- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Amended 2023 Federal Tax Return has been rejected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Hi, there,

I have two questions about my amended tax return.

1. I received the form 1099-R this year that is for excess contribution of Roth in 2023. I amended my 2023 federal tax return and submitted it. However, it has been rejected because WithholdingTaxAmt must be equal to the sum of the forms 1099-R. I checked the form1099-R in Turbotax Desktop and the amount ($170.48) in field 4, Federal income tax withheld was there. However, in form1040-X, field 12, Federal income tax withheld, it is 0. What should I do to make the withheld amount displayed in form 1040-X?

2. In form 1040-X, field 10, Other taxes, the number 144 is there. This is the penalty of 6% on our (I and my wife) early distribution of $2400. However, I withdrawn the excess contribution and the earnings before the due day and we are 68 years old. We should not get the penalty. The form 1099-R has the distribution code of J and P. I checked the page Form 1099-R, Distribution from Pension, IRAs. etc in Turbotax Desktop. The box that is for If box 7 code is 2 or 5, check if the distribution is from a Roth IRA, is checked. Is something wrong here? The box 7 only has the code J and P. How should I do to take out the other taxes from form 1040-X?

Thank you so much for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

1) The withheld tax has to be reported on your 2024 return since the withheld tax is applied to the year it was withheld. Therefore, you can delete the withheld tax entry in box 4 when you enter it on your 2023 amended return if it gives you an error. Please be aware that you cannot e-file a 2023 amended return. You need to print and mail it. Please see Can I e-file my federal Form 1040-X amended return?

You will need to add the 2024 Form with P and J also on your 2024 return to get the withheld taxes applied to 2024. The 2024 code P will not add anything to your income in the 2024 tax return but the withholdings will be applied to 2024.

2) Please make sure you indicate in the IRA contribution interview that you withdrew the excess contribution by the due date:

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Enter the Roth IRA contribution

- Continue until the penalty screen and enter the excess contribution amount withdrawn.

Also, make sure you entered the earnings from box 2a on the "Did you use your IRA to pay for any of these expenses?" screen:

- Click on the "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- On the "Which year on Form 1099-R" screen say that this is a 2024 Form 1099-R.

- Click "Continue" after all 1099-R are entered and answer all the questions.

- Continue until "Did you use your IRA to pay for any of these expenses?" screen and enter the amount of earnings under "Corrective distributions made before the due date of the return".

To confirm your Form 1099-R entry shows code P and J? If yes then you can ignore that the box "If box 7 code is 2 or 5, check if the distribution is from a Roth IRA" is checked.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Yes, if you are in the phaseout range for Roth IRA contributions then the earnings from the return of excess contribution can create a new excess contribution.

You will have to pay the 6% penalty on your 2023 return on the new excess.

If you cannot apply the 2023 excess as a 2024 contribution then you will have to pay the 6% penalty on your 2024 return:

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- On the "Do you have any Excess Roth Contributions" answer "Yes"

- On the "Enter Excess Contributions" screen enter the total excess contribution from 2023

- On the "How Much Excess to 2024?" screen enter the amount applied to 2024.

If cannot apply the excess to 2024 then you need to take a regular distribution without earnings, since it is after the due date of the 2023 return to remove the 2023 excess contribution. You will get a 2025 Form 1099-R with code T or Q. When you add the 2025 Form 1099-R on your 2025 return, it will resolve the excess in 2025.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

1. You need to include any form where the numbers changed. That will include the 1040 and the schedule A (if you have one). Check the forms against your original return to be sure.

2. You will need to amend 2024. Then you can correct the issue and ignore it on the 2025 return.

3. You don't need to worry about earnings.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Can some experts answer my questions? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

1) The withheld tax has to be reported on your 2024 return since the withheld tax is applied to the year it was withheld. Therefore, you can delete the withheld tax entry in box 4 when you enter it on your 2023 amended return if it gives you an error. Please be aware that you cannot e-file a 2023 amended return. You need to print and mail it. Please see Can I e-file my federal Form 1040-X amended return?

You will need to add the 2024 Form with P and J also on your 2024 return to get the withheld taxes applied to 2024. The 2024 code P will not add anything to your income in the 2024 tax return but the withholdings will be applied to 2024.

2) Please make sure you indicate in the IRA contribution interview that you withdrew the excess contribution by the due date:

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Enter the Roth IRA contribution

- Continue until the penalty screen and enter the excess contribution amount withdrawn.

Also, make sure you entered the earnings from box 2a on the "Did you use your IRA to pay for any of these expenses?" screen:

- Click on the "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- On the "Which year on Form 1099-R" screen say that this is a 2024 Form 1099-R.

- Click "Continue" after all 1099-R are entered and answer all the questions.

- Continue until "Did you use your IRA to pay for any of these expenses?" screen and enter the amount of earnings under "Corrective distributions made before the due date of the return".

To confirm your Form 1099-R entry shows code P and J? If yes then you can ignore that the box "If box 7 code is 2 or 5, check if the distribution is from a Roth IRA" is checked.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Hi, DanaB27,

Thank you so much for your reply. It is very helpful. I confirmed that the withheld tax was actually reported to my 2024 return. I will delete it from my 2023 amended return. My first question was resolved.

For my second question, I just figured out that the 6% penalty is not for the early withdraw but it is for the excess contribution. Here is what I figured out. In 2023, I and my wife both made Roth IRA contribution $7500 for each. Our MAGI was $226407 for 2023. We only allowed Roth contribution of $1200. We withdrawn the excess contributions plus the earnings ($1705) before the due date. I thought we avoided the excess contribution penalty. However, when I submitted my 2023 amended return, since it added up $1705 earnings, our MAGI now became $228112. In this case, we do not allow any Roth IRA contribution. The regular contribution of $1200 now becomes excess contribution and we got penalty on it. Not sure if my analysis is correct. If this is the case, I think it is unfair for us since we followed the correct process to do it. Also, if it is the case, we need to withdraw $1200 immediately otherwise we will get further penalty. Do I still have options to avoid the penalty? Please advice.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Yes, if you are in the phaseout range for Roth IRA contributions then the earnings from the return of excess contribution can create a new excess contribution.

You will have to pay the 6% penalty on your 2023 return on the new excess.

If you cannot apply the 2023 excess as a 2024 contribution then you will have to pay the 6% penalty on your 2024 return:

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- On the "Do you have any Excess Roth Contributions" answer "Yes"

- On the "Enter Excess Contributions" screen enter the total excess contribution from 2023

- On the "How Much Excess to 2024?" screen enter the amount applied to 2024.

If cannot apply the excess to 2024 then you need to take a regular distribution without earnings, since it is after the due date of the 2023 return to remove the 2023 excess contribution. You will get a 2025 Form 1099-R with code T or Q. When you add the 2025 Form 1099-R on your 2025 return, it will resolve the excess in 2025.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Thank you DabaB27! I still need your help for the following:

1. I will mail my amended 2023 return to IRS. Should I only need to mail the form1040-X and the forms related to the excess contributions (form 1099-R, schedule 2, form 5329)? Since I owe money to IRS, I need to include a check for it, right?

2. Because it is now passed the due date of 2024, I have to pay the 6% excess contribution penalty for 2024. Since I already filed my 2024 return, I need to file an amended 2024 return for the excess contribution carryover or I can pay the penalty in 2025 return?

3. Should I only need to take a regular distribution for the excess amount, don't need to concern the earnings, right? (should be no any earnings since the market dropped a lot now).

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Thank you for your response. I still need your advice for the following questions:

1. I will mail my amended 2023 return to IRS. Should I only need to mail the form1040-X and the forms related to the excess contributions (form 1099-R, schedule 2, form 5329)? Since I owe money to IRS, I need to include a check for it, right?

2. Because it is now passed the due date of 2024, I have to pay the 6% excess contribution penalty for 2024. Since I already filed my 2024 return, I need to file an amended 2024 return for the excess contribution carryover or I can pay the penalty in 2025 return?

3. Should I only need to take a regular distribution for the excess amount, don't need to concern the earnings, right? (should be no any earnings since the market dropped a lot now).

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

1. You need to include any form where the numbers changed. That will include the 1040 and the schedule A (if you have one). Check the forms against your original return to be sure.

2. You will need to amend 2024. Then you can correct the issue and ignore it on the 2025 return.

3. You don't need to worry about earnings.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Hi, Robert, I have mailed out my amended 2023 tax return. Now I prepare to file my amended 2024 tax return. This is for the penalty of the carryover excess contribution of $1200 in 2024. I just withdrawn the excess contribution. I will not get the form1099-R until 2025 right? I don't know how to add the penalty to my amended 2024 return. Please advise.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

That is correct. You will receive a 1099-R form in 2026 for the excess contribution that was returned to you in 2025.

As for the penalty, when you prepare your 2024 amended return, TurboTax will make this calculation for you and you will avoid the penalty on your 2025 return.

Please see this FAQ for more details on when you would pay the penalty based upon your specific situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Thank you for the response! I checked that FAQ. Here are the steps:

- Or, remove only the excess contribution after your tax deadline. After you file:

- Request a regular distribution between October 17 and December 31, 2025. This is to remove the excess contribution- without earnings.

- You’ll keep the earnings in the Roth IRA account.

- You'll take the 6% penalty on the 2024 return.

- You'll avoid the penalty on next year’s tax return.

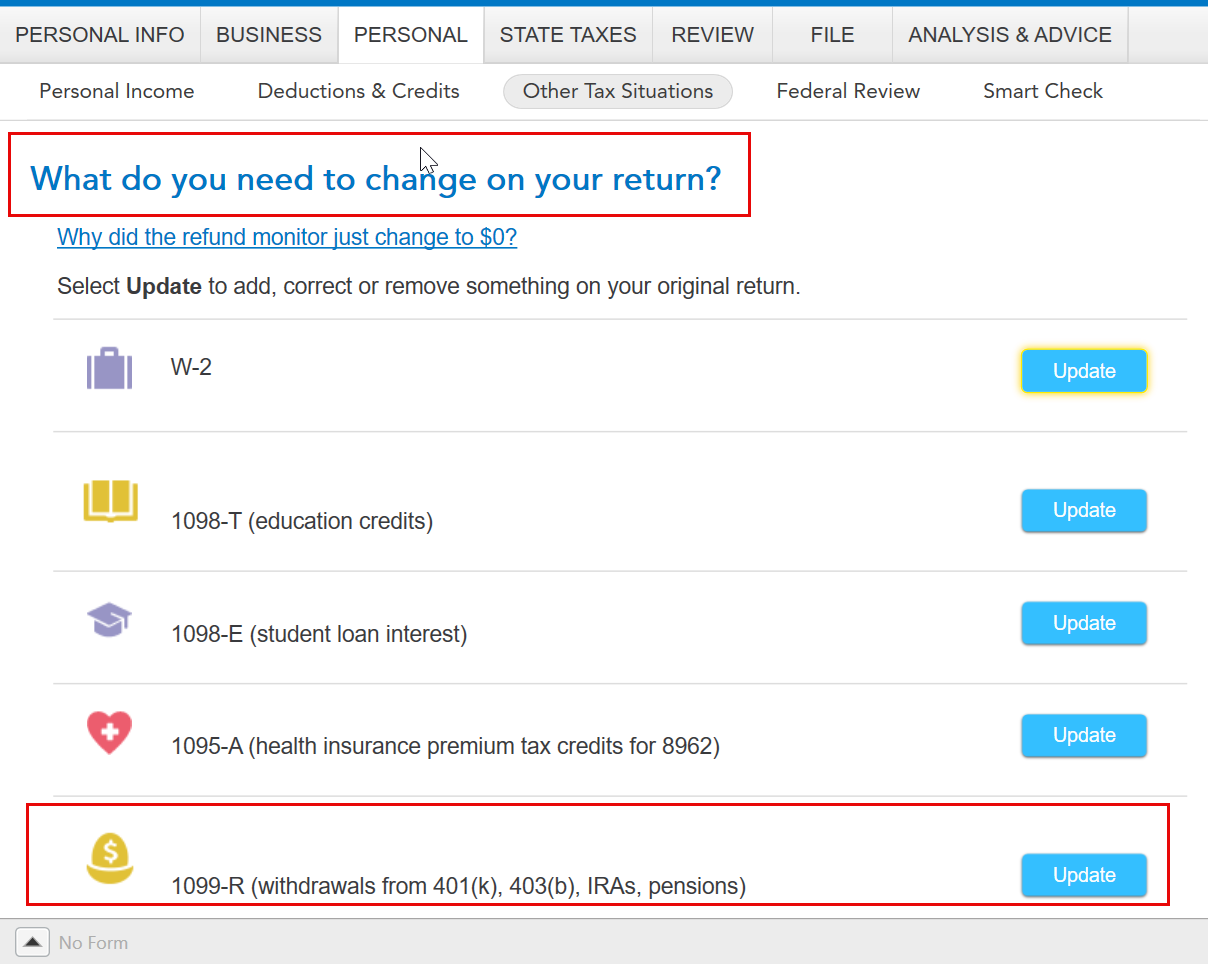

I already requested a regular distribution for excess contribution only. I now want to submit an amended 2024 tax return to pay the penalty for 2024. But I don't know how to do it. On "Do you need to change anything else" page, I did not see any items fit to my case. I choose Other tax Situations. I still did not find anything fit to me. So, please advise me.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Please see this thread from DanaB27 that lays out the steps you need to take to report this on your amended return.

The entry point would be under the amended menu in Other Tax Situations. You will need to select update to the right of the section titled 1099-R (withdrawals from 401(k), 403(b), IRAs, pensions).

You will then be able to follow the steps in the link above to report the penalty on the excess contributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended 2023 Federal Tax Return has been rejected

Thank you @JotikaT2 , sorry for the delay. Not sure what's going on but I could not login to my account for a long time. I checked the thread you suggested and I saw I could submit my amended 2024 return after I received my 2025 1099-R in 2026. So I will do it next year. Thank you so much for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cobralady

Level 1

cj5

Level 2

easytrak2002

New Member

dabbsj58

New Member

Omar80

Level 3