- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Constantly get "Hmmm. Looks like that bit of info isn't available right now."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Constantly get "Hmmm. Looks like that bit of info isn't available right now."

I'm very surprised I haven't found anyone else reporting this. I have it on my computer and my phone and I remember from last year and I think even the year before.

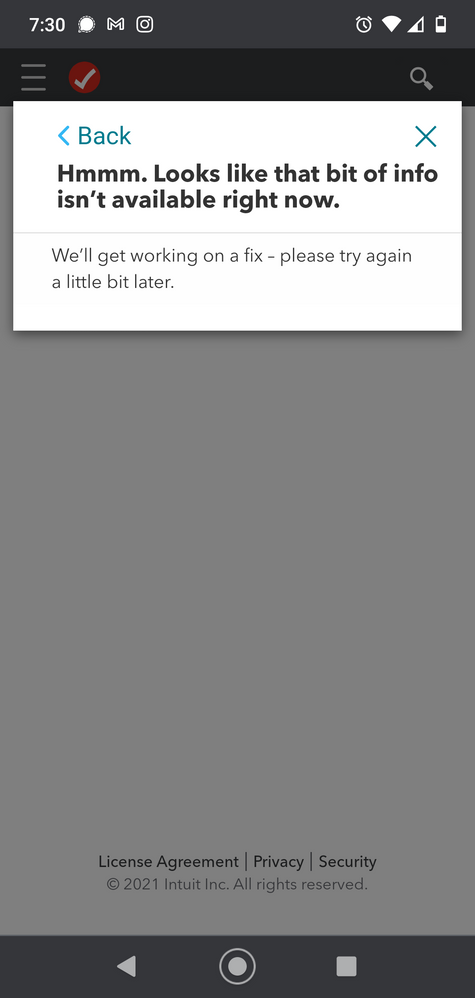

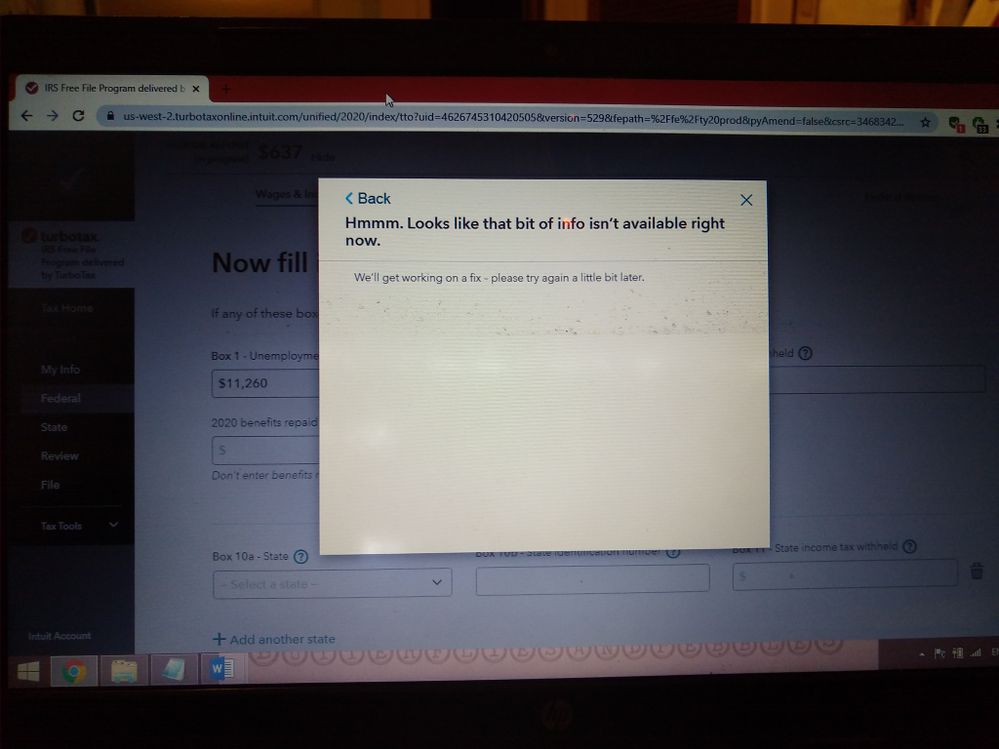

Every time I click any hyperlink in the filing process, the pop up window just says

"Hmmm. Looks like that bit of info isn't available right now.

We'll get working on a fix - please try again a little bit later." I think last year, some info windows did load, but none so far this year. It's pretty frustrating to have the program offer help and then be like, "Actually... Just kidding! Google it, I guess, sucker!

I'm using free file. On my computer I'm using Chrome on a laptop with windows 8. My phone is an android and I'm using Brave. I thought maybe the ad blocker extension was messing it up, even though I didn't use the ad blocker last year, but turning it off didn't help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Constantly get "Hmmm. Looks like that bit of info isn't available right now."

Oh! Looks like at least one info box is working! I managed to get the info on Interest... So it's just the complicated issues that I really want clarification on, like what gets included in the unemployment repayment box that I don't get

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Constantly get "Hmmm. Looks like that bit of info isn't available right now."

If you repaid the overpayment of unemployment benefits in the same year you received them — Subtract the amount of unemployment repayment from the total taxable amount you received. Report the difference as unemployment compensation.

If you didn’t repay overpayment of unemployment benefits in the same year — Include the benefits in income for the year they were paid.

If the amount of unemployment repayment is $3,000 or less, deduct it on Schedule A in the year you repaid. The deduction is subject to the limit of 2% of your adjusted gross income (AGI).

If the amount of unemployment repayment is more than $3,000, calculate the tax under both of the following methods. Compare the results and use the method (deduction or credit) that results in less tax:

- Repayment claimed as a deduction — Deduct the repayment on Schedule A in the year you repaid it. The deduction isn’t limited to 2% of your AGI.

- Repayment as a credit:

- Figure the tax for the year of repayment without deducting the repaid amount.

- Refigure the tax from the earlier year without including in income the amount repaid in the current tax year.

- Subtract the tax in step 2 from the tax shown on the return for the earlier year tax. This is the credit amount.

- Subtract the answer in step 3 from the tax for the current tax year figured without the deduction (step 1).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Constantly get "Hmmm. Looks like that bit of info isn't available right now."

I am experiencing the same issue in TT Free File as the original poster - either "Hmmm. Looks like that bit of info isn't available right now." or "This content is not available". This is rather unhelpful - especially as the errors are seemingly for the most critical information needs.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DJLila

Level 1

NADamewood

Level 1

sierranething

New Member

franksrental

Level 3

rfamilyturbotax

Level 1