- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thanks, @PaulaM for your response.

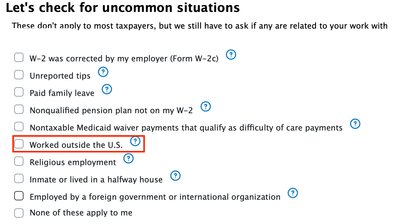

I think I found the issue in my tax return filing. In the income section, while filing W2 info, I checked the box "Worked outside of the U.S." That's why TT keeps telling me there is missing info on Form 2555 because it thought my W2 contained foreign income.

Here is what I did to fix the error:

- Uncheck the box "Worked outside of the U.S." in the W2 income section.

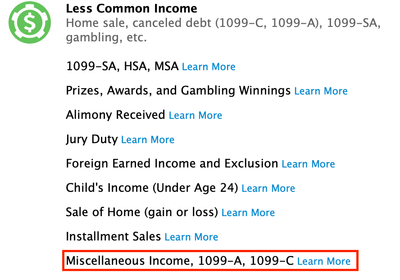

- Because I still need to report my foreign earned income, I go to "Less common income"; instead of using "Foreign Earned Income and Exclusion", I choose "Miscellaneous Income", then click "Update"

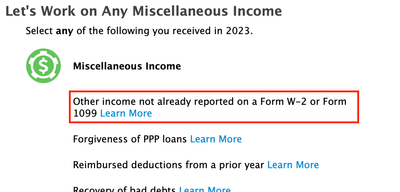

- Click "Start" for "Other income not already reported on a Form W-2 or Form 1099"

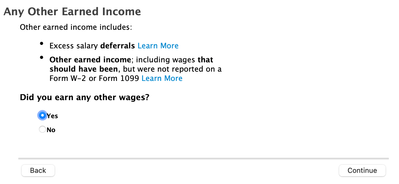

- Click on "Continue" to skip a few steps until I see the question "Any Other Eared Income". I answer YES.

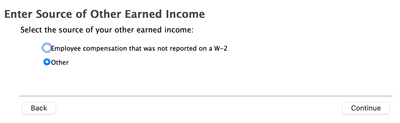

- The next question is "Enter Source of Other Eared Income". I choose "Other."

- In the next step, "Any Other Eared Income", I type "Foreign earned income" in the description field and the amount under my name field.

By doing this, the error message is gone. 😊

@PaulaM @ThomasM125 Please advise if I'm doing it right. Thank you!

April 10, 2024

10:56 PM