- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Amount earned as if nonresident the entire year must be entered

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

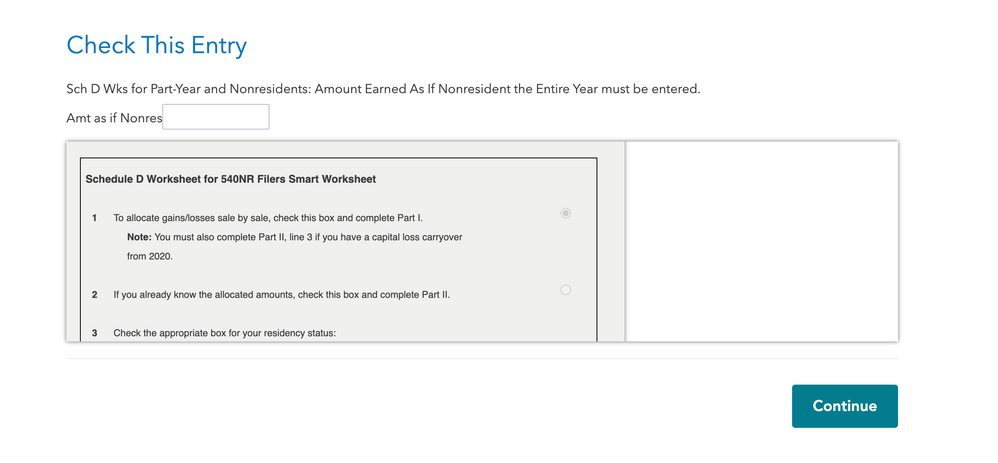

Amount earned as if nonresident the entire year must be entered

Hi,

I am quite confused about which cell in the form is the "Amt as if Nonres" talking about? I am also not sure, what does this means "Amount earned as if nonresident the entire year must be entered". How should I fill in this value (or calculate this value)?

The context is quite complex: my wife and I lived in NJ for the first 10 months and lived in CA for the last 2 months of 2021; while for the entire year, I worked for a company in New York and my wife worked for a company in CA.

Thanks for any feedback.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

Assuming your wife, while you were non-residents of CA, did not physically work in CA, the answer would be "Zero" for CA income assuming non-resident all year. Another way to look at it is if you had not moved to CA for the last two months, there would have been zero CA income.

If there was some time while you were non-resident CA that she physically worked in CA then you would prorate the CA income based on the percent or ratio of workdays in CA out of total workdays.

For example 20 workdays a month and 10 of those are worked in CA each month then 50% of the CA company income would be CA income if non-resident all year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

Assuming your wife, while you were non-residents of CA, did not physically work in CA, the answer would be "Zero" for CA income assuming non-resident all year. Another way to look at it is if you had not moved to CA for the last two months, there would have been zero CA income.

If there was some time while you were non-resident CA that she physically worked in CA then you would prorate the CA income based on the percent or ratio of workdays in CA out of total workdays.

For example 20 workdays a month and 10 of those are worked in CA each month then 50% of the CA company income would be CA income if non-resident all year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

thanks you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

So I am in a similar situation where I'm being asked by Turbo Tax to enter "Amount Earned As If Nonresident the Entire Year must be entered".

Now in my case, I've been California Resident from 2017 up until the September of 2021 when I moved to NYC. I did not physically worked in California after moving to NYC but I got 4 RSU vests throughout 2021. Most of the RSUs that vested were granted to me in years prior to 2021 when I was a California resident. Now, California has this rule that even if you stop being its resident you are supposed to keep paying taxes on vested RSUs (using some special allocation rules) as long as these were granted back when you were a California resident.

What should I put into "Amt as if Nonres" field in my case? I assume that the amount should be non zero since even if I had been a California non resident for the whole 2021 I would've had to pay taxes on some of the RSUs that vested? Am I correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

@CoffeeBreak You are correct. California would consider those to be "income from California Sources".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

@RobertB4444 Thank you - that makes sense. What I have trouble understanding is @DMarkM1's response to the initial question in this thread. According to @DMarkM1's response, even though @douglasjia's wife worked for the CA company for the whole year, if we assume that she was not a California resident for the whole year she would need to report 0 as her California "as if non resident income". And that's despite that fact that for the last 2 months of the year she was physically located in the CA.

So in my case, I was located in the California up until September and I continued to receive salary (wages) from my CA employee. Now, if we assume that I had not been a California resident I think that I would still need to report my California wages for the purpose of California "as if non resident income" field - is that correct? That's because I was located in California and my company's office was located in the California too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

According to ftb.ca.gov, as a nonresident, you pay tax on your taxable income from California sources.

Sourced income includes, but is not limited to:

- Services performed in California

- Rent from real property located in California

- The sale or transfer of real California property

- Income from a California business, trade or profession

So in the first, example the wife would needed to report her California sourced income as a non-resident. In your example, the same condition would apply.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

what if i moved to california and physically worked in california?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amount earned as if nonresident the entire year must be entered

If you moved to California in 2021, you would file a part-year resident return. You would be liable for all of your income when you were a resident of California, as well as any income earned from California sources when you were a nonresident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

michaelavillesca

New Member

stamperhs20

New Member

waffles4926

New Member

dbow58

Returning Member

valentivanessa

New Member