- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Computation Error In New York State Return @AmyC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Amy, please take a look at my New York Return. I'm getting the same letter in the mail from New York State as everyone else about a computation error in IT-196. Here's my token number: 1225817.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

I see an error on line 40 worksheet 2 which is affecting line 41 worksheet 2 - our sub adj lmt wk in your return which causes a $32 difference on line 41. Does this go along with your letter?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

No, the discrepancy is $301.26 in line 34 (Itemized deduction) of form IT-201.The overall difference amounts to $18.52 in tax.

The error that you found, whose error is it? New York State or Turbotax?

(I sent you a copy of the letter New York State mailed me in a reply to the email I received from this site.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

I also have similar computation discrepancy between TurboTax and NY. Is there a resolution on this? Have we figured out whose calculations are wrong? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

No, Amy didn't seem to be able to resolve the difference between my return and New York State. It's still unclear who's in error, Turbotax or New York State. I responded using NY State's online tax site to their "Department Notice," but have yet to hear anything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

I also got a letter but decided not to appeal. Please keep us posted on this. Very curious to know the root cause of this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

I may have found an error for those who itemize on the line 40 worksheet, line 2. This affects the line 41 worksheet which is called sub adj lmt wks in the program. If you start there, you may find the issue for your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Thanks @AmyC for this information. Does this mean TurboTax is miscalculating? I believe these worksheets are computed automatically by TurboTax. Thanks again for spending time to dig deeper in this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Thanks, AmyC. I can't find that what you found is what NY State says is incorrect in my return. Whose error is the one that you found? New York State's or Turbotax's? If it's Turbotax's error, are you going to correct it in a program update?

This part of New York State's income tax calculations hasn't changed in years. I looked back at previous years, and I had to use those same Worksheets as part of IT-196, and New York State never complained about the way TurboTax did the computations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

I also took a closer look at your token file to see if there is something that needs to be addressed by TurboTax. I did not find the discrepancy in the calculation that Amy reported. Everything appears correct to me with regard to the separate calculation used to determine the value of line 40 on Form IT-196.

Unfortunately, we don't have a way to see the copy of the letter that you sent via email. If you could share more information about what it said with regard to the $301.26 discrepancy on line 34 of Form IT-201, I would like to take another look to see what may have caused it and make sure that there is not something that needs attention in the TurboTax program. Does the letter state that one of your deductions was claimed in excess or in error which caused the reduction in the itemized deductions? Any additional information from your letter could be helpful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Hi AnnetteB6.

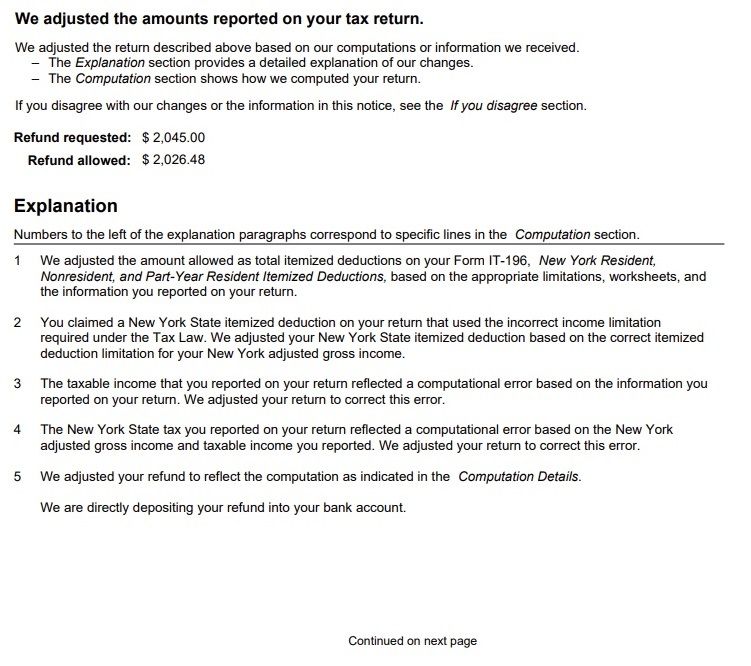

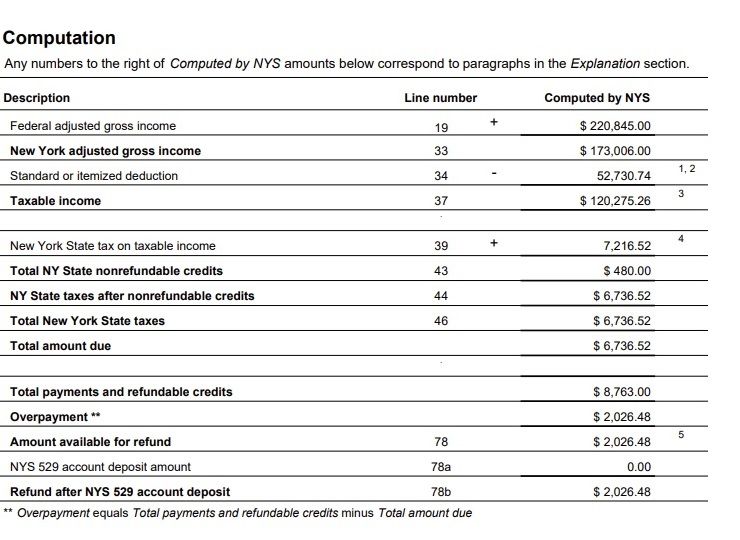

Thank you for looking into this issue. I took screen shots of the two relevant pages that New York State sent me. Here they are:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Thank you for providing the additional details from the letter you received. I reviewed that information and the information reported in your return, as well as the NY instructions for determining the NY itemized deductions. I did not find any discrepancy in your return or withing TurboTax with regard to the calculations or items reported. I was unable to duplicate the numbers shown in your letter to justify the change in your return.

Since the change was minimal, you can either accept it as presented to you or try to get more information from New York with regard to exactly what income limitation was incorrect according to item 2 from your letter.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Thank you @AnnetteB6.

I responded on New York's tax website about a month ago to the Notice that they mailed me, indicating that TurboTax is a verified software product and that New York State is in error regarding my return. I said that New York owes me $18.52. I'm still waiting for them to respond.

Thank you for your diligent efforts!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Hi Annette and TaxNovice24 and AmyC,

It looks like New York State admitted their error, because they are now refunding me my $18.52.

So tell everyone who got a similar notice from New York State that they should respond to the notice and dispute the findings and get a refund.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computation Error In New York State Return @AmyC

Hey @Reuven

did NY issue a letter admitting their mistake in the original notice? Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pwalters1117

New Member

Coverage

New Member

rodowski

New Member

kjaymes02

New Member

meli5

New Member