- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- charitable gift annuity

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

charitable gift annuity

I made a Charitable Gift that was funded from my IRA. The entire amount was the Required Minimum Distribution that I would be normally added to my income. However, since this was a Charitable Gift then the entire amount should be excluded from my gross income. The problem is that my 1099R states that this was a "Normal Distribution".

How do I show on Turbotax that this amount should be excluded from income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

charitable gift annuity

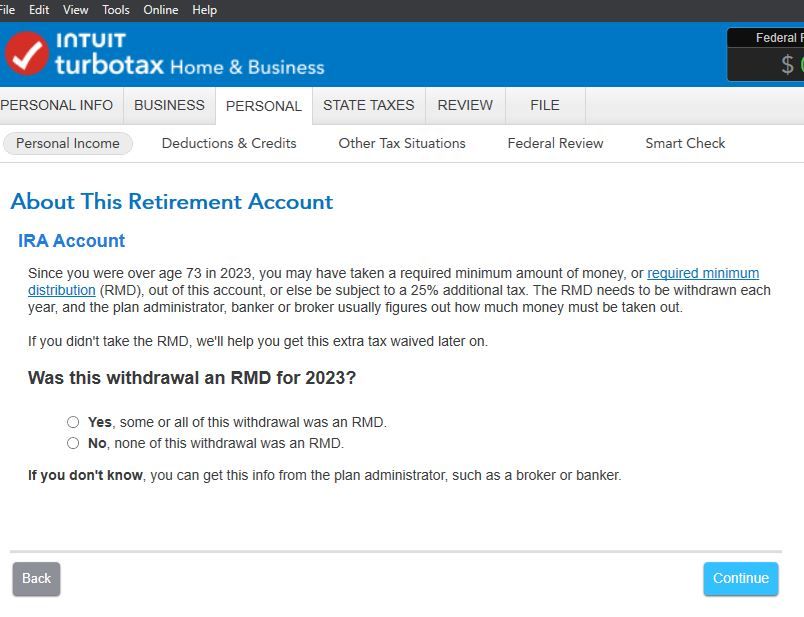

I made a QCD too last year. After you enter the 1099R keep going and it will ask if it was the RMD and then if you made a QCD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

charitable gift annuity

I made a QCD too last year. After you enter the 1099R keep going and it will ask if it was the RMD and then if you made a QCD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

charitable gift annuity

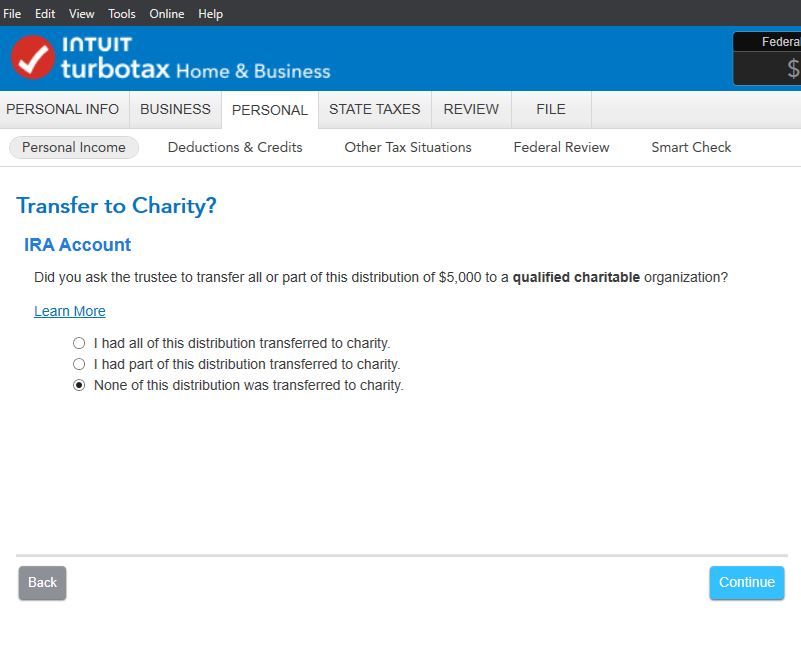

Make sure the little IRA box is checked between boxes 7&8. I made you 2 screen shots from my Windows program. Should be similar in the Online version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

charitable gift annuity

This worked. Th

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

charitable gift annuity

It is not clear from your question exactly how the contribution was made. QCDs must be made directly by the trustee of the IRA to the charity. An IRA distribution, such as an electronic payment made directly to the IRA owner, does not count as a QCD. Likewise, a check made payable to the IRA owner is not a QCD.

Here are the IRS rules: https://www.irs.gov/newsroom/qualified-charitable-distributions-allow-eligible-ira-owners-up-to-1000...

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jscot100

Returning Member

dovhun

Returning Member

Eagleproud

Level 1

taxmanwalrus

Returning Member

taxfromhome

Level 1