- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Distributions to Shareholders....what form does that end up on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Distributions to Shareholders....what form does that end up on?

When you answer the 'distributions to shareholders' question on Turbotax Business, what line do they enter that and on what form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Distributions to Shareholders....what form does that end up on?

In TurboTax Business, distributions to shareholders for an S corporation are typically reported on Schedule K-1 (Form 1120-S). Specifically, these distributions are entered on Line 16d of the K-1.

If you aren't referring to an S corporation please reach back out and clarify.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Distributions to Shareholders....what form does that end up on?

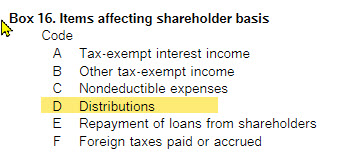

It is for S Corp. However, on the K-1 I only see a 16 that says 'Items affecting shareholder basis' and don't see a D On the 1120S I see on line 16 'Loan balance at the beginning of the corporation's tax year.'

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Distributions to Shareholders....what form does that end up on?

Would it be line 6 on 1120S?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Distributions to Shareholders....what form does that end up on?

On Form 1120S Schedule K-1, distributions are reported on Line 16 using Code D. The list of codes generally supplied with Schedule K-1 shows the description for Code D as "Distributions" (see below).

You'll also find total distributions on Form 1120S Line 16d.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DIY_Tax_Person

Level 3

Kaohsiung1940

New Member

joao1

New Member

deniser2d2

New Member

chans209

New Member