- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Hi,

I had my daughter filled her taxes using turbo tax for the 1st time. She turned 18 on March 1st, or after the tax year started ( I think tax year starts Jan 1 2023) so per TABOR legibility she can qualify for the CO TABOR sales tax refund:

Sales Tax Refund - Eligible 2023 full-year residents may claim this refund by filing in the manner described below by the appropriate deadline. The refund is $800 for one qualifying taxpayer or $1,600 for two qualifying taxpayers filing jointly.

- File a 2023 DR 0104 by April 15, 2024, if you:

- Were at least 18 years old when the tax year began,

- Do not have a Colorado income tax liability,

- Are not claiming a refund of wage withholding, and

- Are not otherwise required to file a Colorado return because you have no federal filing requirement.

- File a 2023 DR 0104 by April 15, 2024, if you:

However, turbo tax awarded her the $800 buckaroos (in her lingo) despite having the correct birthday under her profile. In addition, turbo tax support told me the tax year is Jan -April and she is eligible -that makes no sense.

So, unless someone has a better suggestion, turbo tax will lose her $64 buckaroos, or the fee to file CO taxes, and her old dad will submit a paper copy, so exciting!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

If your daughter turned 18 during the 2023 tax year, she may be eligible for the credit.

It's not really clear whether your daughter turned 18 in 2023 or 2024, but because you appear to think she doesn't qualify for the TABOR credit, I'll assume she turned 18 in 2023.

If that's the case, it's very possible she's eligible for the credit. You may be overlooking the second part of the requirements you cite, bolded below:

Sales Tax Refund - Eligible 2023 full-year residents may claim this refund by filing in the manner described below by the appropriate deadline. The refund is $800 for one qualifying taxpayer or $1,600 for two qualifying taxpayers filing jointly.

- File a 2023 DR 0104 by April 15, 2024, if you:

- Were at least 18 years old when the tax year began,

- Do not have a Colorado income tax liability,

- Are not claiming a refund of wage withholding, and

- Are not otherwise required to file a Colorado return because you have no federal filing requirement.

- File a 2023 DR 0104 by October 15, 2024, if you:

- Have a Colorado income tax liability,

- Claim a refund of wage withholding, or

- Are required to file a Colorado return because you are required to file a federal return.

The requirements for the credit described in the first bullet don't apply to a taxpayer who was under age 18 when tax year 2023 began. But the requirements in the second bullet do. So, if your daughter was under 18 when the tax year began and otherwise qualifies under the second bullet, she gets the credit.

The language of this second bullet has confused many taxpayers, and will hopefully be addressed before the next filing year. If this response address what you're asking, feel free to re-post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Hi and thank you for your reply. Your assumption that my daughter turned 18 in 2023 is correct (the post title has her bday). I wish the state language would be easier to understand.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Hi, it's still unclear about what constitutes as "qualified".

Colorado form 104 line 34 states

"34. State Sales Tax Refund: For full-year Colorado residents, born before 2005,

or

full-year Colorado residents who are under the age of eighteen but are required

to file a return.

Enter $800 for one qualifying taxpayer or $1,600 for two qualifying

taxpayers filing jointly. See instructions if you are filing an extension."

My wife and I filed my son as a dependent.

My son was 14, at the time so he doesn't qualify of the first statement.

following the "or" for residents under 18 "but are required to file a return" is what's unclear. There's no literature in SB23B-003 regarding age nor it it clear what the term required means. He did have both Colorado state and federal taxes withheld (aka liability) which entitles him to a refund. I imagine if he owed the state a payment, they would require him to file to get their money, therefore it would seem logical that a refund is also a requirement of the state to pay their liability through a filing.

Looking into the thresholds for children filing for a federal return (publication 929). The other filing requirements probably answers the question, but I thought I would run it though the community. The requirement for federal sill does not cover if a child is required by the state. Seems like a scam for a working individual that paid taxes but can get the benefit of the refund. :(

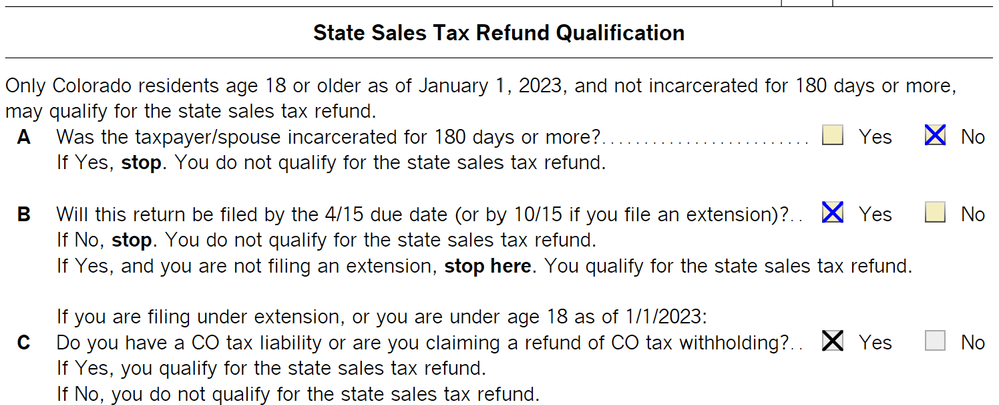

Additionally the TurboTax checklist on form 104 implies he does qualify.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Your son appears to qualify, based on what you’re describing.

Instead of looking at the description on line 34 of Form DR 0104, focus on the instructions to Line 34, State Sales Tax Refund in the Form DR 0104 Booklet:

If you are a full-year Colorado resident who was under 18 as of January 1, 2023, you may claim the state sales tax refund only if you have a Colorado tax liability (line 14 must be greater than 0) or you are claiming a refund of Colorado wage withholding on a W-2. Your return must be postmarked by October 15, 2024.

[Bolding mine.]

What this means is, a taxpayer under age 18 can claim the credit if they were a full-year Colorado resident during the tax year, file their return by October 15, 2024, and

- They have a Colorado tax liability or

- They are claiming a refund of Colorado wage withholding from a Form W-2.

As for the “required to file” provision, it’s addressed in the Colorado Department of Revenue's Taxpayer's Bill of Rights (TABOR) Information for more information. See the second bullet under Sales Tax Refund. For a taxpayer under 18, the requirement is to file a 2023 DR 0104 by October 15, 2024 and

- Have a Colorado income tax liability, or

- Claim a refund of wage withholding, or

- Are required to file a Colorado return because you are required to file a federal return.

So, if either of the first two bullets apply, the third doesn’t matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

So I have the same question, but need to understand the third "required" criteria because my daughter (who turned 18 during 2023) does not have a CO tax liability (line 14 is 0) and her employer did not withhold state tax so she is not filing for a refund. She is, however, filing a federal return to get a refund of her federal taxes that were withheld. Does that mean she is "required" to file a CO tax return and therefore can get the tabor refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

I believe the answer is, "yes, file the CO return."

Just remember to go all the way through the CO interview because the two questions that qualify her are at the very end.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Thanks. I did read that earlier but didn't know if the line 34 text took prescient. We'll give it go. Appreciate the help. It's been racking my brain with conflicting information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

So, I do see the third bullet under the 2023 Tabor refund link you posted, that you can claim the refund if "are required to file a Colorado return because you are required to file a federal return." However, TurboTax appears to only be picking up the first two bullets because it is saying my daughter is "Ineligible for the Colorado state sales tax refund - To qualify for the state sales tax refund, you must have a Colorado tax liability or you're claiming a refund of Colorado tax withheld." That third bullet is under the deadline section of with a deadline of October 15, 2024. Do we have to file an extension in order to qualify for the refund using the third bullet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Update: I just filled out the survey on the IRS website to determine if my daughter is "required" to file a return. It came back saying "You are not required to file a return for 2023." However, it then says "You should file a return for 2023. The return may generate a refund." Based on that, I'm assuming we cannot try to qualify for the tabor refund using the third bullet. Agree?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

You read my mind! I agree that you will not qualify. It is all of the bullets so without a CO liability or refund, she is out of luck.

Double check that you need to file a federal return rather than want to file a return. See Who needs to file a tax return. A single person making less than $12,950 is not required to file a return on w2 wages.

Filing an extension will not change the requirements. That is just telling you the deadline by which to file. Filers with no CO tax liability or tax withheld, need to file by April 15.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Bummer. But thanks for taking the time to reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

Does anyone know how you file in Turbo Tax for the Tabor refund under the third bullet (Are required to file a Colorado return because you are required to file a federal return)? The TT questions seem to only focus on the tax liability or requesting a refund bullets. How do we tell it we're required to file a federal return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado resident turned 18 on March 1, 2023-still elligible for TABOR sales tax refund?

See the TurboTax Help article Do I need to file a federal return this year? for the federal filing requirements.

The TurboTax programming uses the information you input to determine whether you have a federal filing requirement, and therefore qualify for the TABOR credit.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

andileb

New Member

willkills

New Member

Scottn1

New Member

scardekat01

New Member

GMcCoy77

New Member