The VA Low Income Credit, similar to the federal Earned Income Credit, is for single individuals making less than $14,380 or those with a family of 8 making up to $50,560 with varying income limits in between. If this does not apply to you, you can skip these questions.

Your Virginia Adjusted Gross Income is found on line 9 of your form 702. You can view this form by selecting Preview My 1040 in TurboTax Online or switching to forms mode in the desktop version.

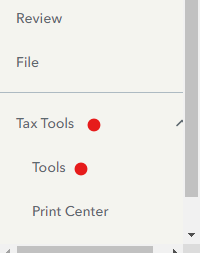

On the menu bar on the left that shows.

- Select Tax Tools

- On the drop-down select Tools

- On the pop-up menu

- Select View Tax Summary

- On the left sidebar, select Preview my 1040

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"