- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-OID bond premium on tax free

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

Have you noticed that we're not getting any response from TT, to say nothing of definitive guidance or information?

I agree that putting numbers where then 1099-0ID has none feels like the wrong thing to do. There are 2 or 3 creative possibilities, but none of them feel right.

I think part of my problem is that my composite 1099 is silent on the whether the bond premium in box 10 is taxable or not. I plan to call the issuer of the 1099 tomorrow, but I'm not really expecting a definitive answer. Instead of putting numbers where there are no numbers, I'd almost be more comfortable in simply omitting the small amount in box 10 entirely.

Your thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

Based on the earlier comments from tax professionals, I do not that the the bond premium is taxable.

Actually I found several other articles and I think the better approach is to NOT enter the premium on 1099-OID, but instead subtract it from exempt interest on 1099-B. Taxslayer says to do this:

And an older post on TurboTax:

It seems like the 1099-B and 1099-OID forms in TT are not handling this automatically, hence the manual process suggested in the posts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

I’ve just made a small discovery. As it happens, I have a competing tax program comparable to TT Dlx, so I tried this little exercise on it. All I did was create a return and then entered the amounts from box 8 and box 10. No problem. It did NOT demand that I reduce the bond premium in box 10 to the amount (which is zero) in box 2. Knowing that, I feel more comfortable in merely not reporting the small amount in box 10.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

I also would be most comfortable omitting the amt in box 10 (or reducing to the amount in box 2, if any), rather than entering something in box 2 that is not the case. My understanding is that the bond premium is something that would lower your taxes, if you had any taxable interest. That's why they tell you to enter it on schedule A instead. If you are itemizing. I just don't understand why, if this is the proper thing to do, that TurboTax doesn't do this step for you, or explain it to you right there as you are entering the 1099-OID. Seems like quite a flaw and many of us are uncomfortable about how the "error" is managed and it is quite confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

Thank you! I couldn't get to the Taxslayer link, but was able to bring up the TT link "Should i recognize a bond premium amortization on tax exempt interest bonds? and if so where?" I'll have to read it through another time, but that looks interesting. I do recall, when you enter the 1099-OID there's a question about whether any of these not usual circumstances apply, and I think ABP adjustment might have been one of them. Hmmmm. Or maybe I saw ABP adjustment somewhere else, I don't know for sure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

What did the software report for total tax-exempt interest? Did it reduce the total by the bond premium amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

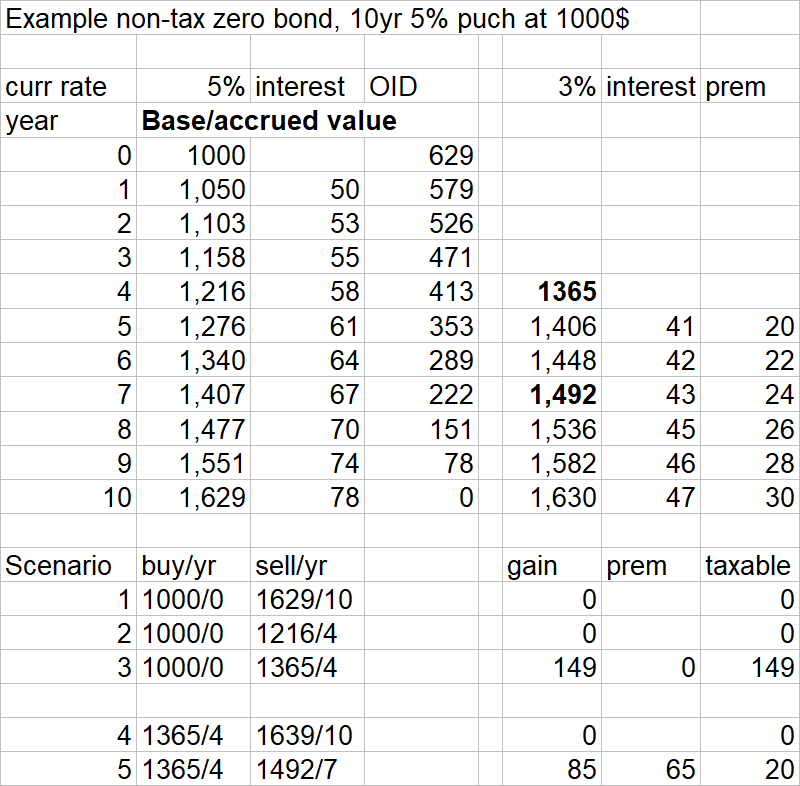

I created a spreadsheet and calculated accrued values and interest on a bond. I don't think the premium is taxable on a municipal bond and I don't think it has an impact unless you sell the bond prior to maturity. If you purchase a bond after issue at a premium (higher cost, lower current interest rate), then the accrued value based on the original price and rate aren't valid. Since your effective interest is lower than the original rate, you can use that difference (premium) to reduce a taxable gain if you sell the bond before maturity. By reporting the lower exempt interest on a return, you are creating a record of the premium.

However, I don't think the tax software will help if you sell the bond. I am creating a separate spreadsheet for such bonds, tracking the 1099 data. If a bond is sold, I can then hopefully calculate the reduced gain. If the IRS questions the gain, then the tax return reporting may be helpful to document the reduced gain. Holding the bond to maturity should avoid this issue.

In the spreadsheet I created there was still a taxable gain after applying the calculated premium (scenario 5). I"m not sure if this is correct or and artifact of the simplified calculations. In an ideal world with stable interest rates, I would think that the premium would wash out the gain.

On the flip side, if a zero coupon municipal bond is purchased at a discount (lower price, higher interest rates), then tax on that discount will be owed when it is sold or matured.

I found these articles helpful:

NOTE: I am not a tax professional. Do not rely on any of this information - do your own due diligence!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

Hi all, I have the exact same issue, and have spent over 3 hours on the phone with Turbo Tax over the last three days and they have been ABSOLUTELY NO HELP! They took screen shots twice, and supposedly escalated, but all I got back was a regurgitation of the question that I originally asked. I tried to get them to explain where on Schedule A they thought I should make the offsetting entry, but they would not answer this question.

Very angry and disappointed with the support from Turbo Tax. Also, it seems from the community that this was an issue for 2019 tax year as well. So they have not done anything to fix it for 2020 tax year.

We should not have to fudge the entries we receive from 1099 documents to fix a problem that Turbo Tax has created.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

I agree. However, the most important lesson for me is that we need to separately track and 1099-OID data for future use, it may affect capital gains and taxes in the future. Even if TurboTax handled the form correctly, external tracking is required to document changes in the basis, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

This is the nonsense that takes so long to resolve in TT. I only have box 11 OID not box 2 and couldn't get rid of the error on box 10. Even leaving it blank and doing a manual adjustment as "bond premium" then triggers some other complaint that box 10 is empty. In the end I just left box 10 blank and did an 'other' adjustment to reduce the OID. It doesn't matter anyway on Fed taxes and will have a small impact on State. It's just a massive time suck in TT resolving these dumb errors and there is no helpful help on this field indicating why it's in error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

Here are the steps missing from TT:

1. Delete the error amount in block 10 of the 1099-OID worksheet.

2. Go to Federal Taxes, Deductions and Credits, Other Deductions and Credits, Other Deductible Expenses, Tell us about your other expenses and the last entry is "Amortized bond premiums." Enter the amount you deleted from block 10 above.

Done!

If you didn't itemize just delete the error amount in block 10 because it won't affect your tax liability.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

where do I find the document to insert to enter acquisition premium in turbotax for a municipal bond.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

Where do I find box 6 for for acquisition premium on a tax exempt bond

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

The acquisition premium is is an amount that reduces the amount of OID that is considered to be taxable interest and is amortized.

Box 6. Acquisition Premium

For a covered security acquired with acquisition premium, enter the amount of premium amortization for the part of the year the debt instrument was owned by the holder. If you reported a net amount of OID in box 1, 8, or 11, as applicable, leave this box blank. You may, but are not required to, report the acquisition premium for a tax-exempt obligation that is a covered security acquired before January 1, 2017.

This can be found when you are entering your Form 1099-OID. Make sure to use the following steps to enter the acquisition premium.

- Open your TurboTax account/return (Online or CD/Download)

- Select Wages & Income > Interest and Dividends > 1099-OID, Foreign Accounts > Start or Update

- Select the check box beside 'Form 1099-OID...' > Continue > Yes > I'll type it in myself > Continue

- Type in the information for each box where there is an amount on your Form 1099-OID

- See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID bond premium on tax free

For several years, TurboTax users have noted that TurboTax claims that Charles Schwab 1099-OID’s for tax-exempt bonds with a positive bond premium in Box 10 must have Box 10 manually reduced to 0 because Schwab provides no Box 2 value and it is treated as being null (0). For young or lower income tax payers it is probably fine to change Box 10 to 0 and simply allow TurboTax to compute an erroneously high 1040 Line 2A value for the net tax-exempt income. After all that doesn’t affect their taxes due.

HOWEVER, for medicare eligible, higher income tax-payers, simply changing Box 10 to 0 might be a costly mistake. If you happen to be very near the top of one of the Medicare IRMAA income brackets you might possibly be subjected to as much as $2,900/year/couple in higher Medicare premiums. Even a single dollar of erroneously high net tax-exempt income could theoretically cause your MAGI (taxable AGI plus net tax-exempt income) to bump you into the next higher IRMAA bracket. Unfortunately the exact IRMAA brackets for 2023 Medicare premiums won’t be announced until December 2022 (much later than when you file your 2021 taxes that are used for determining what your 2023 Medicare premiums will be).

After several failed attempts to get Schwab to send me and others corrected 1099’s, I have decided to change the 1099-OID Box 10 value to 0, AND TO REPORT in TurboTax for the Schwab 1099-INT a positive “adjustment to interest” of type “T --- Bond premium on tax-exempt”. The positive amount of the adjustment is the total amount of the 1099-OID box 10 value that had to be set to 0. This seems to then allow TurboTax to compute the correct net tax-exempt income for Line 1040 Line 2A. Schwab clients shouldn’t have to know how to make these manual adjustments (that could be error prone) in order to get the proper net tax-exempt interest for 1040 Line 2A.

After careful reading of IRS Pub 550 and Instructions for Forms 1099-INT and 1099-OID it is clear that for tax-exempt bonds subject to OID reporting, the IRS requires the payer to report the usually relatively insignificant net tax-exempt OID as Box 11 minus Box 6 of the 1099-OID (and I agree that Schwab must generate a 1099-OID with Box 11 and Box 6 populated for the bonds subject to OID reporting). The IRS also describes two options for payers to report net tax-exempt income (for the usually much larger semi-annual interest payments). It can be reported VIA 1099-INT (Box 8 minus Box 13) OR VIA 1099-OID (Box 2 minus Box 10).

Without any apparent justification in those IRS documents, the dimwits at Schwab (or their subcontractors) apparently decided to report the total gross tax-exempt income (for all OID and non-OID bonds) on 1099-INT Box 8 but to only report the non-OID bond premium in Box 13. Without any apparent justification, they decided to separate out and report the individual bond premium for OID bonds on individual 1099-OID’s Box 10 without reporting the gross tax-exempt interest for those bonds in the same 1099-OID’s Box 2 (as implied by the IRS instructions giving payers the option to report the semi-annual periodic interest for those bonds in the 1099-OID rather than the 1099-INT).

There appear to be absolutely no IRS instructions telling tax payers or tax prep software developers that they should match up gross tax exempt interest on the single 1099-INT with the bond premiums on multiple 1099-OID’s Box 10. It appears perfectly valid for TurboTax to complain about the Schwab 1099-OID’s. While I have no easy way of knowing, I seriously doubt that other tax-prep software would handle the bizarre reporting by Schwab any better, and I seriously doubt that the IRS would adjust the 1040 Line 2A value before passing it along to CMS/Medicare for IRMAA based premium calculations. It would seem reasonable and probably required by the IRS to treat a negative value for 1099-OID Box 2 minus 1099-OID Box 10 as 0 rather a negative value to be used as an adjustment to Form 1040 Line 2A. At least TurboTax warns about the reporting error. Some tax-prep software might silently discard the adjustment that should reduce the Form 1040 Line 2A value.

Frankly, I could find no REALLY REALLY explicit IRS instructions specifically forbidding the bizarre Schwab manner of reporting bond premiums, but then why should they have to forbid all cases of stupidity. Rather than this possible omission tacitly implying that Schwab has reported the data properly, I believe that it is merely indicative of the IRS document authors simply never considering that any payer would be so incredibly naive as to split up the reporting of gross interest and the associated premium onto separate forms (as Schwab has done). The 1099-INT Box 13 instructions seem clear enough to me that Box 13 is supposed to contain the bond premium for any bond interest reported in 1099-INT Box 8 (that seems to implicitly include bonds subject to OID if the payer has chosen to report the semi-annual gross tax-exempt income in 1099-INT Box 8). The instructions very definitely DO NOT say ANYWHERE that it is OK for the payer to report the semi-annual gross tax-exempt income in 1099-INT Box 8, report $0 premium in 1099-INT Box 13, and then turn around and report the premium associated with that gross income in a completely different form (in this case 1099-OID Box 10) where the premium will be ignored by tax-prep software rather than used to compute the correct net tax-exempt income.

It appears to me that Schwab (or their subcontractors) had incredibly poor understanding of proper accounting methods to report an adjustment to income on a completely separate form from the form that reports the associated gross income that needs to be adjusted. I have repeatedly asked that this issue be escalated to the proper level, but I have repeatedly been told that Schwab thinks what they have been doing is correct and that their software cannot generate the corrected consolidated 1099 that I have requested (at least I agree that bad software cannot magically become good software without putting some effort into fixing it). I understand that this issue is again being reviewed, but so far after several alleged reviews I have heard no credible justification for the manner of reporting that Schwab has done for years. I have so far gotten no commitment from Schwab to correct their software and otherwise take responsibility for what sure appears to be improper reporting for several years.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

phillip-grey

New Member

SDSoCal

Level 3

joabrady

Level 2

matt183896

Level 2

joabrady

Level 2