- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can i claim my granddaughter as a dependent ? Or is she in the Other category ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i claim my granddaughter as a dependent ? Or is she in the Other category ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i claim my granddaughter as a dependent ? Or is she in the Other category ?

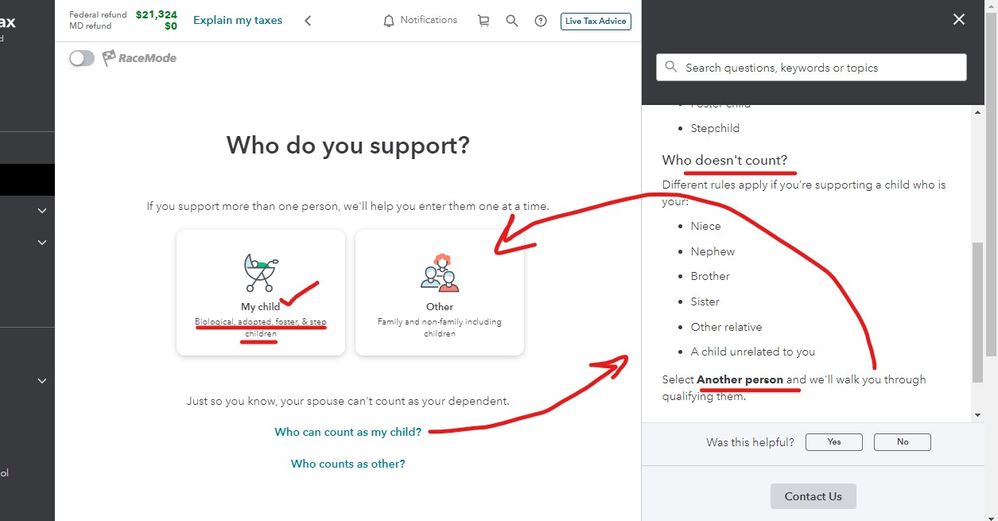

If you follow the interview screens you will find your answer ...

A dependent must meet the requirements of a qualifying child or a qualifying relative in order for you to claim them on your tax return.

The tests for a qualifying child are:

- Relationship: Must be your child, adopted child, foster child, brother or sister, or a descendant of one of these (grand or nephew).

- Residence: Must have the same residence for more than half the year.

- Age: Must be under age 19 or under 24 and a full-time student for at least 5 months. They can be any age if they are totally and permanently disabled.

- Support: The dependent must not have provided more than half of their own support during the year.

- Joint Support: The child cannot file a joint return for the year.

The tests for a qualifying relative are:

- Qualifying Child: They are not the “qualifying child” of another taxpayer or your “qualifying child.”

- Gross Income: The dependent being claimed earns less than $4,400 in 2022.

- Total Support: You provide more than half of the total support for the year.

- Member of Household or Relationship: The person (a friend, girlfriend, non-blood relative) must live with you all year as a member of your household or be related to you.

TurboTax software will ask you simple questions and give you the tax deductions and credits for which you are eligible based upon your answers.

See also these TurboTax Helps.

Who Can I Claim as a Tax Dependent?

Can I claim my relative or friend as my dependent?

You may also want to view IRS Publication 501.

Dependents, Standard Deduction, and Filing Information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i claim my granddaughter as a dependent ? Or is she in the Other category ?

A stepchild is treated the same as your own child.

Just being your stepdaughter does not make her your dependent. For you to claim her as a dependent she has to meet all of the tests that Critter-3 listed for either a qualifying child or a qualifying relative.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i claim my granddaughter as a dependent ? Or is she in the Other category ?

Q. Can i claim my granddaughter as a dependent?

A. Yes, a grandchild meets the relationship test for either a "Qualifying Child" dependent or a "Qualifying Relative".

Q. Or is she in the Other category?

A. In taxes, "other" has two meanings. In the TurboTax interview, you answer other. The dropdown menu will include grandchild. A grandchild can be your "qualifying child", for the Child Tax Credit (CTC) and EIC. But, if she is over 16, you will only get the "Other dependent credit" (up to $500, not the CTC (up to $2000).

Q. is a stepdaughter a dependent?

A. A stepchild is the same as a biological child for tax purposes. So, yes, a stepchild meets the relationship test for either a "Qualifying Child" dependent or a "Qualifying Relative". So, as others have said, you need to meet all the dependent rules (not just the relationship test) for her to be your dependent.

Even if you can claim her as a qualifying child dependent, there are additional rules to meet to claim the child tax credit or the Earned Income Credit (EIC)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i claim my granddaughter as a dependent ? Or is she in the Other category ?

@cynxmart21 simply use this IRS tool to determine the answer for your scenario. will take no more than 5 minutes to answer the questions

https://www.irs.gov/help/ita/whom-may-i-claim-as-a-dependent

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

sherri2020

New Member

lindsayjo_b

New Member

tbduvall

Level 4

hmharvey0312-gma

New Member

chris-gon7731

New Member