- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-NEC Non employee compensation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Non employee compensation

I am a retired employee of a Bank that purchased a split dollar life insurance policy on me when I was employed. I have been receiving 1099-misc forms in previous years and a 1099-NEC last year and this year for a calculated amount that is supposed to be the economic benefit to me. This year Turbo Tax is wanting me to complete a schedule C. This is new this year. I do not have a business, this is not business income but apparently it is taxable compensation because I am a former employee. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Non employee compensation

I did some more playing around with the software and selected under uncommon situations: This is not money earned as an employee or self-employed individual, it is from sporadic activity or hobby. This worked and didn't require a schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Non employee compensation

You are correct, this is not self employment income, and should be reported on Form 1099-MISC. However, for you it is easily reported without using Schedule C, which would be incorrect.

This income sounds like group term life insurance benefits that exceed $50,000. For this reason you are receiving the reporting form. Since you are retired, they can no longer add this to your wages.

To report this income you can use the following steps.

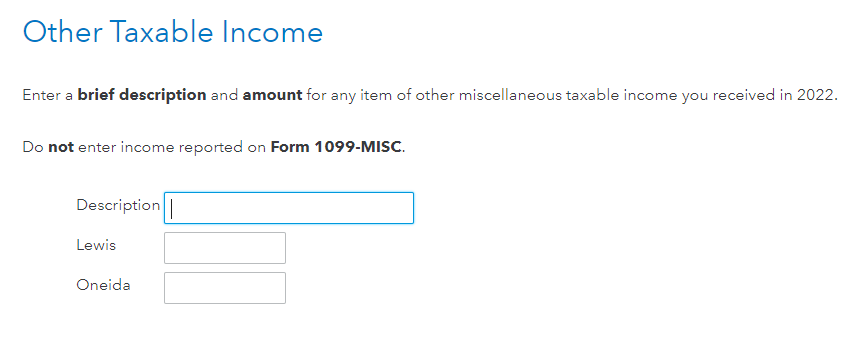

Go to the Wages and Income section of TurboTax

- Scroll to Less Common Income > Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable Income > Enter a description (GTL Retired) and the amount

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sarahphillipsinteriors

New Member

avadventurespllc

New Member

DIYTaxLady

New Member

Eric_A

New Member

tt40disme40

New Member