- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why is TurboTax saying the "total personal portion of your Alternative Vehicle Refueling Property Credit is currently $0"? I paid $1286 total for the EVSE + installation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying the "total personal portion of your Alternative Vehicle Refueling Property Credit is currently $0"? I paid $1286 total for the EVSE + installation.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying the "total personal portion of your Alternative Vehicle Refueling Property Credit is currently $0"? I paid $1286 total for the EVSE + installation.

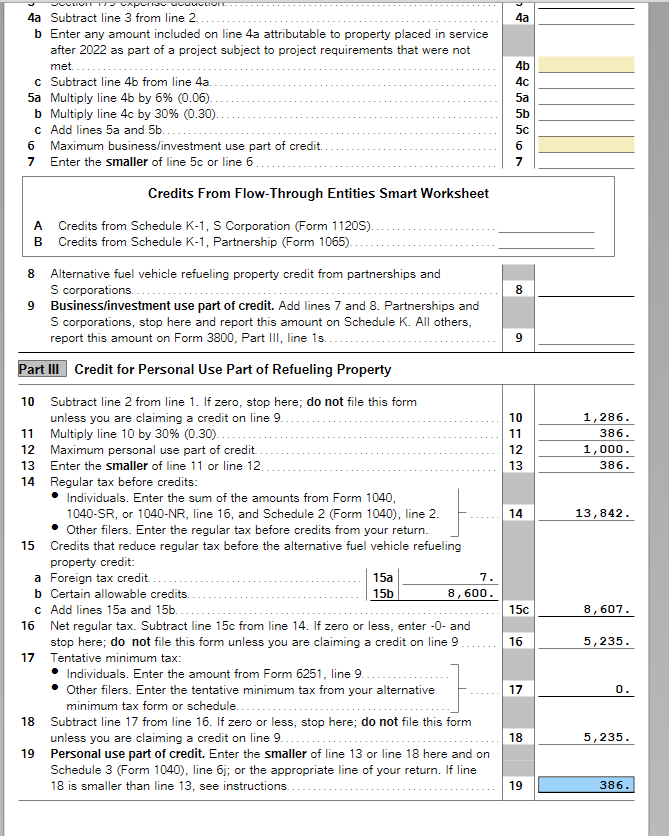

You can review Form 8911 to see the calculations for the Alternative Fuel Vehicle Refueling Property Credit.

If you're using TurboTax Online, you can save a PDF of your return to your computer in the FILE section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying the "total personal portion of your Alternative Vehicle Refueling Property Credit is currently $0"? I paid $1286 total for the EVSE + installation.

You can review Form 8911 to see the calculations for the Alternative Fuel Vehicle Refueling Property Credit.

If you're using TurboTax Online, you can save a PDF of your return to your computer in the FILE section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying the "total personal portion of your Alternative Vehicle Refueling Property Credit is currently $0"? I paid $1286 total for the EVSE + installation.

I downloaded the PDF (including government and TurboTax worksheets) and the form is missing.

Looking back at the Alternative Vehicle Refueling Property Credit Summary, it says:

"The total personal portion and the total business portion of your Alternative Vehicle Refueling Property Credit for all vehicles is currently $0. This form will not be included in the tax return you file."

So it looks like TurboTax won't let me see what calculations it used in the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying the "total personal portion of your Alternative Vehicle Refueling Property Credit is currently $0"? I paid $1286 total for the EVSE + installation.

So this did give me an idea through. I played around with the question and entered different details into TurboTax until it finally gave me the credit and then looked at the generated Form 8911 to see what it did for a calculation.

Turns out I don't qualify for the Alternative Fuel Vehicle Refueling Property Credit due to my Tentative Minimum Tax (TMT) which is used on Line 15b of Form 8911 to calculate my Net Regular Tax. Since my TMT was too high, it causes my Net Regular Tax to go negative so I therefore do not qualify for the credit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rebeccaspann2011

Level 1

user17521708675

New Member

granitegator

New Member

Rav101

New Member

iDas

Level 2