- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my type of asset changing in the Asset Entry Worksheet used for depreciation? Should I manually change it?

Edition:

Turbo Tax 2019 Desktop

Information:

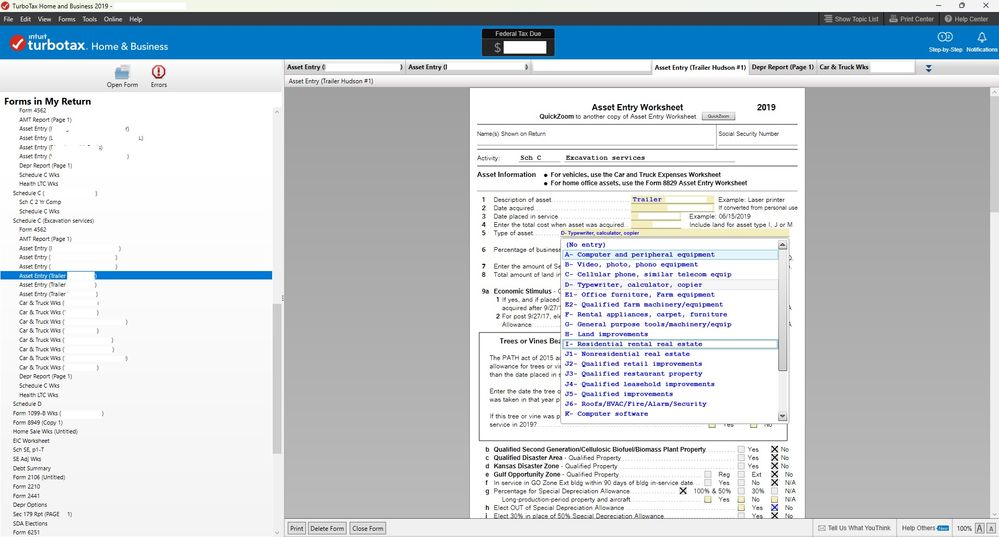

When I go through the main Turbo Tax to list the assets I'm going to depreciate, I get asked what type of asset it is. I choose trailer. However, as I'm looking in the Forms, it lists it as "D - Office Equipment" not "G - Tools, equipment."

When I manually change it to "G" instead of "D" my tax liability increases. I looked over "Publication 946 How to Depreciate Property" and the MACRS for Construction Equipment is 5 years but Office Equipment is 7 years (as per the 2022 publication; can't find 2019). See https://www.irs.gov/pub/irs-pdf/p946.pdf for reference.

Question:

Should I manually change the type of asset?

Where can I find a list of Turbo Tax for asset type equivalencies to the IRS?

Thank you all!