- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can I claim my parents as dependent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

Here's my unique situation with my parents that makes this tricky:

- My parents came to the US in 4/2023 as tourist visa

- My sister sponsor them for green card in 7/2023.

- I applied CoveredCA for them (only them as my family have separate insurance) under my name starting 7/2023 till the rest of the year w/o any ATPC

- They stayed with me pretty much since April

- They don't have any income

Question I have:

- For tax purposes, can I claim them as my dependent? I'm not clear if they're considered as US resident or not.

- Can I claim their medical bill I paid for them if they're not my dependent?

- If I can't claim them as my dependent, what do I do w/ the 1095A file that I received since it's under my name?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

Yes. They may be considered US Resident Aliens by meeting the substantial presence test outlined in this link (since they probably didn't have green cards by 31 Dec 2023). Generally, if they were lawfully in the US for at least 31 days in 2023 and at least 183 days over the past 3 years (Apr through Dec 2023 would meet these tests) then they may be resident aliens for tax purposes. (NOTE: Citizens of Mexico and Canada may also be dependents on US tax returns).

Assuming they meet the tests to be US residents, they must also pass the tests to be considered your dependents in Publication 501, Table 5. Generally they may be qualifying relatives, since they are not your children but are your parents, they lived with you more than 1/2 the year and have no income. However the last test is did you provide more than 1/2 of their total support in 2023. Likely, yes since they lived with you, but if anyone else provided support that must be considered.

Now to be dependents on your tax return they need either social security numbers or Individual Taxpayer Identification Numbers (ITIN), if they are for some reason ineligible for social security numbers. Contact your local social security administration for more guidance. You may need to apply for a tax filing extension to allow time to get the identification numbers.

Once they are eligible dependents on your tax return you can claim medical expenses paid for them as an itemized deduction.

NOTE: If the 1095A does not have any Advanced Premium Tax Credits (APTC) in column C and you are not claiming a Premium Tax Credit (PTC), then you do not need to enter the form 1095A information on your tax return. In that case, if you can't or do not wish to claim your parents as dependents for 2023 there will not be an issue.

If there is APTC or you wish to claim PTC, then you would enter the form 1095A information in the "Deductions & Credits" section using the "Medical" dropdown and the "Affordable Care Act" topic.

If they are dependents on your return, there are no special caveats. However, if for some reason they are not dependents on your return and there is APTC, you will use the allocation option in the ACA topic to allocate the coverage to your parents.

You parents would need to file a 1040NR and include the 1095A information on their return to reconcile the APTC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

Thank you so much for this. I definitely paid more than 1/2 of their total support in 2023. Thankfully they both have SSN already. So I guess I can claim them as my dependent.

For the 1095A, I didn't claim APTC last time, so both column B & C are 0 on my 1095A. I do wish to claim PTC if possible. I called CoveredCA to inquire for the missing value on column B, they told me that "0" is correct since I declined for it during registration. They told me it's too late for me to claim this year. I read people filling in value for column B using a the federal tax tools, but they're not for CA. Is CA different, and I just can't claim it after the fact? I'm ok with this as well, but just curious.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

Yes, it is too late to try to claim it for 2023. You may wish to contact the marketplace to see if you can apply for the APTC in 2024 so you won't miss out on it again this year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

Following up on this 1095A issue. I know I'm too late for the APTC, but can I still claim the premium I paid as deductible? How do I do this in TurboTax? Do I enter it under "Medical Expenses" or I enter the value under "Affordable Care Act (Form 1095-A)"?

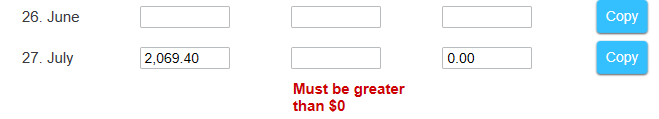

If the later, TurboTax is throwing an error saying that my Column B (Monthly SLCSP premium) cannot be 0, but 0 is what is on the 1095-A form I received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

Yes, you can report the premiums as a medical expense and may be deductible if you are itemizing your deductions and your medical expenses exceed 7.5% of your Adjusted Gross income for the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

How would I enter it in TT? Through the 1095-A form or under the Medical Expenses?

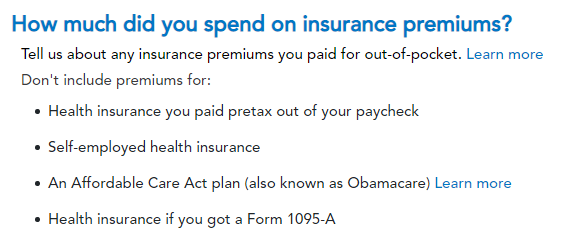

Under "Medical Expenses" has this caveat below

If it's under the 1095-A, I got the following error:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

Leave the 1095-A off your return and enter the amount in the medical expenses section. If covered CA is not going to give you the Column B amounts, you can't enter it in TurboTax. Even if the Premium Tax Credit advances (column C) were zero, they should still give you the correct figures for Column B. If you have confirmed they are not expecting the 1095-A, leave it off the return. If your return gets rejected, see this help article.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

How can I confirm they're not expecting the 1095-A? Just by filing the tax and see if it gets rejected?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim my parents as dependent?

You can contact Healthcare.gov and scroll to contact us. You can also file without the 1095 A to see if the return either gets rejected. Also at some point, the IRS may contact you to send them a copy of the 1095 A. You can send it to them if they request it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tjoyb

New Member

tsboevers

New Member

1c98707ce2ff

New Member

Guavalord54

Level 2

kaylinflores30-g

New Member