- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

Hi,

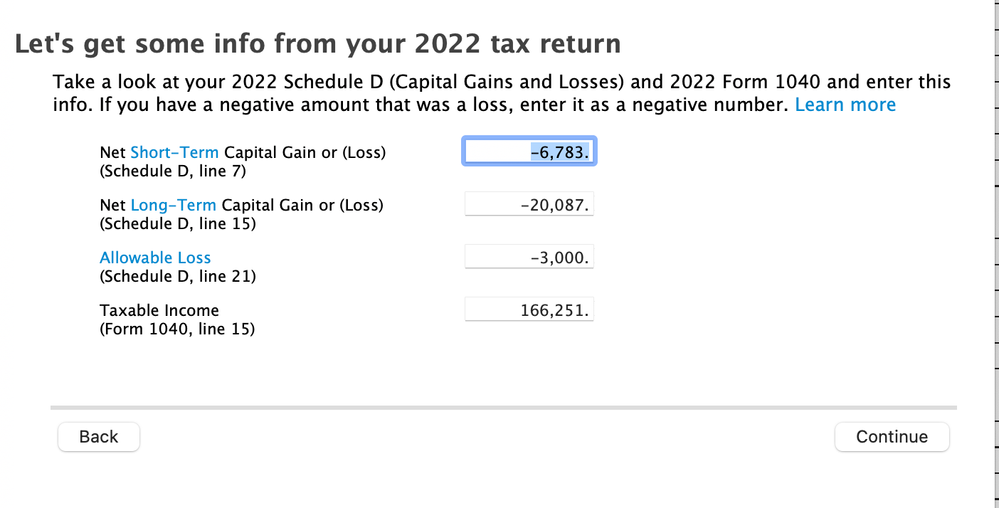

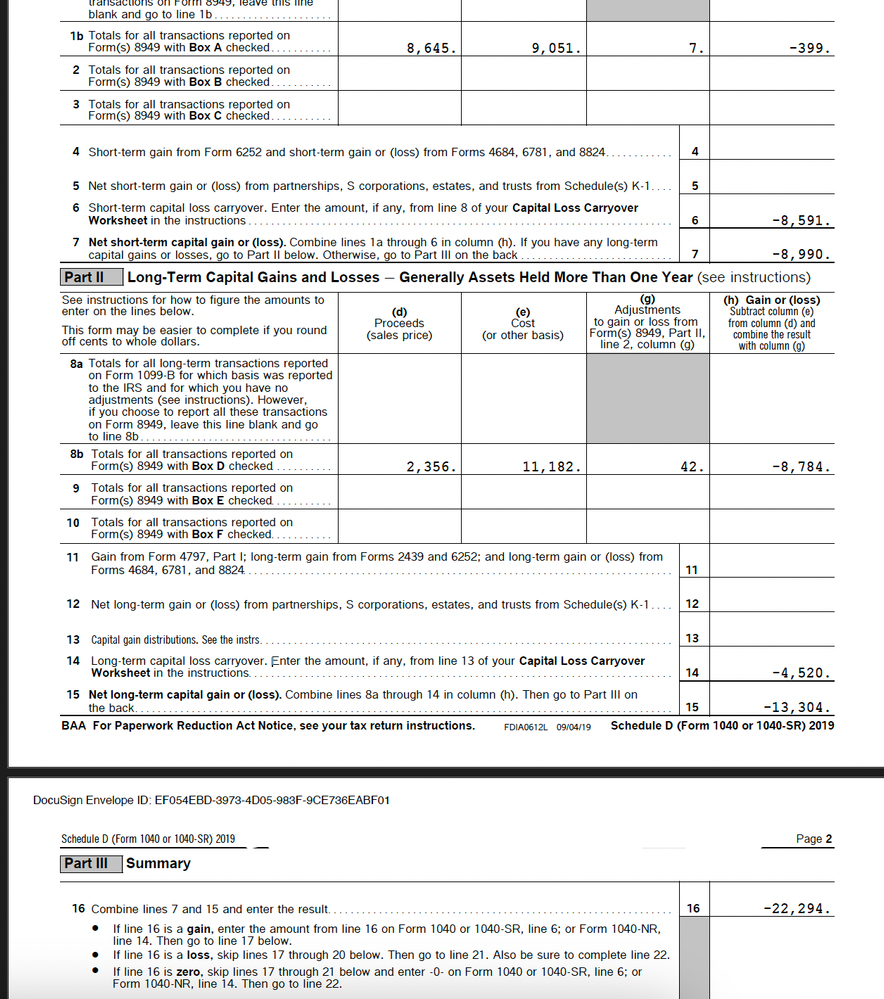

I was looking at my previous years tax fillings and noticed that i have not carry forwarded my tax year 2019 short term capital gain loss deduction filled in 2020 till now since that time a cpa used to do my taxes and from tax year 2020 till now i am using turbo tax to carry over short term capital tax losses. How can i make sure i enter the capital gain losses from previous fillings to the current year in turbo tax. Please see attached screenshot of my

SCHEDULE D (Form 1040 or 1040-SR) from tax year 2019 (filled in 2020) and let me know how i can include them from now on for future carry overs with some detailed instructions if possible and correct amount i can carry forward from that filling year. Those losses have hurt me a lot last few years and would like to atleast deduct them from taxes. Thanks.

Update:

I made updates to this screen as below and use the earlier screenshot

My Tax year 2022 filling had -6,783 as capital loss

Tax year 2019 i used -13,304 from Line 15 total -20,087.