- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Reporting Foreign Earned Income by claiming FTC only instead of FEIE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

Hi everyone,

I'm a US citizen living and working in Japan. I have salary income earned in Japan in 2023. I'm filing my US taxes and noticed TurboTax automatically generated Form 2555 (Foreign Earned Income Exclusion).

However, I'm interested in claiming the Foreign Tax Credit (FTC, Form1116) only instead of the Foreign Earned Income Exclusion (FEIE, Form2555).

Here's my question:

Can I simply delete Form 2555 in TurboTax if I want to claim the FTC?

Or is there a specific way to indicate I'm choosing the FTC within TurboTax?

I've paid Japanese income taxes on my salary.

Any insights or guidance would be greatly appreciated!

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

Yes, you can delete Form 2555 if you don't want to use your foreign earned income exclusion, provided you had not chosen that election in a prior year. If you took the foreign earned income exclusion previously, you must revoke that election before you can forgo it in favor of taking the foreign tax credit in the current year. You can see IRS Pub 54 for how to do this.

Your foreign income will then be taxable on your US return, but you may be entitled to a foreign tax credit to the extent of your US income tax on your foreign income. Any unused foreign tax credit can be carried back one year or forward up to ten years.

You can read more here: Choosing the FEI exclusion or FTC

Here is how to delete Form 2555 in TurboTax:

1. Choose the Tax Tools option on your left menu bar

2. Choose Tools

3. Choose the Delete a form option under Other Helpful links

4. Find Form 2555 in the list of form and delete it

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

Yes, you can delete Form 2555 if you don't want to use your foreign earned income exclusion, provided you had not chosen that election in a prior year. If you took the foreign earned income exclusion previously, you must revoke that election before you can forgo it in favor of taking the foreign tax credit in the current year. You can see IRS Pub 54 for how to do this.

Your foreign income will then be taxable on your US return, but you may be entitled to a foreign tax credit to the extent of your US income tax on your foreign income. Any unused foreign tax credit can be carried back one year or forward up to ten years.

You can read more here: Choosing the FEI exclusion or FTC

Here is how to delete Form 2555 in TurboTax:

1. Choose the Tax Tools option on your left menu bar

2. Choose Tools

3. Choose the Delete a form option under Other Helpful links

4. Find Form 2555 in the list of form and delete it

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

Thank you @ThomasM125 for responding to the questions and explaining carry back/forward and the step of deletion. This is my first time reporting foreign income.

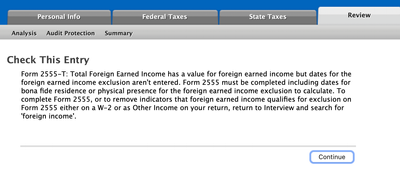

After deleting the forms (2555-T and 2555 p3-T), I noticed that in the Turbotax "Review", smart check step, there's a message prompting me to check the date within the form which no longer exists. It doesn't seem like a blocker because I can continue (skip it) and proceed. Is it okay if I just skip this step and move on?

Thanks again for all your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

It is possible the Form 2555 did not get deleted. You can try to delete it again to see if it is still showing in your forms. If so, you need to go in to where it is entered, in the Wages and Income section, then Less Common Income, then Foreign Earned Income and Exclusion and update that section. You will come to a screen that says Would You Like to Try and Exclude Your Foreign Earned Income? On that screen you need to indicate No, I know I don't qualify to exclude my foreign income to have the form deleted.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

Thanks, @ThomasM125 again for the guidance on checking FEIE!

Unfortunately, I couldn't reproduce the same question asking me "If I'd like to try FEIE~" This may be because I am using MFJ (or other conditions,) which might prompt different questions.

However, I used the Preview function (on the Desktop Mac version) and downloaded all the "Return For Filing" forms to check for the presence of Form 2555. As it turns out, Form 2555 is not included in the filing package. I suspect the message is a bug, as it prompts regardless of whether the form has been deleted. Can it be? 🤔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

You'll see the question in the Income section. When you choose the 'No' button that ThomasM125 indicated, the form 2555 is removed from the return. There may be a stray worksheet that wasn't deleted manually.

You could revisit the FEIE area to start/delete the form within the section, or carry on to the credit section. Comment back if you have an issue transmitting your return with the message.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Foreign Earned Income by claiming FTC only instead of FEIE

Thanks, @PaulaM for your response.

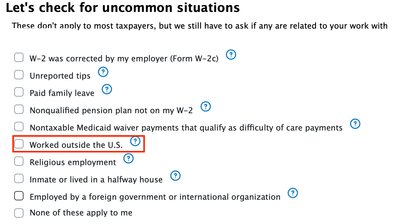

I think I found the issue in my tax return filing. In the income section, while filing W2 info, I checked the box "Worked outside of the U.S." That's why TT keeps telling me there is missing info on Form 2555 because it thought my W2 contained foreign income.

Here is what I did to fix the error:

- Uncheck the box "Worked outside of the U.S." in the W2 income section.

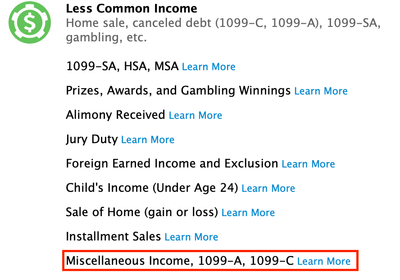

- Because I still need to report my foreign earned income, I go to "Less common income"; instead of using "Foreign Earned Income and Exclusion", I choose "Miscellaneous Income", then click "Update"

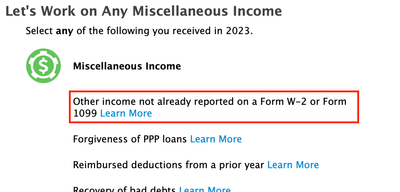

- Click "Start" for "Other income not already reported on a Form W-2 or Form 1099"

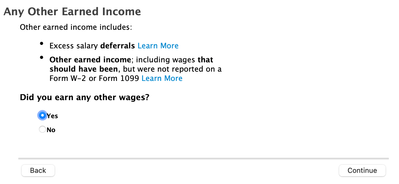

- Click on "Continue" to skip a few steps until I see the question "Any Other Eared Income". I answer YES.

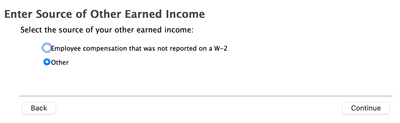

- The next question is "Enter Source of Other Eared Income". I choose "Other."

- In the next step, "Any Other Eared Income", I type "Foreign earned income" in the description field and the amount under my name field.

By doing this, the error message is gone. 😊

@PaulaM @ThomasM125 Please advise if I'm doing it right. Thank you!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rvjackson3

New Member

VB27

New Member

lillycuccu

New Member

a-e-gabrielli

New Member

temperaturesealion

Level 1