- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099B autoimport tax withheld entry needs check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B autoimport tax withheld entry needs check

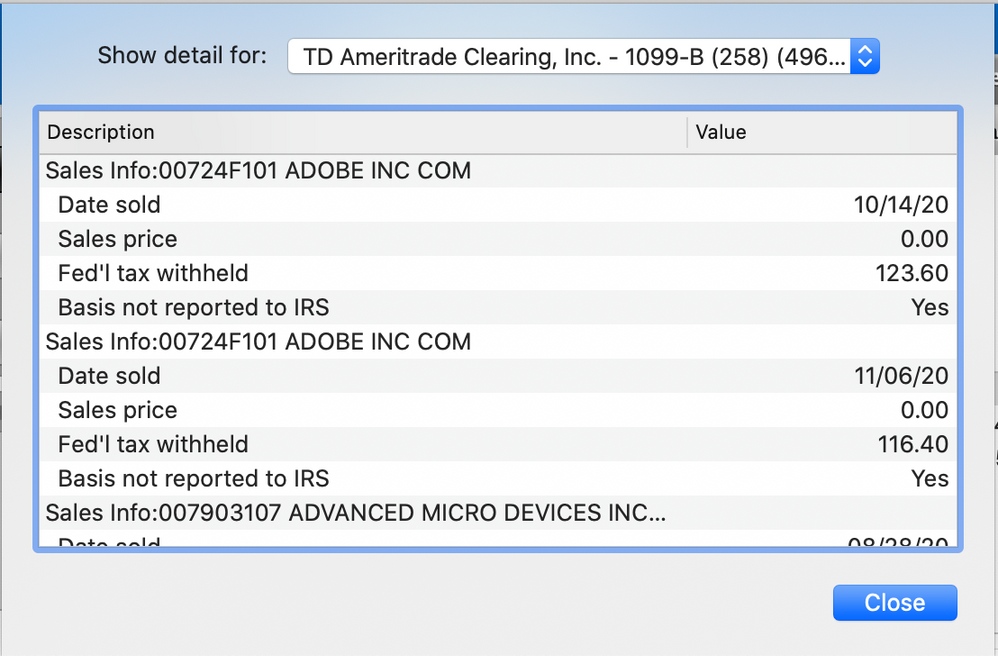

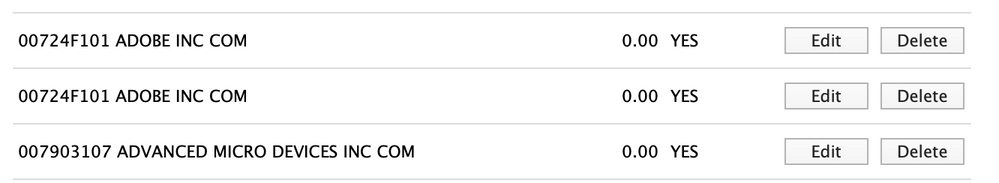

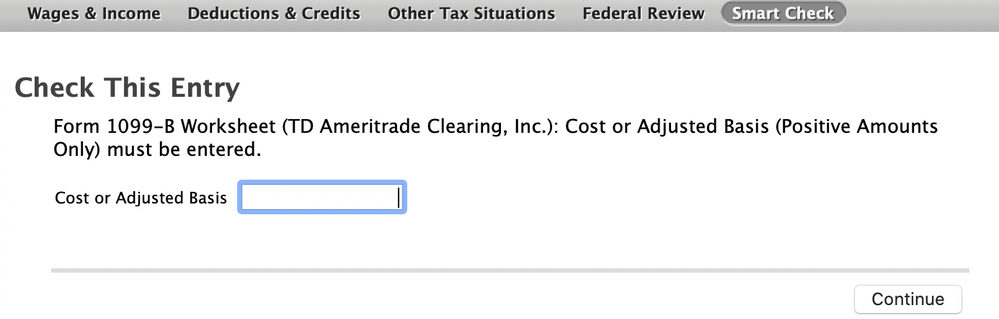

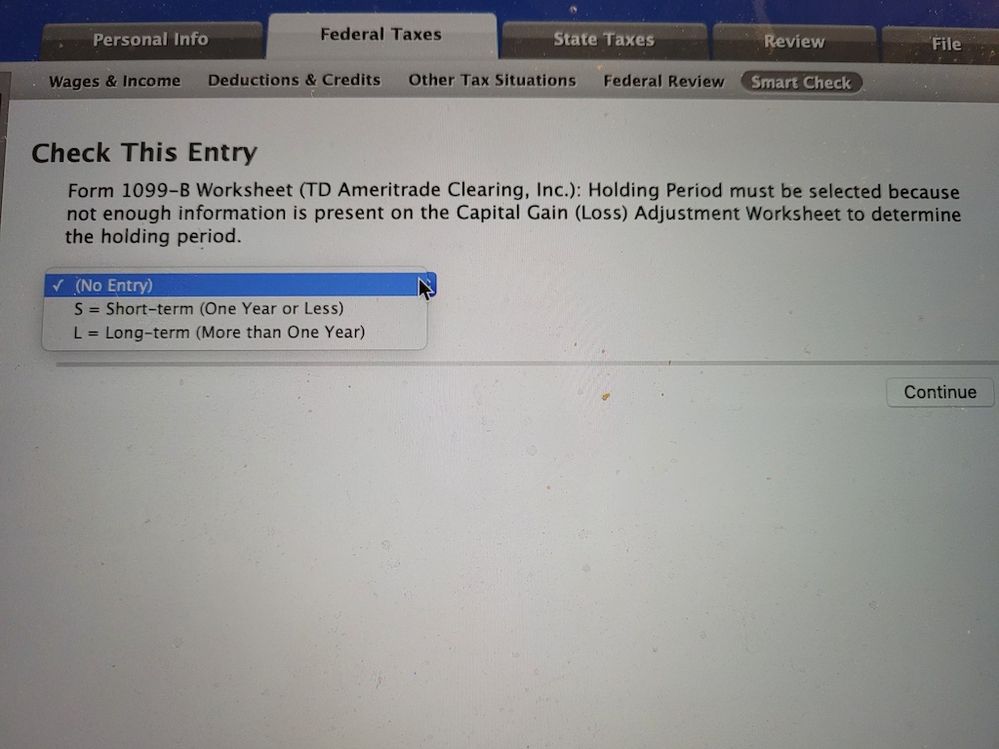

I imported my 1099-B from TD ameritrade using the automatic import feature. It is capturing my "federal incometax withheld" information due to my sales as a zero gross proceeds transaction (figure 1 and 2 below). After the automatic import during smart check, it is advising me to fix error on these zero gross proceeds entries to provide (a) Category information -- short term or long term (figure 4) and (b) cost or adjusted basis information (figure 3). There are 100s of entries with zero value gross proceeds for the federal income tax withheld transactions. How should I fix these errors? For each of these entries

- Should I manually enter the (a) and (b) information above?

- What do I need to enter for these (a) and (b) ? say short-term and 0. If I choose short term for (a) during fix errors of smart check as in Figure 4, and go to "Edit" later, it has chosen "Box B - Short term non-covered" for these federal income tax withheld entries. Is this expected?

For your reference, I am pasting the screen shot of each of these details.

Figure 1:

Figure 2:

Figure 3

Figure 4

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B autoimport tax withheld entry needs check

I believe this is a warning.

proceed to file ignoring this.

Come back again if you can't e-file because of it.

PS.

A tax withheld looks fishy in this case.

Your import may have gone very wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B autoimport tax withheld entry needs check

If the basis (or any other info) didn't transfer into the program then YOU must fill in the blanks from your own records or talk to the broker to see if they have it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B autoimport tax withheld entry needs check

@fanfare , it is not allowing me to file. At the filing stage, it is asking me to fix the problem. A stage similar during "smart check", fix errors. I see a tax withheld entry three-four days after every sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B autoimport tax withheld entry needs check

I think zero basis is a warning. I guess I missed that Figure 4 before.

You always must specify LT or ST for all your trades.

You must have set up tax withholding with your broker. That is unusual.

Do you remember doing that?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

palomino2316

New Member

wyattennis-hotma

New Member

rykcade

New Member

Nucci

New Member

edwardwilliam98

New Member