- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-R code P--What to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

Hi,

In 2018, I switched jobs and, due to a bonus paycheck I received right before quitting my first job, I already maxed out my 401k at my first job. My 2nd job, which started mid-2018, continued to contribute to my 401k and I had an overcontribution in that year. I had also rolled over my 401k at my previous job into my new 401k, so all those funds ended up co-mingled.

I noticed this in Feb 2019, and in March 2019 my 401k administrator issued me a corrective distribution. At the time, my current employer refused to issue me an amended W2 and told me that the 401k administrator would be the one to give me a tax document.

Fast forward to today (2020), and I have received my 1099-R code P. Box 1 (Gross distribution) reflects the full amount of the overcontribution to the 401k in 2018. Box 2a (taxable amount), however, shows a lower number. I understand that gains/losses on the overcontribution amount are supposed to be taxable in the year of corrective distribution, but I'm wondering where I find that number (my inference is that is it Box 2a minus Box 1, but I am not sure). Also, I am wondering how I should be reflecting the overcontribution as income in my 2018 taxes now that I have received this 1099-R code P.

Thank you so much for the help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

@dkang94 wrote:

Well I'm not sure if there was a loss or not.

Let's put numbers to the situation, maybe that'll clarify.

I overcontributed $7942 in 2018, so in March 2019, I asked my 401k administrator to give me a corrective distribution of the $7942. They then distributed me $7375 instead, which I assume was because of a loss on that contribution, as the markets had dropped a bit since the time of my contributions. Now I am not 100% sure it was from a loss or if there is some other reason why they distributed less than $7942.

The 1099-R code P they sent me shows the $7942 in box 1 and then $7375 in box 2a. I did not receive a 1099-R code 8

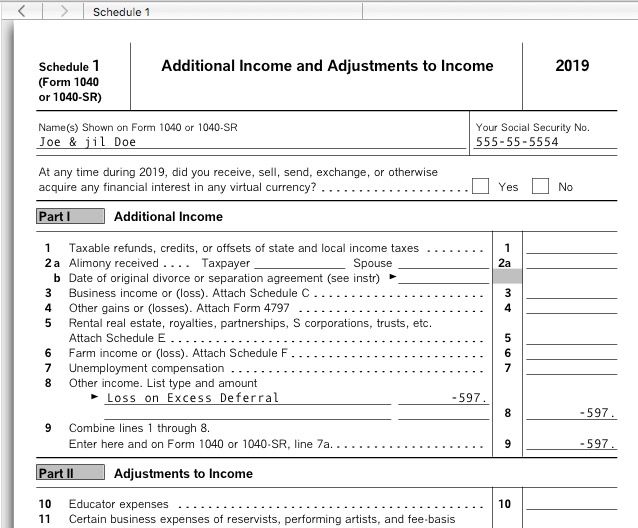

OK that clarifies it. If your excess was $7,942 and $7,345 was returned then you had a $597 loss. The loss will NOT be reported an a 1099-R, it must be entered into your 2019 tax return (the year returned) as a negative number on a 1040 Schedule 1, line 8 (more on that later). For 2018 the entire $7,942 must be reported as returned wages because that is the amount that yiu did not have to pay 2018 tax on when contributed so it must all be included just as if never excluded form tax.

The 1099-R with the code P is wrong. The $7,942 must be in both box 1 and 2a for it to be properly added to the 2018 1040 line 1 wages. The IRS 1099-R instructions that the 401(k) trustee is required to follow say:

Losses.

If a corrective distribution of an excess deferral is made in a year after the year of deferral and a net loss has been allocated to the excess deferral, report the corrective distribution amount in boxes 1 and 2a of Form 1099-R for the year of the distribution with the appropriate distribution code in box 7. I However, taxpayers must include the total amount of the excess deferral (unadjusted for loss) in income in the year of deferral, and they may report a loss on the tax return for the year the corrective distribution is made.

You need a corrected 1099-R that has box 1 and 2a the same per the IRS instructions.

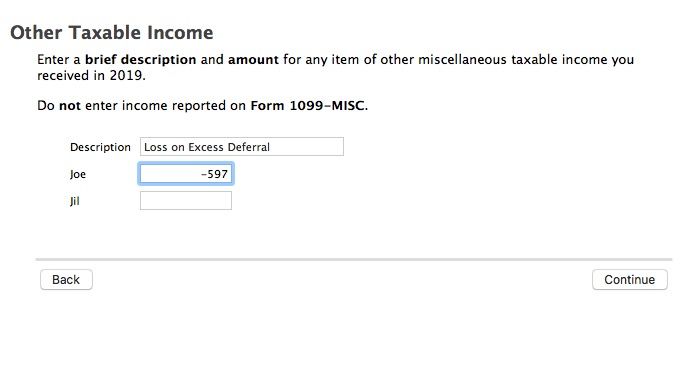

For 2019 Under income, Less Common Income, Miscellaneous Income, Other Reportable Income, Enter “Loss on Excess Deferral Distribution.” in the description box and -597 in the amount box.

It should look like this screenshot and schedule 1 line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

A code P on a 2019 1099-R means it was a 2018 excess returned in 2019. The excess must be reported as returned wages on an amended 2018 tax return. Entering the code P in to the 2018 software will ask if it is a 2018 or 2019 1099-R - say 2019 and the box 1 amount will be added to the 2018 1040 line 1 as wages.

They cannot change the W-2 since the W-2 reports what happened in 2018 and the past cannot be changed.

You should have received a 2nd 2019 1099-R with the earnings in box 1 and box 2 with a code "8" in box 7 because the earnings are taxable in the year returned - 2019.

For information see IRS Pub 525 page 10

https://www.irs.gov/pub/irs-pdf/p525.pdf

Excess distributed to you.

If you take out the excess after the year of the deferral and you receive the corrective distribution by April 15 of the following year, don't include it in income again in the year you receive it. If you receive it later, you must include it in income in both the year of the deferral and the year you receive it (unless the excess deferral was a designated Roth contribution). Any income on the excess deferral taken out is taxable in the tax year in which you take it out. If you take out part of the excess deferral and the income on it, allocate the distribution proportionately between the excess deferral and the income.

•

If the distribution was for a 2018 excess deferral, your Form 1099-R should have code P in box 7. If you didn't add the excess deferral amount to your wages on your 2018 tax return, you must file an amended return on Form 1040-X. If you didn't receive the distribution by April 15, 2019, you must also add it to your wages on your 2019 tax return.

•

If the distribution was for the income earned on an excess deferral, your Form 1099-R should have code 8 in box 7. Add the income amount to your wages on your 2019 income tax return, regardless of when the excess deferral was made.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

So where I get confused is that the 1099-R code P showed the right overcontribution number in box 1, but a different, lower number in box 2. The number in box 2 is what I got sent to me as a check back in March 2019 as the corrective distribution.

I did not get a 1099-R code 8, as I never got a second distribution of earnings.

Should I have received the full gross amount back in March 2019? Or did they send me a lower number because I had already incurred losses on that overcontribution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

@dkang94 wrote:

So where I get confused is that the 1099-R code P showed the right overcontribution number in box 1, but a different, lower number in box 2. The number in box 2 is what I got sent to me as a check back in March 2019 as the corrective distribution.

I did not get a 1099-R code 8, as I never got a second distribution of earnings.

Should I have received the full gross amount back in March 2019? Or did they send me a lower number because I had already incurred losses on that overcontribution?

You should have been sent a check for the excess plus the earnings.

The IRS Pub states: "Any income on the excess deferral taken out is taxable in the tax year in which you take it out." The "income on the excess" is the earnings, taxable in 2019 since that is when it was taken out.

It would appear the the 1099-R is incorrect for a 2018 excess returned in 2019. The earnings should not be in the code P because as the IRS Pub states: "If the distribution was for a 2018 excess deferral, your Form 1099-R should have code P in box 7."

And further states: "f the distribution was for the income earned on an excess deferral, your Form 1099-R should have code 8 in box 7."

The code P should have ONLY the excess in box 1 and box 2a and goes on your 2018 tax return. A separate code 8 1099-R should have only the earnings in box 1 and 2a and goes on yiur 2019 tax return.

You should refer the 401(k) trustee to the IRS publications for a corrected 1099-R code P and a 2019 code 8 1099-R. If they refuse then you should ignore the 1099-R and enter two substitute (4852) 1099-R's with explanation statements (that the interview will ask for) to replace the incorrect 1099-R that you have.

[A 2019 1099-R with a code P and both the excess and earnings does not make sense because it would say that both the excess AND earnings were returned in *2018*, but if that was the case and it was a 2018 distribution then it would be on a *2018* 1099-R with a code 8 and yiu would not have a 2019 1099-R at all.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

Got it, so is your sense that the administrator filled the 1099-R code P incorrectly and accidentally put the loss, which should be attributable to 2019 via a 1099-R code 8, in the code P?

Just to be clear--1099-R code P for corrective distributions should always have the same number in Box 1 and Box 2a, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

Also, if there is a loss, then should I ask the administrator to send me a new 1099-R code 8 with a negative number for Box 2a?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

@dkang94 wrote:

Also, if there is a loss, then should I ask the administrator to send me a new 1099-R code 8 with a negative number for Box 2a?

Please explain? You did not say before that there was a loss. Losses are done differently. What exactly is in box 2a? Is there a negative number in box 2a?

You do not get a 1099-R code 8 for a loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

Well I'm not sure if there was a loss or not.

Let's put numbers to the situation, maybe that'll clarify.

I overcontributed $7942 in 2018, so in March 2019, I asked my 401k administrator to give me a corrective distribution of the $7942. They then distributed me $7375 instead, which I assume was because of a loss on that contribution, as the markets had dropped a bit since the time of my contributions. Now I am not 100% sure it was from a loss or if there is some other reason why they distributed less than $7942.

The 1099-R code P they sent me shows the $7942 in box 1 and then $7375 in box 2a. I did not receive a 1099-R code 8

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

@dkang94 wrote:

Well I'm not sure if there was a loss or not.

Let's put numbers to the situation, maybe that'll clarify.

I overcontributed $7942 in 2018, so in March 2019, I asked my 401k administrator to give me a corrective distribution of the $7942. They then distributed me $7375 instead, which I assume was because of a loss on that contribution, as the markets had dropped a bit since the time of my contributions. Now I am not 100% sure it was from a loss or if there is some other reason why they distributed less than $7942.

The 1099-R code P they sent me shows the $7942 in box 1 and then $7375 in box 2a. I did not receive a 1099-R code 8

OK that clarifies it. If your excess was $7,942 and $7,345 was returned then you had a $597 loss. The loss will NOT be reported an a 1099-R, it must be entered into your 2019 tax return (the year returned) as a negative number on a 1040 Schedule 1, line 8 (more on that later). For 2018 the entire $7,942 must be reported as returned wages because that is the amount that yiu did not have to pay 2018 tax on when contributed so it must all be included just as if never excluded form tax.

The 1099-R with the code P is wrong. The $7,942 must be in both box 1 and 2a for it to be properly added to the 2018 1040 line 1 wages. The IRS 1099-R instructions that the 401(k) trustee is required to follow say:

Losses.

If a corrective distribution of an excess deferral is made in a year after the year of deferral and a net loss has been allocated to the excess deferral, report the corrective distribution amount in boxes 1 and 2a of Form 1099-R for the year of the distribution with the appropriate distribution code in box 7. I However, taxpayers must include the total amount of the excess deferral (unadjusted for loss) in income in the year of deferral, and they may report a loss on the tax return for the year the corrective distribution is made.

You need a corrected 1099-R that has box 1 and 2a the same per the IRS instructions.

For 2019 Under income, Less Common Income, Miscellaneous Income, Other Reportable Income, Enter “Loss on Excess Deferral Distribution.” in the description box and -597 in the amount box.

It should look like this screenshot and schedule 1 line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

Had excess contribution of $9,000 to 401k in 2021 due to change in employer. Noticed and informed new employer the same in 2021 itself and they sent me a cheque for the overpayment of $9000 in Dec, 2021. They just send me a distribution statement but no tax form. 2021 W2 also doesn't reflect this correction. What should i do? HR said i will get tax forms next year. I read that i need to report the $9000 as income in my 2020 tax return. Please advise how to handle this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

@ajaychhawacharia wrote:

Had excess contribution of $9,000 to 401k in 2021 due to change in employer. Noticed and informed new employer the same in 2021 itself and they sent me a cheque for the overpayment of $9000 in Dec, 2021. They just send me a distribution statement but no tax form. 2021 W2 also doesn't reflect this correction. What should i do? HR said i will get tax forms next year. I read that i need to report the $9000 as income in my 2020 tax return. Please advise how to handle this.

You do not need to wait for a 1099-R next year that will probably require you to amend your 2021 tax return to report the excess on line 1 of your tax return - it can be entered this way and then ignore the 2021 1099-R with a code P in box 7 when it comes.

There are two methods to do this (I prefer the 2nd method because many people make errors or get confused by the 1099-R interview):

1) Enter a 1099-R with the returned contribution amount (not including earnings) in box 1 & 2a, and a code "P" in box 7. When asked what year 1099-R say 2021.

or 2)

Excess 401(k) deferrals should be reported in:

(There are several screens to click through to get to the right place)

Miscellionious Income ->

Other Income not reported on a W-2 ->

Other wages (yes) ->

House Hold employee (Continue) ->

Sick Pay (Continue) ->

Other earned income (yes) (Includes excess salary deferrals)->

Source of income (other) ->

Any other income - enter the amount of the excess deferral and an explanation.

This will add the returned excess to your 2020 wages on line 1 exactly the same way that the 1099-R would. The only information that is sent to the IRS is the line 1 amount.

[Note: If there were any earning that were returned in 2021 then the earnings will be reported on a separate 2022 1099-R with a code 8 that goes on your 2022 tax return - do not enter the earnings here.]

Both methods will add the returned excess to your 2021 wages on 1040 line 1 exactly the same way that the 1099-R would. The only information that is sent to the IRS is the line 1 amount.

For information see IRS Pub 525 page 10

https://www.irs.gov/pub/irs-pdf/p525.pdf

Report a loss on a corrective distribution of an excess deferral in the year the excess amount (reduced by the loss) is distributed to you. Include the loss as a negative amount on Schedule 1 (Form 1040), line 8 and identify it as “Loss on Excess Deferral Distribution.”

Enter as:

Miscellionious Income ->

Other reportable Income ->

Any Other Taxable Income (yes) ->

Description (enter "Loss on Excess Deferral Distribution" and amount as a negative number).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R code P--What to do?

Hi, I am in a similar situation. I received a 1099r with P code and a 1099r with 8 code after I submitted tax return this year. Both of them say Year 2022 on top of them. When I amend the 2022 tax using TurboTax Desktop, I can successfully upload both forms but it warned that I need to amend 2021 tax for the 1099r with P code. So I just pay what I owe for 1099r with 8 code with TurboTax.

The problem comes when I amend 2021 tax. Back then I was NRA, so I used Sprintax. I followed the instruction, adding a new 1099r form on my 2021 tax files. However, the tax form popping up has a 2021 on top of it, I am confused whether I should enter code P(prior) or 8(currently working on) on the website. Thanks for any suggestions. Knowledge about Sprintax tax amendment is so sparse online. So I decide to seek help from fellows here.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thenritzy

New Member

tyronedevine8612

New Member

Kat78

New Member

in Education

GeekyGurl613

New Member

angelamecum

New Member