- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

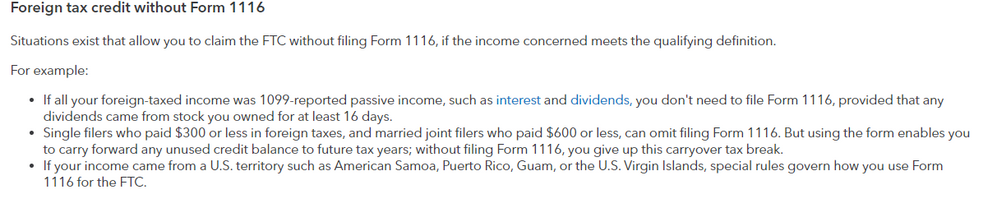

My 1099-DIV has $3 in foreign taxes paid. I'm eligible to get the credit without filing a Form 1116 (according to Turbotax's own website: https://turbotax.intuit.com/tax-tips/military/filing-irs-form-1116-to-claim-the-foreign-tax-credit/L...:(

I'm eligible for both point 1 and 2, but filing a 1099-DIV in Turbotax is forcing me to file Form 1116. This is the only form making my return not "simple", which forces my to upgrade to Deluxe edition. I'm being forced by Turbotax to pay $59 to upgrade to Deluxe for non-simple returns, in order to file a Form 1116 (which by their own admission I don't need to) to get a $3 Foreign Tax Credit. Doubly frustrating is the fact that this 1099-DIV is from Acorns.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

My suggestion is to first try to remove form 1116 by going to tax tools>tools>delete a form>delete form 1116. If this doesn't work, remove the foreign tax paid in Box 7 of the 1099 DIV because it isn't worth paying the $59 upgrade just to claim a $3 credit.

Let us know if his works.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

No. The $3 in foreign tax will give you a credit of $3 on your tax return. I am assuming here at $3 this is a mutual fund that knows which countries qualify for the deduction/ credit. If losing $3 is cheaper than upgrading, that would be the way to go - delete the foreign tax paid. You need to report the 1099-DIV and any dividend interest. You just don't need to report the foreign tax paid in box 7 - leave it blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

My suggestion is to first try to remove form 1116 by going to tax tools>tools>delete a form>delete form 1116. If this doesn't work, remove the foreign tax paid in Box 7 of the 1099 DIV because it isn't worth paying the $59 upgrade just to claim a $3 credit.

Let us know if his works.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

@DaveF1006 is spot on ... just remove the $3 that is causing this issue or use a different product.

TurboTax Free Edition is very limited. It's only for the simplest tax returns.

If your AGI is $73,000 or less you can probably use IRS Free File.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

Do I not need to disclose the $3 in foreign tax paid?

You can't delete Form 1116, it's not in the list of documents, it just goes away when I delete the 1099-DIV.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is forcing me to file Form 1116, even though I'm eligible to not file. This also forces me to upgrade to Deluxe.

No. The $3 in foreign tax will give you a credit of $3 on your tax return. I am assuming here at $3 this is a mutual fund that knows which countries qualify for the deduction/ credit. If losing $3 is cheaper than upgrading, that would be the way to go - delete the foreign tax paid. You need to report the 1099-DIV and any dividend interest. You just don't need to report the foreign tax paid in box 7 - leave it blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

casraecav

New Member

9fce0d600f24

New Member

jcanalesr92

New Member

srfrgyrl

New Member

emnem

New Member