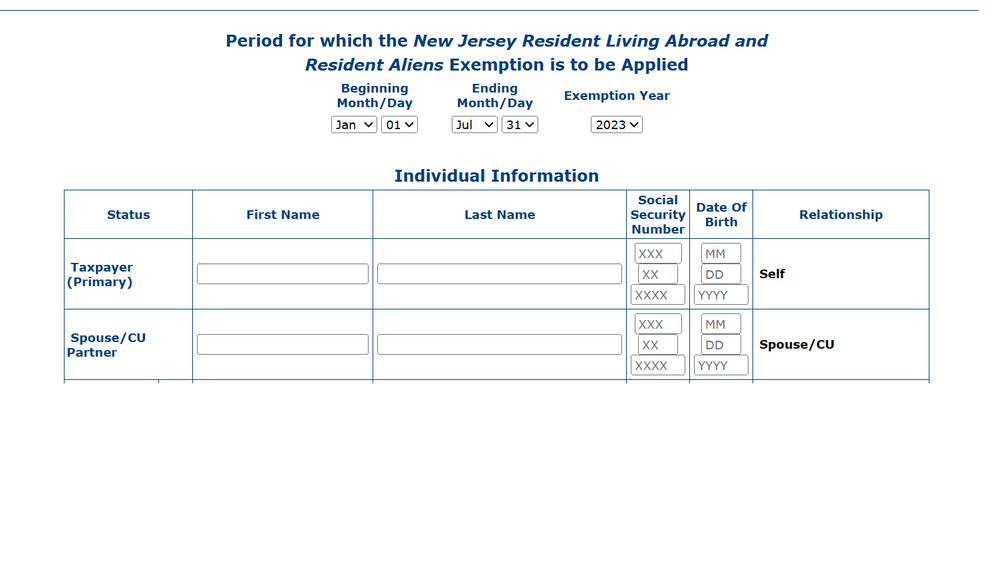

while I am trying to complete exemption form -

form is asking to enter taxpayer (primary) name: relationship (self)

and spouse/CU partner name: relationship (spouse)

Do i have to put my wife's name in primary. and mine in spouse column? or

my name in primary as I will be the primary taxpayer and wife name in spouse but again, I am filing this form to get exemption number for my wife.

Thank you for your help in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DO I NEED EXEMPTION NUMBER TO AVOID HEALTH INSURANCE PENALTY FOR NJ STATE TAX

You are still the primary taxpayer so your name should be listed first.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

franco-pech

New Member

taxun

Returning Member

TR2022

Returning Member

basitsheikh1

New Member

jiyeonparkrn

New Member