- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, complete the Form 1099-R information using the Husband's 1099-R form. The income belongs to his spouse since she inherited it when he died. She reports it as if she received the Form 1099-R, as it should have been reported.

You are correct, you don't need a TIN for the husband since you don't have an estate to settle for him. His wife took possession of his property immediately so there is no estate to account for, so no Form 1041.

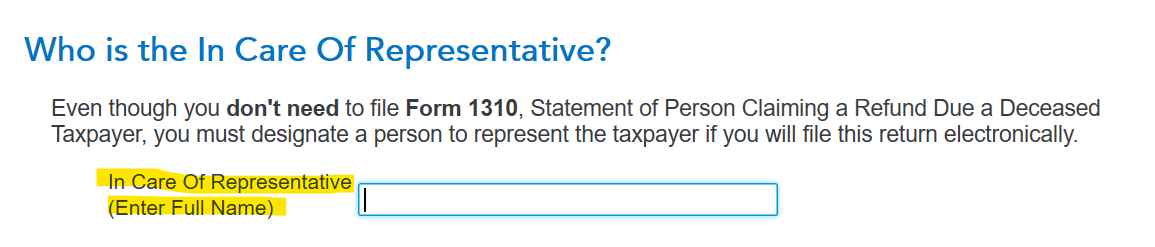

You will see this screen after you are done entering your income and deductions, on which you will enter your daughter's name:

She would be the executor and would enter a PIN.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 2, 2024

5:44 PM