- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why is my type of asset changing in the Asset Entry Worksheet used for depreciation? Should I manually change it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

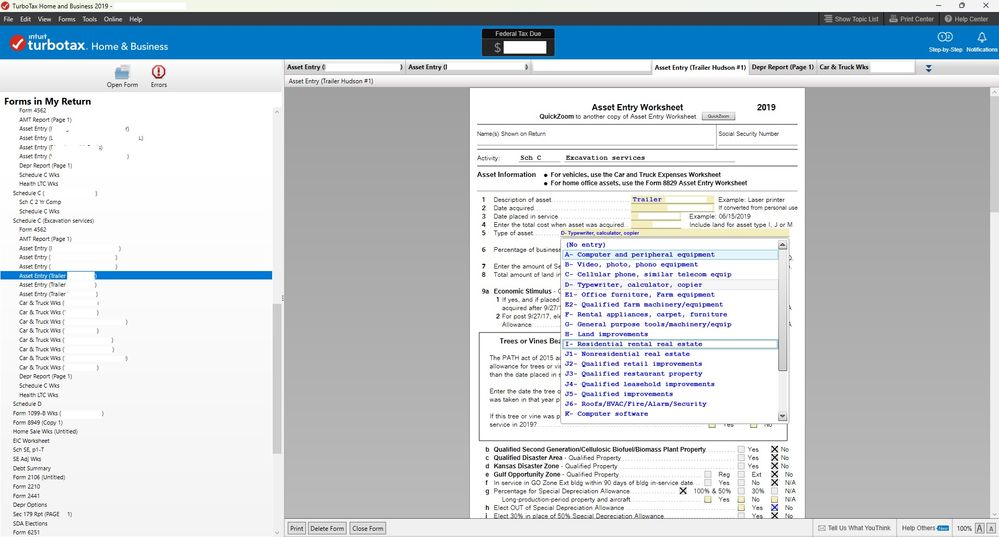

Why is my type of asset changing in the Asset Entry Worksheet used for depreciation? Should I manually change it?

Edition:

Turbo Tax 2019 Desktop

Information:

When I go through the main Turbo Tax to list the assets I'm going to depreciate, I get asked what type of asset it is. I choose trailer. However, as I'm looking in the Forms, it lists it as "D - Office Equipment" not "G - Tools, equipment."

When I manually change it to "G" instead of "D" my tax liability increases. I looked over "Publication 946 How to Depreciate Property" and the MACRS for Construction Equipment is 5 years but Office Equipment is 7 years (as per the 2022 publication; can't find 2019). See https://www.irs.gov/pub/irs-pdf/p946.pdf for reference.

Question:

Should I manually change the type of asset?

Where can I find a list of Turbo Tax for asset type equivalencies to the IRS?

Thank you all!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my type of asset changing in the Asset Entry Worksheet used for depreciation? Should I manually change it?

You may have to use the Other category for this asset and select 5-year MACRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my type of asset changing in the Asset Entry Worksheet used for depreciation? Should I manually change it?

just select type G from drop down. the IRS will never know you used Turbotax Type G because that info is not transmitted. It may not even matter. if you want, between section 179 depreciation and bonus depreciation you can expense 100% of the cost. if the trailer cost less than $2500 it can be expensed directly without capitalizing and deprecating it under safe harbor rules

What is the de minimis safe harbor election?

Under the final tangibles regulations, you may elect to apply a de minimis safe harbor to amounts paid to acquire or produce tangible property to the extent such amounts are deducted by you for financial accounting purposes or in keeping your books and records. If you have an applicable financial statement (AFS), you may use this safe harbor to deduct amounts paid for tangible property up to $5,000 per invoice or item (as substantiated by invoice). If you don't have an AFS, you may use the safe harbor to deduct amounts up to $2,500 ($500 prior to 1-1-2016) per invoice or item (as substantiated by invoice).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my type of asset changing in the Asset Entry Worksheet used for depreciation? Should I manually change it?

@Mike9241 wrote:

just select type G from drop down. the IRS will never know you used Turbotax Type G because that info is not transmitted.

That can't be done without an override because TurboTax automatically changes the recovery period to 7 years (from 5 years).

Section 179 and bonus depreciation are both potential alternatives, of course.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my type of asset changing in the Asset Entry Worksheet used for depreciation? Should I manually change it?

After messing with Turbo Tax and comparing it to the IRS tables for a while, I noticed that for software purposes certain groups are clumped together because of the time frame. It's the wrong category name but it's the right time frame. Thank you for your answer!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Sweendog10

Returning Member

abarmot

Level 1

anon30

Level 3

cparke3

Level 4

Sandy55

New Member