- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Spouses medical premiums on my self-employed insurance deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouses medical premiums on my self-employed insurance deduction

I am self-employed and wife will be going on Medicare this year and will be dropped from my Obamacare plan. Can I deduct my spouses medicare supplement (medigap) if it is in her name on my self-employed insurance deduction? Also her Parts A, B, C or D.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouses medical premiums on my self-employed insurance deduction

Sorry that I misunderstood your original post.

I can't find anything specific on this, but I'll give you my opinion and how I reached it.

It's clear in Publication 535 that a self-employed individual can deduct insurance premiums for themselves and their spouse. The unclear part comes when your spouse, as you've said, enrolls in Medicare. But the publication is again quite clear that Medicare premiums can be deducted, as well.

Now...your wife's Medicare premiums (deductible) are not in your name. That said, I'd think that any supplement plans that you've purchased for her (in her name) would also be deductible.

If it were me, I'd go ahead and use those Medicare and Medicare supplement premiums as deductions. As long as the primary criteria for using the SE Health Insurance Deduction are met for your business, I believe you'd be safe doing so.

*Please click the thumbs-up icon if this response was helpful.

**Please click "Mark As Best Answer" if your question has been resolved. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouses medical premiums on my self-employed insurance deduction

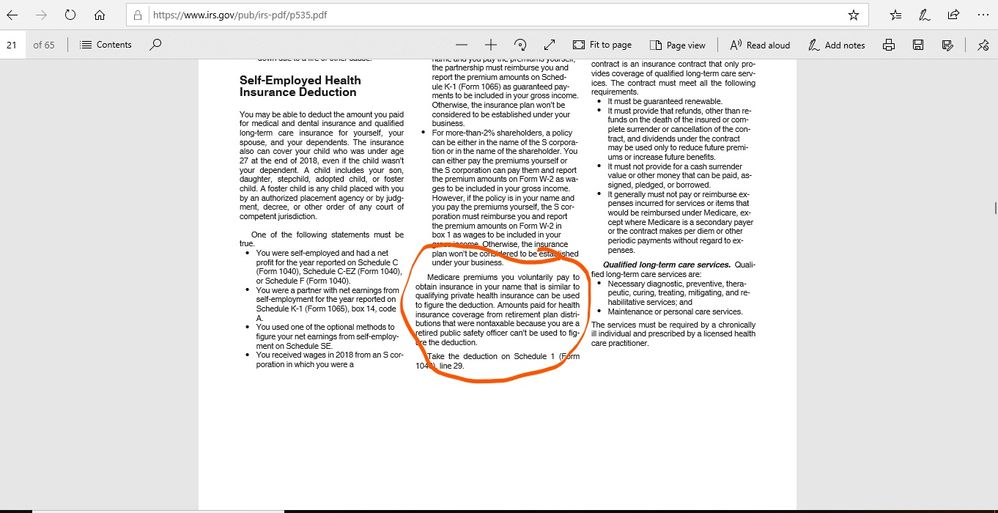

Yes, her Medicare premiums can be used as self-employed health insurance deduction. See IRS Pub. 535 for specifics. One "specific" is that her business must show a profit. I've linked the IRS Publication below.

https://www.irs.gov/pub/irs-pdf/p535.pdf

Also see the screenshot attached.

*Please click the thumbs-up icon if this response was helpful.

**Please click "Mark As Best Answer" if your question has been resolved. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouses medical premiums on my self-employed insurance deduction

I am asking specifically about a Medicare SUPPLEMENT that she is buying in her name (from an insurance company to supplement her Medicare). She does not have a business, she is retired. It is my business for which I am taking the self-employed health insurance deduction. I have read that I can deduct her Medicare premiums, but I have also read that any other insurance bought by her has to be in my name in order to deduct it. Is that true?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouses medical premiums on my self-employed insurance deduction

Sorry that I misunderstood your original post.

I can't find anything specific on this, but I'll give you my opinion and how I reached it.

It's clear in Publication 535 that a self-employed individual can deduct insurance premiums for themselves and their spouse. The unclear part comes when your spouse, as you've said, enrolls in Medicare. But the publication is again quite clear that Medicare premiums can be deducted, as well.

Now...your wife's Medicare premiums (deductible) are not in your name. That said, I'd think that any supplement plans that you've purchased for her (in her name) would also be deductible.

If it were me, I'd go ahead and use those Medicare and Medicare supplement premiums as deductions. As long as the primary criteria for using the SE Health Insurance Deduction are met for your business, I believe you'd be safe doing so.

*Please click the thumbs-up icon if this response was helpful.

**Please click "Mark As Best Answer" if your question has been resolved. Thank you.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zbchristy501

Returning Member

ycarreto17

New Member

shivasfeet

New Member

jlbusiness

New Member

bbbbgallant

New Member