- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

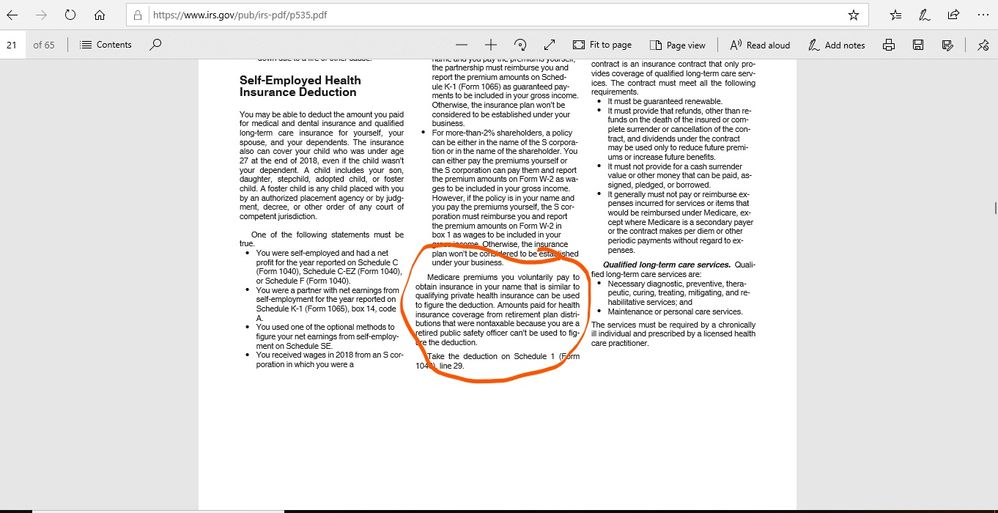

Yes, her Medicare premiums can be used as self-employed health insurance deduction. See IRS Pub. 535 for specifics. One "specific" is that her business must show a profit. I've linked the IRS Publication below.

https://www.irs.gov/pub/irs-pdf/p535.pdf

Also see the screenshot attached.

*Please click the thumbs-up icon if this response was helpful.

**Please click "Mark As Best Answer" if your question has been resolved. Thank you.

*** I am NOT a tax expert. I am a seasoned TurboTax user, and volunteer to provide assistance to TT users. Nothing I post is to be considered TAX ADVICE; I bear no legal liability for responses.***

September 18, 2019

12:42 PM