- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@dkang94 wrote:

Well I'm not sure if there was a loss or not.

Let's put numbers to the situation, maybe that'll clarify.

I overcontributed $7942 in 2018, so in March 2019, I asked my 401k administrator to give me a corrective distribution of the $7942. They then distributed me $7375 instead, which I assume was because of a loss on that contribution, as the markets had dropped a bit since the time of my contributions. Now I am not 100% sure it was from a loss or if there is some other reason why they distributed less than $7942.

The 1099-R code P they sent me shows the $7942 in box 1 and then $7375 in box 2a. I did not receive a 1099-R code 8

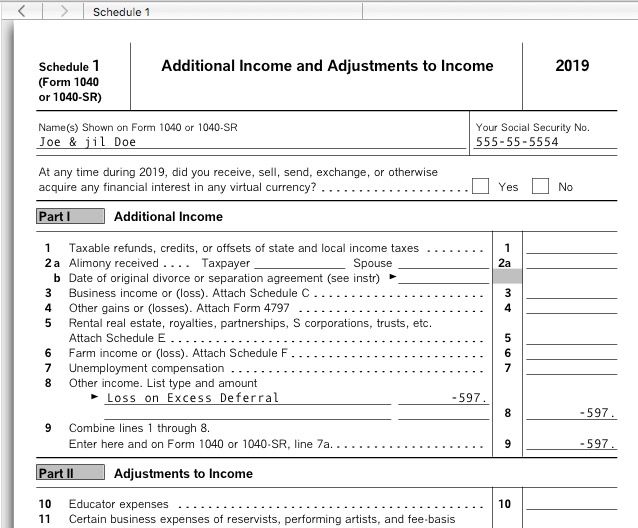

OK that clarifies it. If your excess was $7,942 and $7,345 was returned then you had a $597 loss. The loss will NOT be reported an a 1099-R, it must be entered into your 2019 tax return (the year returned) as a negative number on a 1040 Schedule 1, line 8 (more on that later). For 2018 the entire $7,942 must be reported as returned wages because that is the amount that yiu did not have to pay 2018 tax on when contributed so it must all be included just as if never excluded form tax.

The 1099-R with the code P is wrong. The $7,942 must be in both box 1 and 2a for it to be properly added to the 2018 1040 line 1 wages. The IRS 1099-R instructions that the 401(k) trustee is required to follow say:

Losses.

If a corrective distribution of an excess deferral is made in a year after the year of deferral and a net loss has been allocated to the excess deferral, report the corrective distribution amount in boxes 1 and 2a of Form 1099-R for the year of the distribution with the appropriate distribution code in box 7. I However, taxpayers must include the total amount of the excess deferral (unadjusted for loss) in income in the year of deferral, and they may report a loss on the tax return for the year the corrective distribution is made.

You need a corrected 1099-R that has box 1 and 2a the same per the IRS instructions.

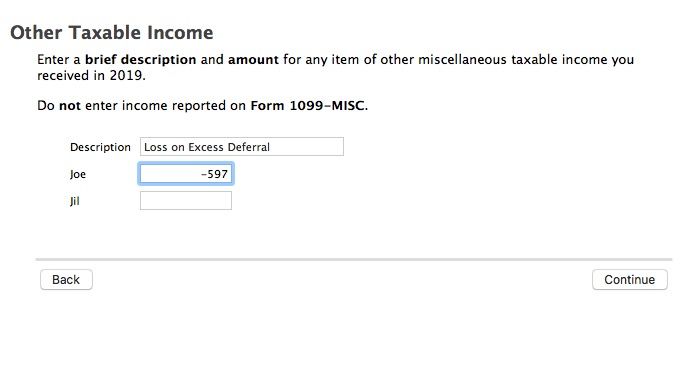

For 2019 Under income, Less Common Income, Miscellaneous Income, Other Reportable Income, Enter “Loss on Excess Deferral Distribution.” in the description box and -597 in the amount box.

It should look like this screenshot and schedule 1 line 8.