- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- "Check This Entry" message, but there's no place to enter any information in the forms screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Check This Entry" message, but there's no place to enter any information in the forms screen.

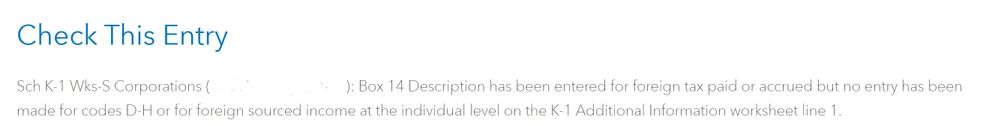

Hello! I am ready to e-file my personal returns, but in the final check, I'm getting the following message. Please note that I've erased out the corporation name:

A forms page then appears below, but the problem is that none of the spaces on the form will let me type anything in. Please advise. Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Check This Entry" message, but there's no place to enter any information in the forms screen.

The error message is saying that you have foreign taxes entered on the K-1, but no indication of the amount or type of income they were paid on.

Go back to the K-1 entry part of the interview and enter the information requested.

- Click on Federal Taxes > Wages & Income [In TT Self-Employed: Personal > Personal Income > I'll choose what I work on].

- Under S-corps, Partnerships, and Trusts [in desktop: Business Investment and Trust Income], click on the Update box next to Schedule K-1.

- On the Tell Us About Your Schedules K-1 screen, click on the Start/Update box next to S corporations (Form 1120S).

- If you have already entered K-1 SCorp information, you will see the SCorp. K-1 Summary screen. Click Edit to continue with the existing form entry.

- Continue to the screen Enter Box 14 Info. You probably already have entered P-Total Foreign Taxes Paid. On the next line enter the code and amount for the type of foreign gross income that generated the taxes: F--Passive; G--General; or H--Other.

- Note that if you have more than one type of foreign gross income, you must enter separate K-1 worksheets for each type.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Check This Entry" message, but there's no place to enter any information in the forms screen.

The error message is saying that you have foreign taxes entered on the K-1, but no indication of the amount or type of income they were paid on.

Go back to the K-1 entry part of the interview and enter the information requested.

- Click on Federal Taxes > Wages & Income [In TT Self-Employed: Personal > Personal Income > I'll choose what I work on].

- Under S-corps, Partnerships, and Trusts [in desktop: Business Investment and Trust Income], click on the Update box next to Schedule K-1.

- On the Tell Us About Your Schedules K-1 screen, click on the Start/Update box next to S corporations (Form 1120S).

- If you have already entered K-1 SCorp information, you will see the SCorp. K-1 Summary screen. Click Edit to continue with the existing form entry.

- Continue to the screen Enter Box 14 Info. You probably already have entered P-Total Foreign Taxes Paid. On the next line enter the code and amount for the type of foreign gross income that generated the taxes: F--Passive; G--General; or H--Other.

- Note that if you have more than one type of foreign gross income, you must enter separate K-1 worksheets for each type.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Check This Entry" message, but there's no place to enter any information in the forms screen.

Thank you, Irene2805, most sincerely. Your guidance was excellent and the problem is solved. I appreciate your having considered by question very much. Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HMC4

New Member

alyssathomps36

New Member

olson-mark1976

New Member

tjams4him

New Member

Ty241

New Member