- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099R (one for monthly pension and one for 401k withdrawal)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R (one for monthly pension and one for 401k withdrawal)

Last year my husband was 72 and required by law to withdraw from his 401k (which he did withdraw the required minimum). This 401k is with Fidelity Investments.

My husband also receives a monthly pension from the same firm as above, which is Fidelity Investments. He has been receiving this monthly pension since 2007 and we have used TurboTax to successfully complete our taxes since then.

This year we received two 1099R's from Fidelity Investments -- for both of the above. No surprise there.

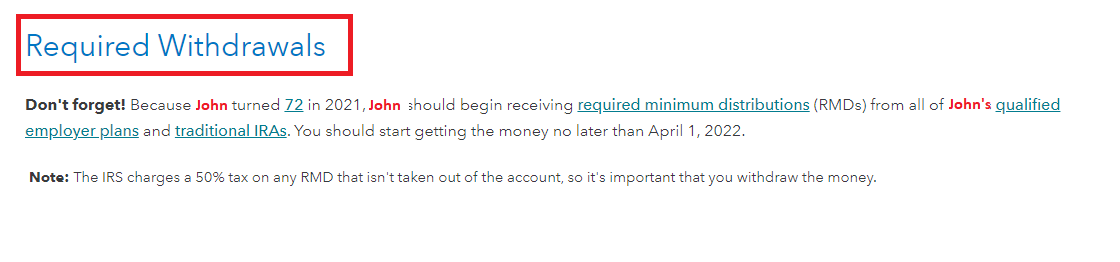

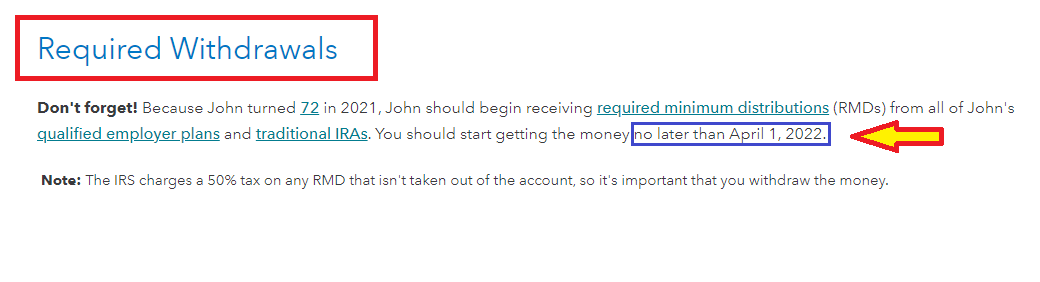

Here is the surprise occurring with TurboTax this year. For the pension distribution (which it is 100% deposited monthly to our checking account and has been since 2007), TurboTax is insisting the following: "Don't forget ..." that since my husband is 72 he must begin receiving required minimum distribution amounts for this pension. Why is this happening when it is a pension fund which we do receive the full amount and we paid federal taxes on it (which are reflected and reported on the 1099R)?

If I ignore this message and submit my taxes, will I be taxed 50% on the RMD -- which makes no sense??

Thank you!

Debd2

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R (one for monthly pension and one for 401k withdrawal)

If you have answered all the questions correctly after entering the 1099-R for the pension, you will not be taxed any penalty amounts for the distribution that you have been receiving monthly or annually for several year. Go back through the questions and make sure they are answered correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R (one for monthly pension and one for 401k withdrawal)

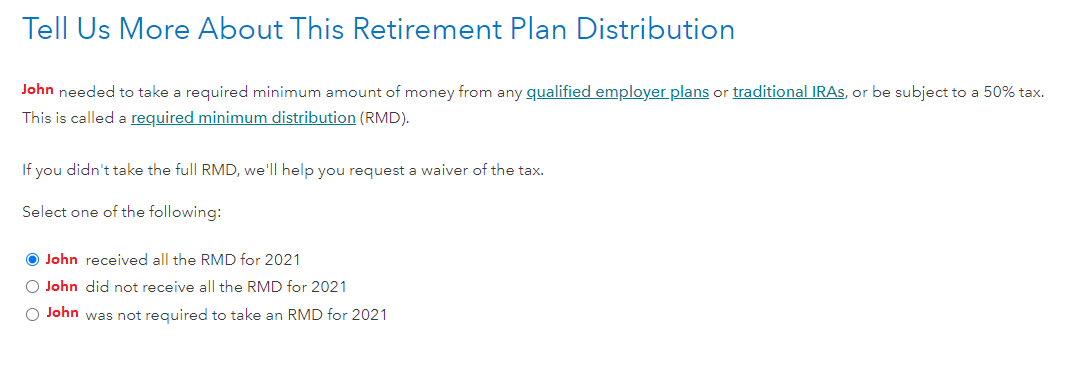

No, you will not be taxed the 50% penalty for not taking the required minimum distribution (RMD). TurboTax is asking to be sure that the RMD has been taken so you should simply answer the question that it is a RMD and that the amount has been taken. You should see screens similar to the ones shown here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jenniedobbins

New Member

MK3386

New Member

pk222

Level 1

Fufwat-nehxow-cegqa7

New Member

allenpark50

New Member