- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

When I input a 1099-NEC and select my spouse as the recipient, the questions that follow change to my name. How do I correct this or is this relevant?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

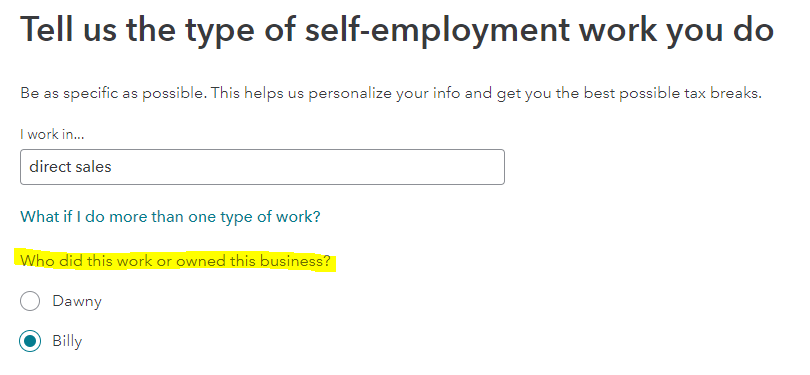

Yes, it is relevant since you want to be sure your spouse is receiving the correct social security and Medicare taxes applied to their social security number. When you enter the 1099-NEC, TurboTax will start a schedule C for his business. You have to make sure that you tell TurboTax that the business and the 1099-NEC is for your spouse. It sounds like maybe the Schedule C is listed as your business. You can find this option on both the 1099-NEC entry screen and the general business profile page under Self-Employment and Business Income.

Why can not link my 1099-NEC in TurboTax Online? If you are getting questions about linking your NEC, see that link for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

I click on the appropriate person, my wife's name, but the questions on subsequent screens list my name. There must be a bug in the download program file. I see the same question has been posted by another user.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC

Some TurboTax customers are experiencing an issue linking a 1099-NEC to the correct person. The name on the NEC is reverting to the main taxpayer's name.

If you're experiencing the issue above, please go here to receive email notifications when any updates related to this issue become available.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bradley

New Member

ngdonna2020

Level 2

Alex012

Level 1

ARJ428

Returning Member

rio4

New Member