- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- box 3 in 1099-MISC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 3 in 1099-MISC

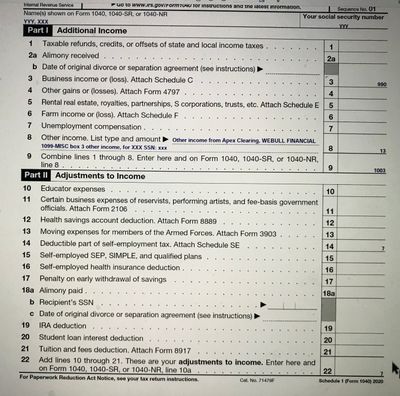

(1) I received $13 from Webull trading that is reported on box 3 of 1099-MISC.

I am entering it on line 8 of schedule 1.

what description should I add for this income ?

(2) my spouse is adding their business income on line 3 of the same schedule 1. would that be a problem ?

their social is the one that appears on the top of the form as we are married filing jointly.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 3 in 1099-MISC

Describe exactly what the income is for. Your line 8 income has nothing to do with his business income. You would not enter it directly on the line but as other income.

- Wages & Income

- I'll choose what I work on

- Less Common Income select Start (or Update) for

- Miscellaneous Income.

- Other reportable income and you can enter your own description(s) and amount(s).

Business income is entered on Schedule C and the profit or loss flows to Line 3 Business income or (loss) on Schedule 1.

To set up your business:

- Open or continue your return.

- Search for schedule c and click the Jump to link in the search results.

- Answer Yes to Did you have any self-employment income or expenses?

- If you've already entered self-employment work and need to enter more, select Add another line of work.

- Follow the onscreen instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 3 in 1099-MISC

I do not remember what this $13 income is for. it is mentioned on box 3 of 1099-MISC from WEBULL. it is most likely for a free stock. what should I mention in line 8 of schedule 1 for "list type and amount"

Does the following description look ok ?

also, please let me know if both spouses can use the same schedule 1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 3 in 1099-MISC

The description is good. Both spouses would use the same form 1 on a joint tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aptiva4tt17

Level 3

todi111

Level 2

rsaffi

New Member

mdcbk

Level 2

megrhy2016

New Member