- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

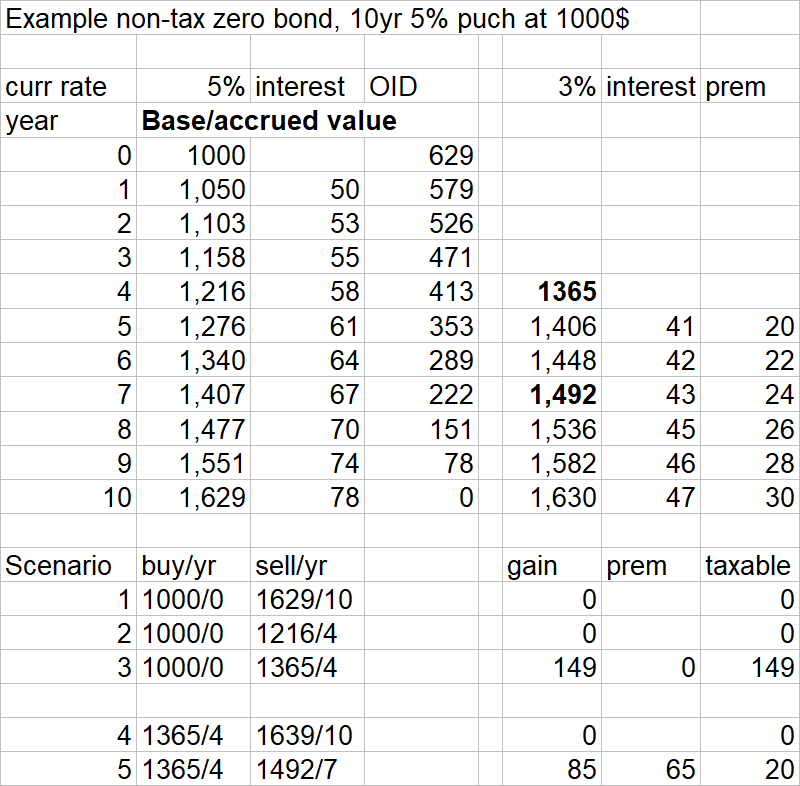

I created a spreadsheet and calculated accrued values and interest on a bond. I don't think the premium is taxable on a municipal bond and I don't think it has an impact unless you sell the bond prior to maturity. If you purchase a bond after issue at a premium (higher cost, lower current interest rate), then the accrued value based on the original price and rate aren't valid. Since your effective interest is lower than the original rate, you can use that difference (premium) to reduce a taxable gain if you sell the bond before maturity. By reporting the lower exempt interest on a return, you are creating a record of the premium.

However, I don't think the tax software will help if you sell the bond. I am creating a separate spreadsheet for such bonds, tracking the 1099 data. If a bond is sold, I can then hopefully calculate the reduced gain. If the IRS questions the gain, then the tax return reporting may be helpful to document the reduced gain. Holding the bond to maturity should avoid this issue.

In the spreadsheet I created there was still a taxable gain after applying the calculated premium (scenario 5). I"m not sure if this is correct or and artifact of the simplified calculations. In an ideal world with stable interest rates, I would think that the premium would wash out the gain.

On the flip side, if a zero coupon municipal bond is purchased at a discount (lower price, higher interest rates), then tax on that discount will be owed when it is sold or matured.

I found these articles helpful:

NOTE: I am not a tax professional. Do not rely on any of this information - do your own due diligence!