- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Categorizing Inventory Assets when importing bank statement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Categorizing Inventory Assets when importing bank statement

I own a small business and decided to use the feature in TT that allows me to import my bank statements, then review and categorize all of the transactions before adding them as expenses on my return. Many of the things imported are correctly categorized, like my internet service automatically categorized as Utilities, my rent as Rent and Lease, stickers from StickerMule as Advertising, etc.

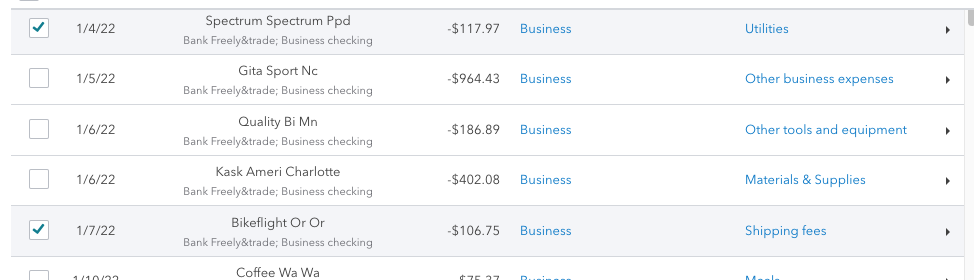

My issue is with inventory assets. I purchase a lot of items to resell in my shop, or to use as part of a larger project to be sold. In Quickbooks, these transactions are categorized as Inventory Assets, however, there is no inventory category in the dropdown list on TT. TT automatically assigned a bunch of different options, yet none of them seem to fit the situation. When I try to type in Inventory, it defaults to Materials and Supplies - is that correct? I've attached a screenshot - the two with checkmarks are correctly categorized, the middle three are all items that I'm purchasing to resell.

What Category would I select for items that I purchased as inventory with the intent to resell?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Categorizing Inventory Assets when importing bank statement

Yes, the default to Material and Supplies is correct. Since you are using QuickBooks for your small business, it is important you make sure your transactions are categorized correctly before importing them to your Tax Return.

Therefore, you will need to correct the incorrect categories in QuickBooks, then you can manually fix them in your tax return. QuickBooks will at times provide suggested categories, but you as the owner of the business must review the transaction and related profit and loss to make sure everything looks correct.

Also, make sure your Cost of Goods Sold correctly shows the correct ending inventory. See the guidelines below:

If your business produces income by manufacturing, selling, or purchasing goods, you can deduct some of your expenses in the Cost of Goods Sold section of your Schedule C. In order to complete this section, you will need to input your beginning and ending inventory amounts. Expenses that are included in the Cost of Goods Sold cannot be entered as both business expenses and cost of goods sold expenses.

4 types of expenses used to figure the cost of goods sold:

- Cost of products or raw materials (this includes freight)

- Storage

- Direct Labor Cost for workers producing products (includes contributions to pensions and annuity plans)

- Factory Overhead

See the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

shubham-123

Level 2

waaeaa

New Member

chinan999

New Member

showard-hfsd-org

New Member

maisie6153

New Member