- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1040SR, 1041, and TIN Details for Filing 2023 Taxes When Husband Died 2022 and Wife Died 2024

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040SR, 1041, and TIN Details for Filing 2023 Taxes When Husband Died 2022 and Wife Died 2024

Background. 1. My brother in-law died 12/22. In his will all left for wife. His wife (and executor) filed a 2022 married filing jointly tax return for both of them. All 2022 taxes were paid. No TIN was obtained for brother in-law. 2. My sister died 1/24. She was alive all of 2023. A TIN for her estate has been obtained and her probate process has started. 3. Their daughter was named as executor in both of their wills.

2023 Tax Situation - Brother In-Law. He received 2023 1099 R (about $3,000) in his name and SSN.

2023 Tax situation - Sister In-Law. We have all of her 2023 tax documents. It will be standard deduction. Since no estate activities, this will be a 1040SR, single.

Questions. 1. Does a TIN need to be obtained and a 1041 need to be filed for husband for 2023? 2. Does his 1099R income need to be included on the 1041 if one needs to be filed? 3. When executor is filing the 2023 1040SR for the wife, does she put in the wife's name and address and note deceased, because estate for wife started in 2024? Does executor need to attach any other form? SSA, etc. have already been advised of her death. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040SR, 1041, and TIN Details for Filing 2023 Taxes When Husband Died 2022 and Wife Died 2024

Yes, complete the Form 1099-R information using the Husband's 1099-R form. The income belongs to his spouse since she inherited it when he died. She reports it as if she received the Form 1099-R, as it should have been reported.

You are correct, you don't need a TIN for the husband since you don't have an estate to settle for him. His wife took possession of his property immediately so there is no estate to account for, so no Form 1041.

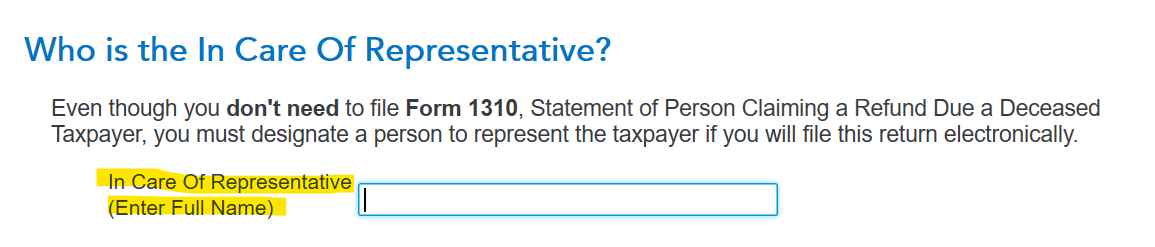

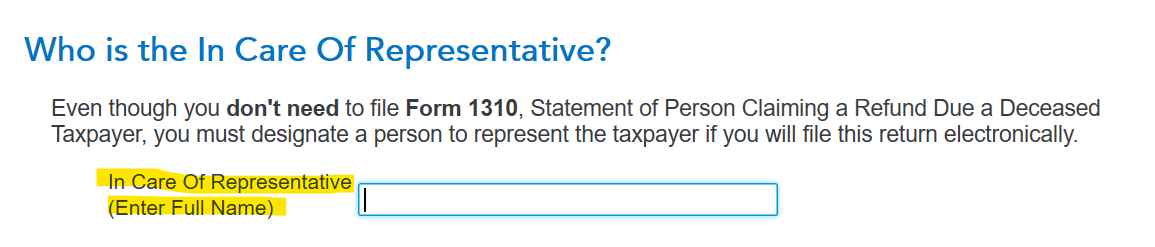

You will see this screen after you are done entering your income and deductions, on which you will enter your daughter's name:

She would be the executor and would enter a PIN.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040SR, 1041, and TIN Details for Filing 2023 Taxes When Husband Died 2022 and Wife Died 2024

No, you don't need a TIN for the husband who died in 2022. The $3,000 pension income received in 2023 in his name needs to be entered on his spouse's 2023 income tax return, since it was willed to her in 2022. You can enter a substitute Form 1099-R in TurboTax for that as follows:

- Go to the personal income section of TurboTax

- Find the Retirement Plans and Social Security menu option

- Start or Update IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Choose Add Another 1099-R

- Choose I'll type it in myself

- On the screen that says Tell Us Which 1099-R You Have choose I need to prepare a Substitute 1099-R

You wouldn't need a TIN for the husband who died in 2022 since all his property was willed to his spouse, assuming she took possession of it upon his demise.

The estate for the wife would start on the day she died. Since she died in 2024, you would file a personal return for her for all of 2023 under her social security number.

You enter that date of death when requested in TurboTax and it will be noted as such on the tax return. You would enter the address you want to receive correspondence from the IRS at on the tax return for 2023. A court appointed representative should attach a copy of the appointment to the tax return. If you aren't court appointed, you need to complete and attach form 1310 if there is a refund to be received. You can learn more here: Final federal tax return for deceased

You would attach any forms that reported tax withheld to the tax return. Also, a W-2 form if there was one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040SR, 1041, and TIN Details for Filing 2023 Taxes When Husband Died 2022 and Wife Died 2024

Thank you for the reply.

1. Husband died 12/25/22. I went through the screens for 2023 1040 for filing single. There is no box to designate who 1099R is for. I see 1099R fill in items and then several screens before I see the file a substitute 1099R check box. Are you are saying fill in 1099 form with info from husband's 1099? I ask because it will be read as wife's income. Then I see the 4852 items. We did tell them husband died, and they gave wife his benefits under her name for which we have a 1099R, but we didn't call and request a corrected 1099R yet for this separate $3,000 1099R. Also confirming that neither TIN or 1041 is due for the husband, right? BTW, the retirement plan reversed any payments not due to husband or wife. Thank you so much.

2. Husband's daughter named as executor in his will if his wife passed away. There is no probate for husband because all real and other property went to wife. Since no probate for husband daughter is named in will but not court appointed. No tax refund involved. Does she state executor in box for third party designee and create a PIN to put in box? Thank you so much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040SR, 1041, and TIN Details for Filing 2023 Taxes When Husband Died 2022 and Wife Died 2024

Yes, complete the Form 1099-R information using the Husband's 1099-R form. The income belongs to his spouse since she inherited it when he died. She reports it as if she received the Form 1099-R, as it should have been reported.

You are correct, you don't need a TIN for the husband since you don't have an estate to settle for him. His wife took possession of his property immediately so there is no estate to account for, so no Form 1041.

You will see this screen after you are done entering your income and deductions, on which you will enter your daughter's name:

She would be the executor and would enter a PIN.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040SR, 1041, and TIN Details for Filing 2023 Taxes When Husband Died 2022 and Wife Died 2024

Thank you. I've completed the return.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

beanorama

Level 3

chrismpt

New Member

chorvath0320

New Member

srji175163

New Member

nada371200

New Member