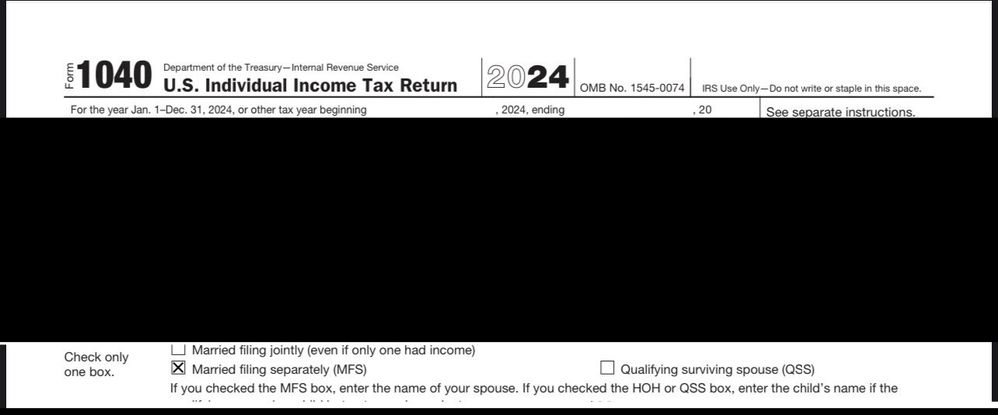

My filing status was entered correctly but the turbo tax system has a credit on my 1040 that I did not claim nor will I qualify for. It has me receiving eitc which I am automatically disqualified for. When I was entering my information the system told me I didn’t qualify which I already knew. My husband and I are not separated and he did not claim eitc for his return but his 1040 is correct.

My return has yet to be approved by the IRS!

- I used the desktop version on on my macbook

- basic