- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can I deduct my minimum essential coverage premiums from federal taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct my minimum essential coverage premiums from federal taxes?

I was between jobs in December and January. I was forced to take minimum essential coverage because the so called Affordable Care Act is unaffordable. Turbo Tax only mention that you could not include premiums for the Bronze, Silver, and Gold plans in the market place.

Thanks

Dan

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct my minimum essential coverage premiums from federal taxes?

Yes, you can deduct the payments you made for Minimum Essential Coverage (MEC) as part of Medical expenses as long they weren't paid through your employer.

Here's how to do that in TurboTax Online:

- Open your return.

- Select Federal, then Deductions & Credits.

- Scroll down to Medical Expenses, expand the section.

- Select Edit to the right of Medical.

- Select Continue until you get to the screen titled, How much did you spend on insurance premiums?

- You can enter the total you paid here.

- Select Continue.

You can deduct the portion of your medical and dental expenses that exceeds 7.5% of your AGI, so you will see that figure when you start the section. It will say something like Do your medical and dental expenses exceed $2,400? Answer Yes to continue.

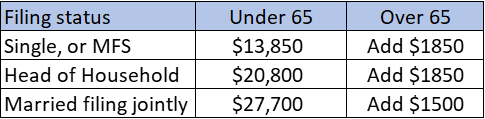

In addition, you deduct either the total of your itemized deductions, or the standard deduction for your filing status. Here are the standard deductions for 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mms4063

Level 1

npetrenko

Returning Member

MainiacGus

Returning Member

OlyPen_Guy

New Member

mckinly16

Level 3