- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- All my stock trades from Etrade say needs review

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

All the trades are correct with the correct price bought and sold. Spoke to support and they told me you just have to go through all of them, there was a change this year. I didn't have to do this last year unless the cost basis was missing. Anybody got a solution? I haven't got my tax form from Merrill yet but that is going to have 100's of trades. Considering using another service if I have to do all that

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

If you're using TurboTax Online, you can save your 1099's as a PDF and attach it to your tax return.

If you're using TurboTax Desktop, here's How to Enter a Summary in Lieu of Individual Transactions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

how do you do that if you're filing online? And will turbo tax let you finish if you don't review all of them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

Yes, you won't need to review the trades, because you're not entering them into the program, just attaching a copy of your 1099-B as a PDF (which the IRS already has a copy of anyway).

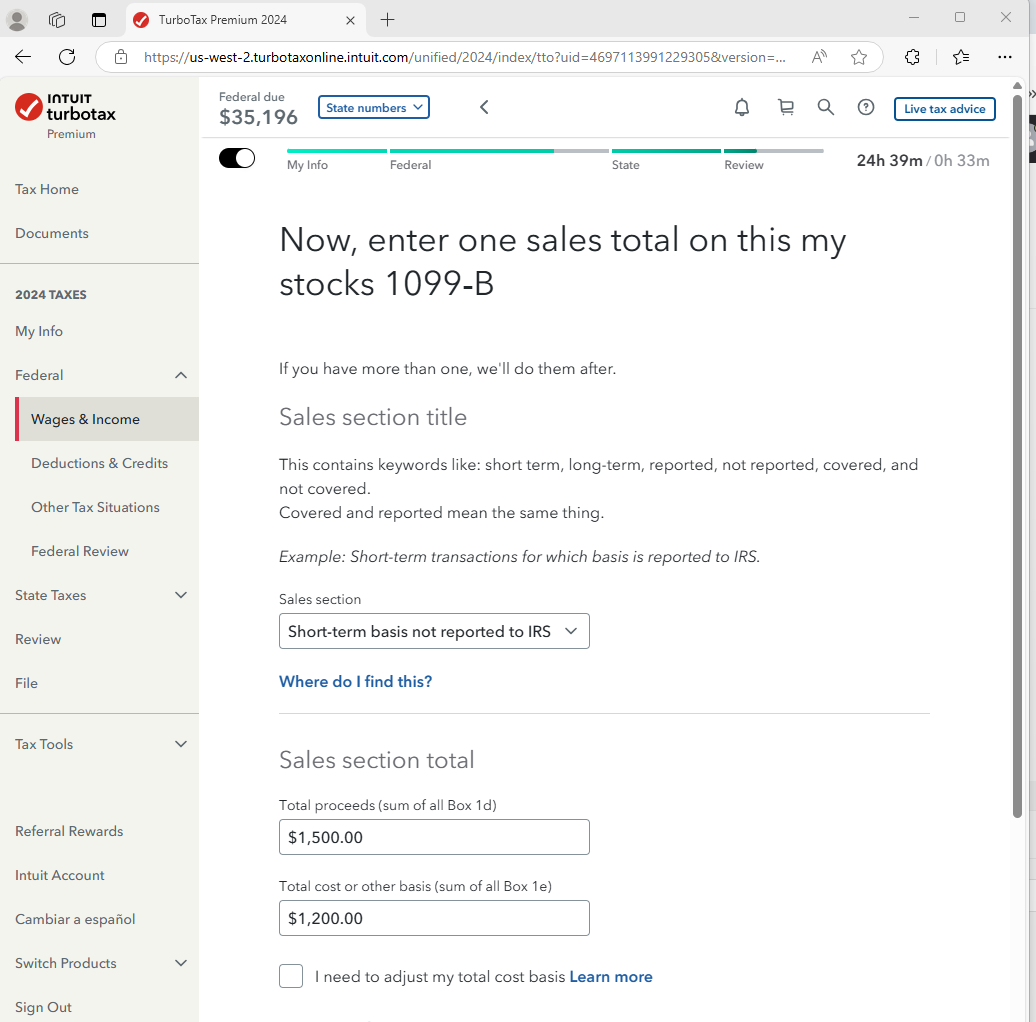

In the Stocks interview, choose Enter a Different Way (not importing), Continue, answer the questions on the next screen, then choose Sales Section Totals on the next page.

You'll make one line entry for each Sales Section, and the next screen will ask for your PDF.

Help me identify sales sections

Sales are categorized under sales sections and might be grouped together by:

- Short-term gains/losses

- Long-term gains/losses

- Unknown term/code

On some 1099-Bs, sales can be listed across rows, making it hard to distinguish a single sale. Make sure each one is listed as a line item with a description, date acquired, date sold, proceeds, cost or other basis, and gain/loss.

When you count your sales, be sure to count the sales under each section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

it did not ask for a pdf on the next page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

There is a page to Review in between the Sales Section Totals entry page and the page asking for PDF. If you add three Sales Section totals, you'll get the PDF entry after you're done, and Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

don't have 3 entries to make

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

they all say box 1d and 1e which would all be the same

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

I just picked 2 others and entered zeros, does that work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

If you entered the transactions, one by one, you won't get the PDF upload option. That option is available in TurboTax Online Premium when you enter summarized transactions. You can delete (use trash can icon) to remove your individual sales and instead enter summaries. For instructions on how to do this, see Option #1 in this TurboTax FAQ

If you have a large number of stock transactions, see this TurboTax FAQ

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

what I meant was how to I enter 3 stock sales selection totals since this is whats on the 1099-b ( I deleted the

amounts on 1d and 1e)

1d. PROCEEDS

COVERED SECURITIES

NONCOVERED SECURITIES

1e. COST OR OTHER BASIS OF COVERED SECURITIES

1f. ACCRUED MARKET DISCOUNT $0.00

1g. WASH SALE LOSS DISALLOWED $1,582.34

4. FEDERAL INCOME TAX WITHHELD $0.00

8. PROFIT OR (LOSS) REALIZED IN 2024 ON CLOSED CONTRACTS $(38.72)

9. UNREALIZED PROFIT OR (LOSS) ON OPEN CONTRACTS 12/31/2023 $0.00

10. UNREALIZED PROFIT OR (LOSS) ON OPEN CONTRACTS 12/31/2024

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

The answers so far aren't helpful.

I, like the original poster, would like the import to work and not then have to edit every single trade line item.

All the trades imported were correct. I tried the "Bulk Edit" option but that didn't clear the "needs review" flag.

This idea of just deleting the import and doing it "some other way" is just foolish - what is the point of the software then?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

I have the exact same issue. I imported my 1099-B from E*Trade, just like I have done for years. But this time, all of my trades are marked as NEEDS REVIEW.

Your help articles say that something must be missing, but everything is there - sales section, type, description, acquire date, sale date, cost basis.

I saw a suggestion from TurboTax Support to re-enable third-party data support (ETrade > Profile > Security Settings > Manage third-party data sharing) but that did not work. I even tried disabling, saving, reenabling, and saving again. I also tried repeating the import in TurboTax several times.

Bulk edit does not clear the NEEDS REVIEW flag.

Just as others says, deleting my import and doing it "some other way" is unacceptable. Literally the only reason I haven't ditched TurboTax for your competitor's more reasonably priced software is that you have (had?) electronic import for E*Trade transactions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

I did it another way they told me and it worked out, entering the cost basis and proceeds then uploading the 1099, I got live help to walk me through it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All my stock trades from Etrade say needs review

Since it worked okay all the previous years, I believe, it's a ploy to force you to buy higher tier of TurboTax. Basically they want you to loosen your pocket a little more. If true, it's a down right dirty trick.

I basically deleted what they had pulled from my broker. Entered all the information from 'FORM 1099-B TOTALS SUMMARY.' Make sure you enter all the appropriate values from 'SHORT -TERM GAIN OR (LOSSES) - REPORT ON FORM 8949, PART I', Box A, Box A and Box B, Box B. Then from 'LONG -TERM GAIN OR (LOSSES) - REPORT ON FORM 8949, PART II' Box D, Box D and Box E, Box E. Of course, enter only non-zero values.

After MANUALLY entering all of this, I got the option to upload the 1099-B PDF from my broker.

It still does not look right to me. I will verify and update this post.

Update: It didn't look right because the year-end totals were not what I thought. I double checked everything and completed the return as per the 1099-B from my broker. I could have been thinking incorrect numbers.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

disoswam

New Member

geemonee

Level 2

jfrankel33

New Member

jserulneck

New Member

dadbirdit

New Member