- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Since the property was sold while it was in the estate, t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

@emceebe wrote:Inheritance is NOT taxed at the Federal level. Is this correct?

In your case, that would be correct in terms of simply inheriting the house.

However, since the house was sold, you need to determine your basis and subtract that from the sales price (less selling expenses).

In this instance, the basis would be the fair market value of the house as of the date of death of the decedent. If the sales price (less selling expenses) was more than that value, you have a gain that would be subject to taxation.

If the sales price (less selling expenses) was lower than the fair market value at the date of death, then you have a loss which could be deductible depending upon how the house was used (if held for investment, the loss could be recognized as a long-term capital loss).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

Since the property was sold while it was in the estate, the proceeds of the sale distributed to the beneficiaries are NOT taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

My father is in a very similar situation. Both parents passed away, leaving their home to their three children. Any money made from selling the home was split in thirds. They decided to sell the home through OpenDoor. OpenDoor estimated the value of the home at $325,000 and HUD was owed money, plus OpenDoor charged for repairs. Between the three siblings they only ended up receiving payments of $9,000-11,000. The 1099-S received from the title company lists $107,000 - 111,000 of gross income. That's clearly not what was actually received. What can they do to get this fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

I have the same problem, My mom passed away in 2007. She has inherited a portion of her parents property when her father passed away in 1988. however her mother was still alive so no one really did anything.

then her mother passed away in 2016. no one still did anything as her brother still lived in the house.

this year her brother decided to purchase the house from the rest of the family. As her children ( my sister and I) received a portion of her inherited amount. (2.3/24 each-for my sister and I). The lawyer that processed the sale sent us both 1099-s of the whole value $202,083.34 but we really only received $ 23,934.63 each. how do i claim this on taxes. The lawyer said we had to do 2 values. the amount when my mother passed in 2007 and then when my grandma passed in 2016. Her brother did not get a appraisal so we only have the tax fair market values which are way lower then the land in the area.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

The best option is to find an appraiser who has been in business for a while. They can give you an appraisal for the property of its value as of 2016.

As long as you inherited the property once your grandmother died this is the basis you would use to report on your tax return.

You also deduct the amount of the sale that was received by your sibling to arrive at the amount for your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

The property belonged to my grandma and I received 1/8 ownership, but my mom who held the majority refused to sell it so everyone went on the title. After 12 years the property was split, half was sold to a neighbor and my mom bought me out of my share of the other half. The sales price was no more than the price my grandma's estate was when appraised at her death.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

You report your 1/8 interest as your sales price. The Fair Market Value (FMV) multiplied by 1/8 at the date of death is your cost basis.

Here's TurboTax data entry:

- Federal Taxes

- Wages & Income

- Scroll down to Investment Income

- Select Stock Mutual Funds, Bonds. Select you have not received 1099-B and continue through the interview; the category is Everything else. The cost basis is the Fair Market Value on date the deceased passed away. You will be able to put your description and sale information; indicate that property is Inheritance, you'll be guided through inheritance sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

Can not find an "Anything Else Category" in 2020 Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

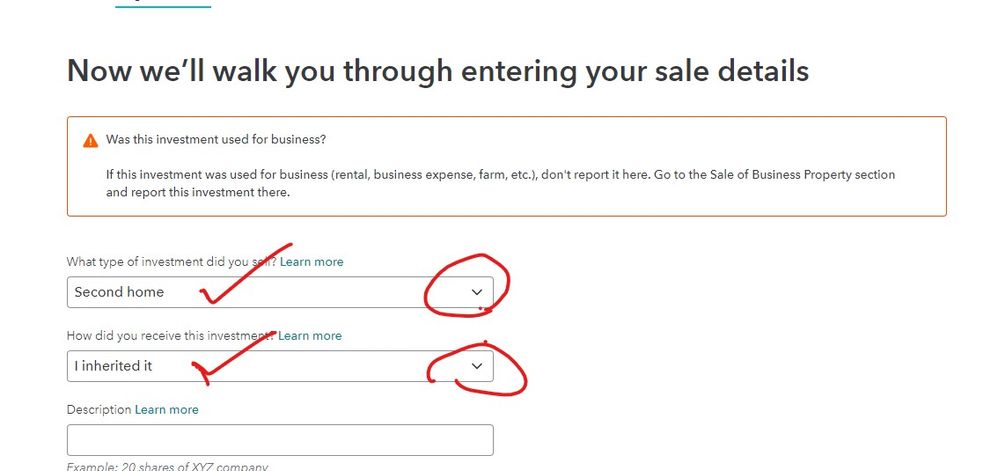

Look for OTHER ... then second home ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

I have the turbo Tax Deluxe and I don’t have that option, do I have to upgrade to get the second house sale section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

Yes, you will need to use TurboTax Premier to record the sale of two houses.

The sale of a second home is entered in the Investment section. The Premier edition can report the sale.

To enter an investment sale other than from a brokerage account (1099-B), follow the steps below.

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

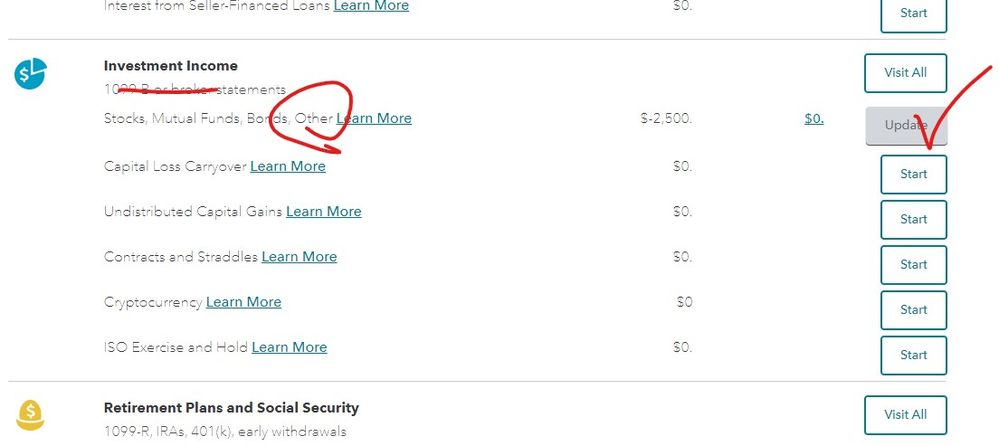

- Under Investment Income

- On Stocks, Mutual Funds, Bonds, Other, click the start or update button

Or enter investment sales in the Search box located in the upper right of the program screen. Click on Jump to investment sales

On the next screen, click Yes

On the next screen, click No

On the next screen, choose Second Home and continue with the section until it completes.

Compare TurboTax 2020-2021 online software products.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elizdara

New Member

janetcbryant

New Member

noodles8843

New Member

josephmarcieadam

Level 2

abarmot

Level 1