- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Short term capital gain losses from prior tax year fillings

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

Hi,

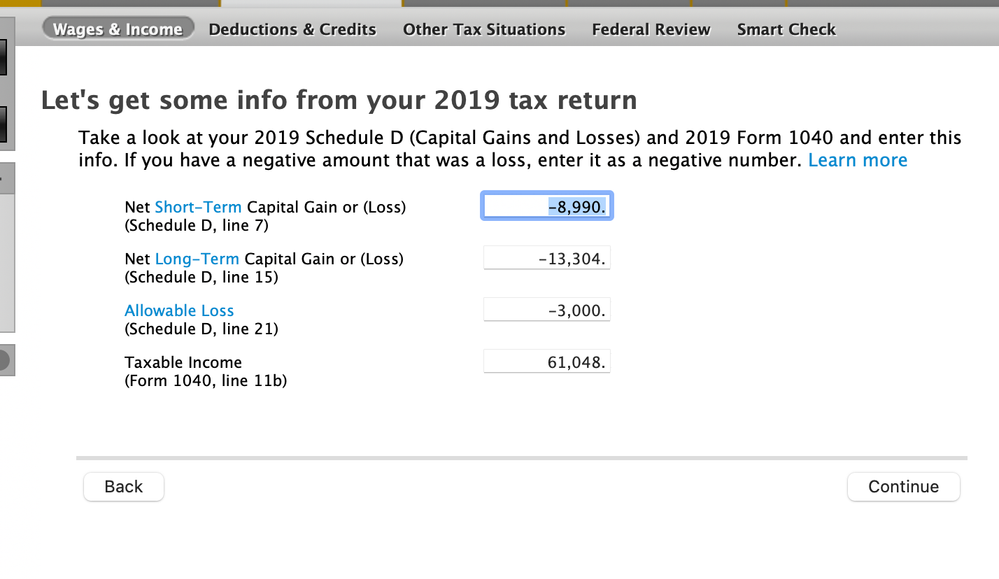

I was looking at my previous years tax fillings and noticed that i have not carry forwarded my tax year 2019 short term capital gain loss deduction filled in 2020 till now since that time a cpa used to do my taxes and from tax year 2020 till now i am using turbo tax to carry over short term capital tax losses. How can i make sure i enter the capital gain losses from previous fillings to the current year in turbo tax. Please see attached screenshot of my

SCHEDULE D (Form 1040 or 1040-SR) from tax year 2019 (filled in 2020) and let me know how i can include them from now on for future carry overs with some detailed instructions if possible and correct amount i can carry forward from that filling year. Those losses have hurt me a lot last few years and would like to atleast deduct them from taxes. Thanks.

Update:

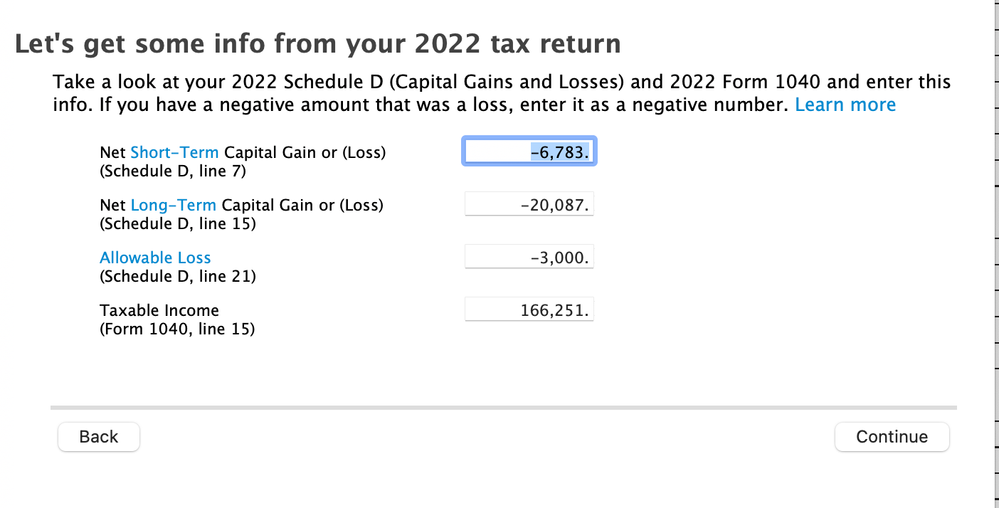

I made updates to this screen as below and use the earlier screenshot

My Tax year 2022 filling had -6,783 as capital loss

Tax year 2019 i used -13,304 from Line 15 total -20,087.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

we can't see the rest of the return or the returns for 2020/2021/2022

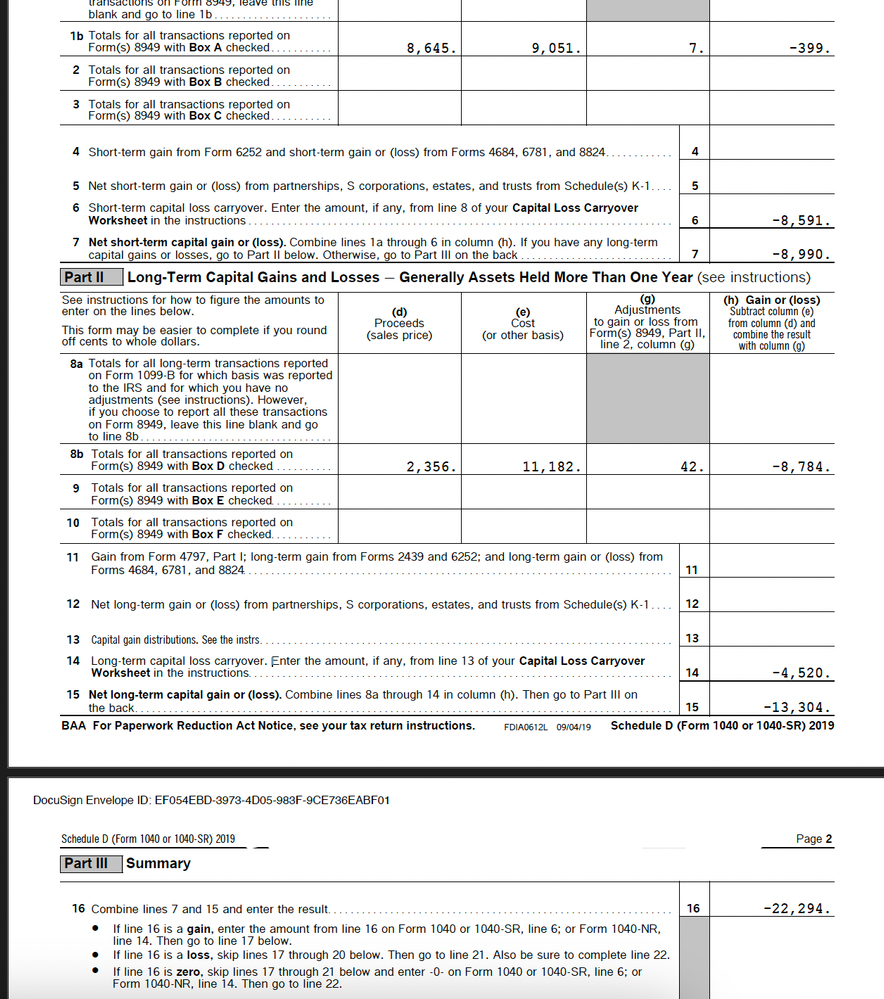

in 2019 the capital loss on line 6 of the 1040 should be -3000. if you substitute 0 for that and line 11 of the 1040 is positive you would have used the lesser of the positive amount or 3000. the c/o to 2020 would be short-term 8990 less the amount used and long term 13304

***********

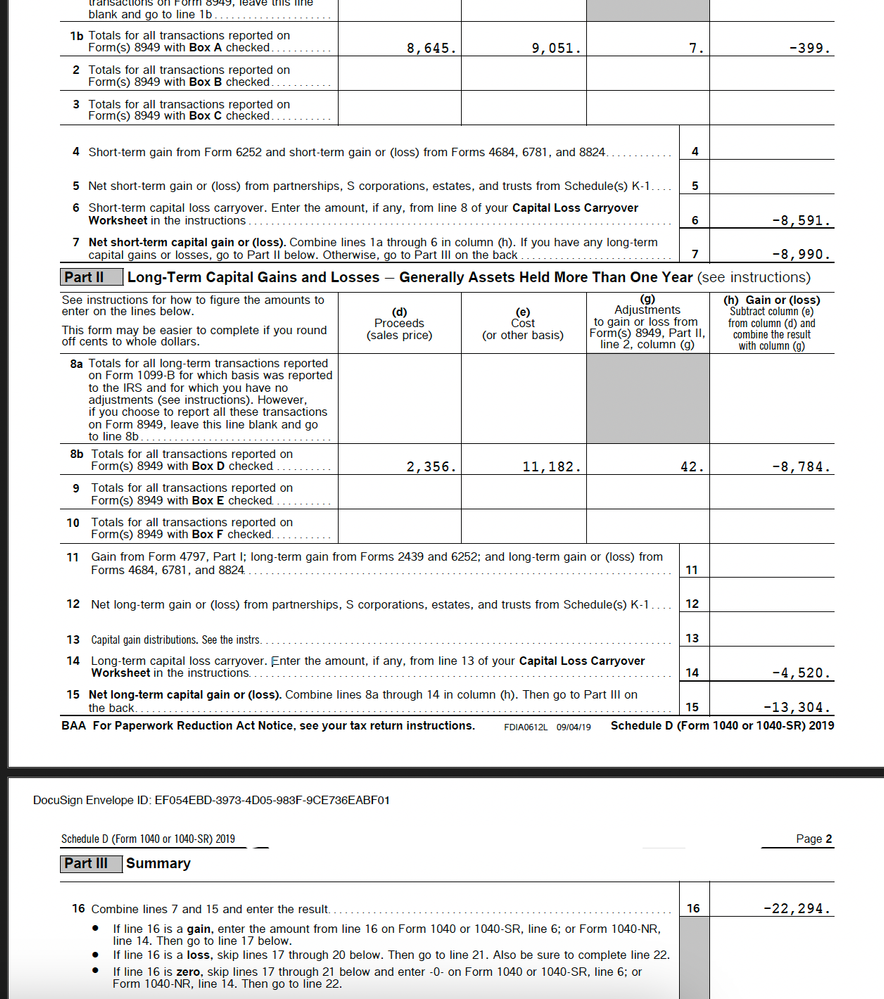

in 2020 repeat above. short-term is used first up to the 3000. if your preparer omitted the clco from the return you'll need to amend or if he's still around he should do it for free. the amended return must be filed by 4/15/2024 otherwise it's unknown if the IRS would allow the clco. Any 2020 capital gains and losses must also be taken into account

****************

in 2021 see 2020 same rules

***************

in 2022 see 2020 same rules

********************

any remaining clcos are then entered in Turbotax

we have no idea of what the proper carryovers are since we have no info other than schedule D for 2019

for better instructions we need to see 2020,2021,2022 schedule D

and what's on line 11 of those years. and 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

I am attaching my schedule D for 2019, 2020, 2021, 2022 see below and also the updated the post when you posted reply.

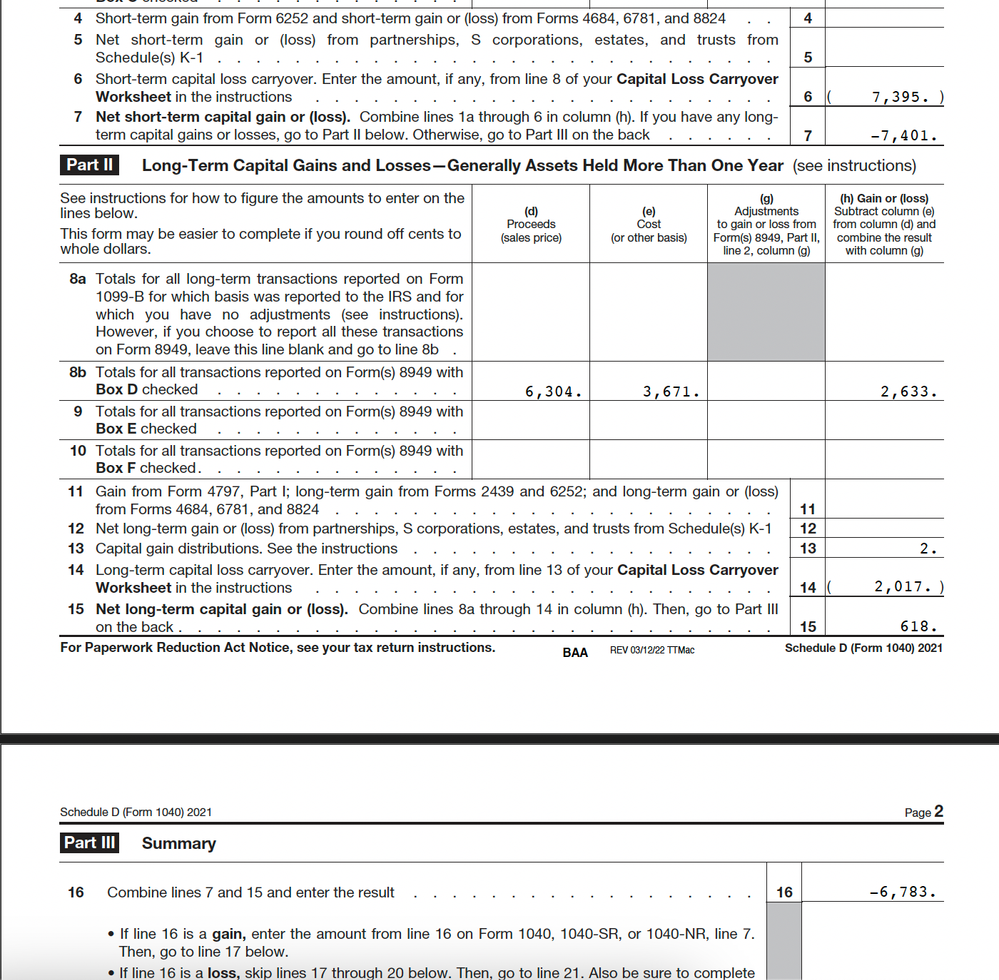

Tax year 2019 Schedule D

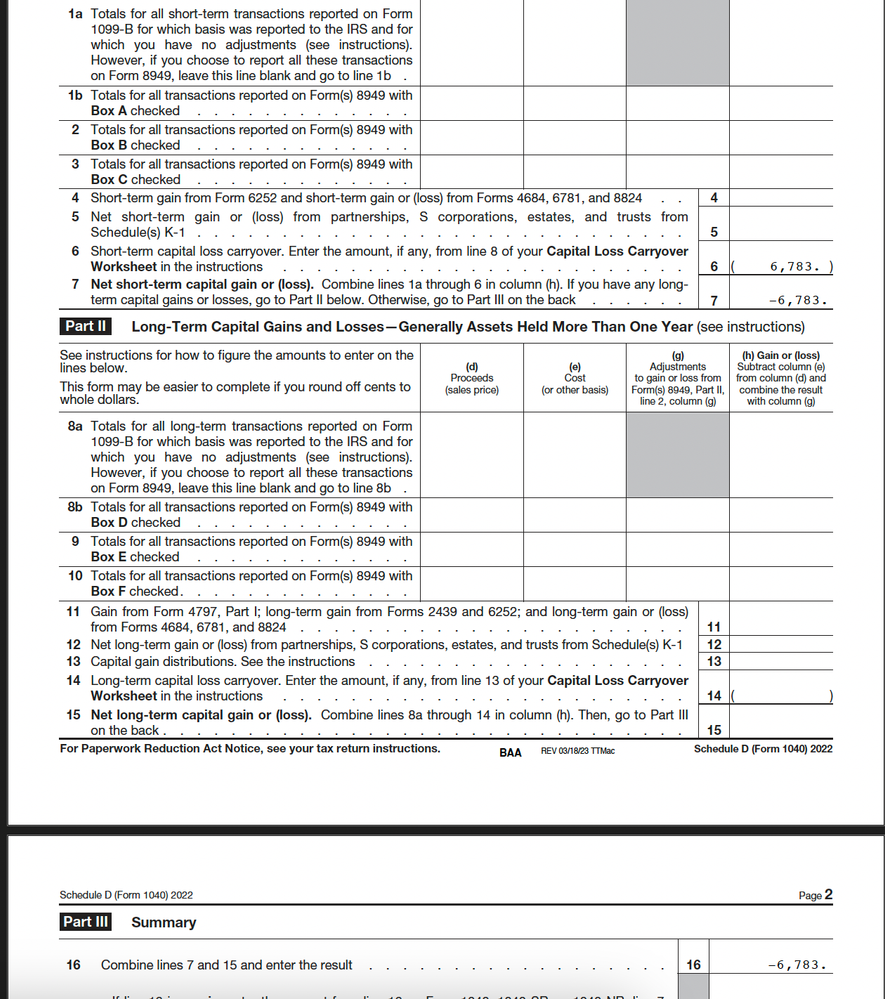

Tax year 2020 Schedule D

Tax year 2021 Schedule D

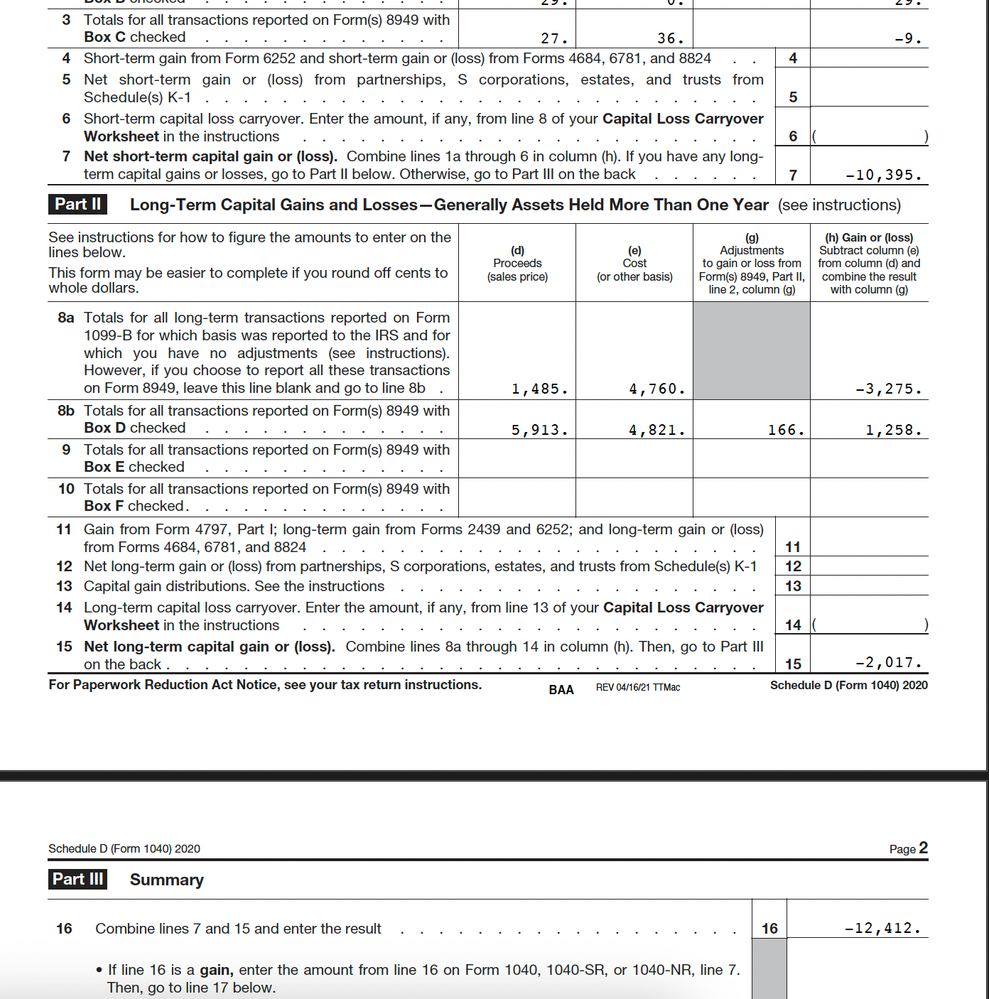

Tax year 2022 Schedule D

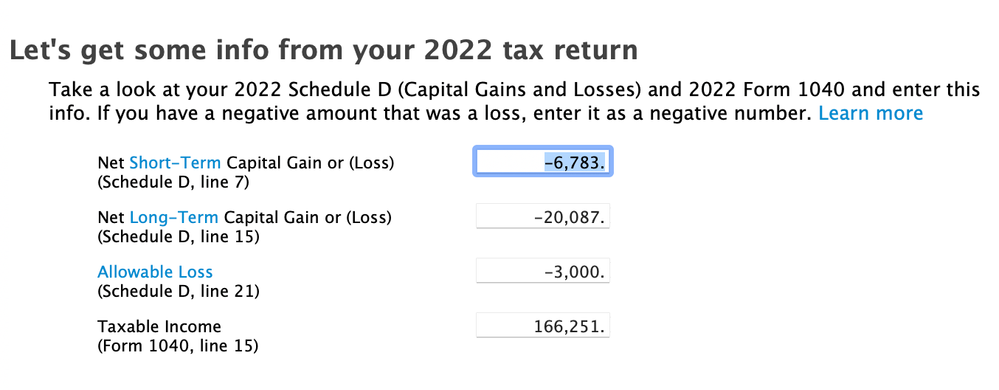

This is what now for tax year 2023 i am adding in my turbotax.

Please review and let me know if the numbers look ok. I am confused what if i should include

-13,304 (Line 15) or -22,294 (Line 16) to add to -6783 (tax year 2022) in above screen. Please let me know what my net Long-Term capital gain or Loss and short term in the current year should look like reviewing years 2019 and 2022 ( i have taken 3K deductions for 2020, 2021,2022). Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

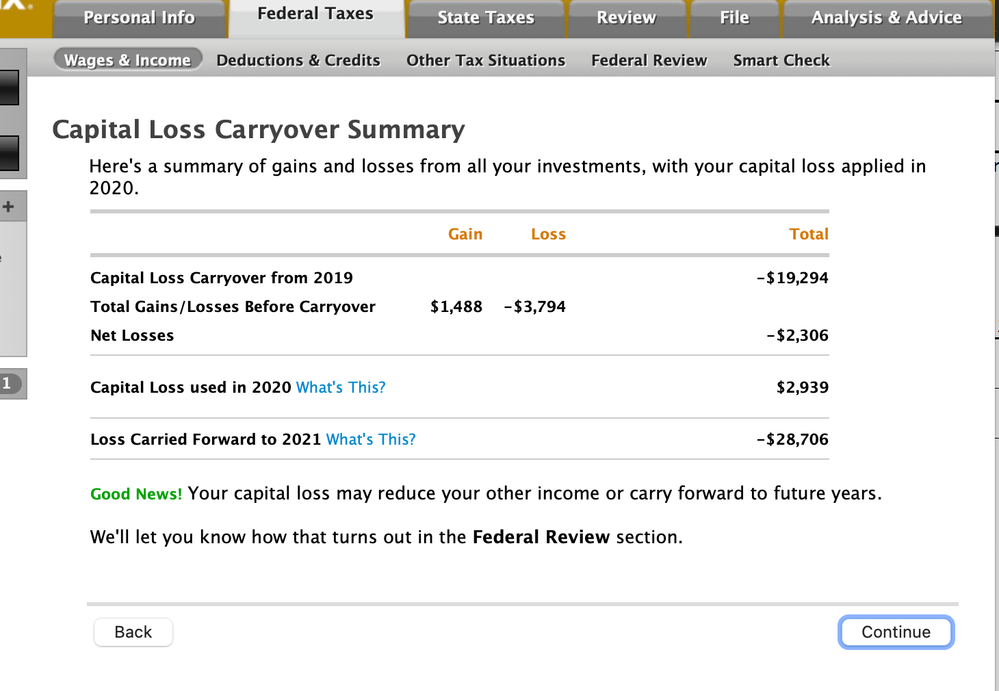

I am thinking of ammending my tax 2020 return for the capital gains loss Schedule D as below screenshots

These numbers are based on 2019 schedule D

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Bill413

Level 1

tony-tman-moore

Returning Member

latefiler5

New Member

redmoose

Returning Member

joycesyi

Level 2