- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

I bought a used vehicle in 2018 and we're trying to get the bonus depreciation. We use the car for our business.

When I was going through the TurboTax screens, it asked me "Did you purchase your car new?". It then gives me 2 choices:

- Yes, I purchased this vehicle new.

- No, this vehicle was used when I bought it.

When I select "used", the TurboTax system DOES NOT let me get the bonus depreciation.

However, if I select "new", the TurboTax system WILL let me get the bonus depreciation.

Question

Why isn't the TurboTax system letting me get the bonus depreciation when I select "used"? Is this a bug in the TurboTax system? Any help would be appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

@teelainen wrote:When I was going through the TurboTax screens, it asked me "Did you purchase your car new?". It then gives me 2 choices:

I honestly do not recall the verbiage in each screen, but I believe there is a sentence to the effect that you should select "Yes, I purchased this vehicle new" if the car is "new to you". Run through the screens again and look for that sentence.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

@tagteam, here is the exact verbiage from the screen:

- No, this vehicle was used when I bought it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

You can't take bonus depreciation on a used car. Period. Also, regardless of what others may say, the car you purchased is used. Just because it's new to *you* doesn't matter. It's still a used car and does not qualify for bonus depreciation any way you look at it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

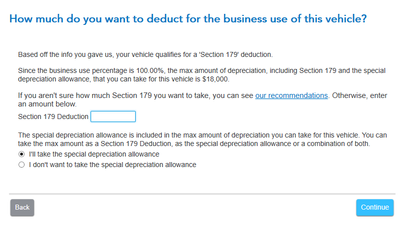

Are you getting the following screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

Here's what I'm seeing at https://www.irs.gov/newsroom/additional-first-year-depreciation-deduction-bonus-faq

The used property requirement is met if the acquisition of the used property by the taxpayer meets the following five requirements:

(a) the property was not used by the taxpayer or a predecessor at any time prior to such acquisition;

(b) the property was not acquired from a related party or component member of a controlled group;

(c) the taxpayer’s basis in the property is not determined in whole or in part by the seller’s or transferor’s adjusted basis in the property;

(d) the taxpayer’s basis in the property is not determined under section 1014(a) or 1022, relating to property acquired from a decedent; and

(e) the cost of the property does not include the basis of property determined by the reference to the basis of other property held at any time by the taxpayer.

See Proposed Treas. Reg. § 1.168(k)-2(b)(3)(iii) and the About Form 4562 webpage for additional information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

@Carl, the word "predecessor" in that sentence refers to the taxpayer's predecessor, not the car's predecessor. The "predecessor" is relevant when there has been a merger, acquisition, or change in corporate structure. It is NOT referring to the previous owner of the asset (the car).

Can you please follow up with your 2 team members @CarolynM and @tagteam and tell mw which answer is correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

@teelainen The original post is correct; the use has to begin with your business but it does not matter whether you bought a new or used car in 2018.

Businesses may also claim a 100% expensing (or bonus depreciation) allowance under Section168(k) for eligible property acquired and placed in service after September 27, 2017, and before January 1, 2023.....The BDA applies to new or used qualified property. Footnote: Before the enactment of P.L. 115-97, the BDA applied to new property only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Used vehicle not getting the bonus depreciation. Is this a TurboTax bug?

Where can I find this screen?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

abarmot

Level 1

cparke3

Level 4

Sandy55

New Member

KPD77

Returning Member

J3SS1CA

New Member