- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Refinance under $375,000 with cash out

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance under $375,000 with cash out

In 2020 we refinanced for $270,000 part of which was a cash out, so we had two 1098s as expected. I have two questions on this.

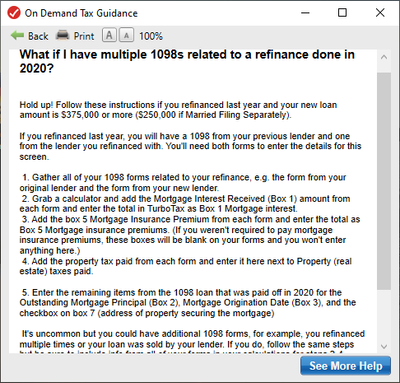

Question 1: When going through TT it says with multiple 1098s and a refi amount of $375,000 or more to follow the given instructions. What to do if the refi was less? Do we follow the same steps? (Image from help below).

Question 2: For the cash out portion we used one third to pay for improvement work on the house in 2020. Am I correct that we do not include the interest from the other two thirds?

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance under $375,000 with cash out

Since your mortgage is not $375 or higher, this notice would not apply to you. Also, you will only use the mortgage interest amount that was used to improve the house and not include the interest for the remaining 2/3's.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance under $375,000 with cash out

Since your mortgage is not $375 or higher, this notice would not apply to you. Also, you will only use the mortgage interest amount that was used to improve the house and not include the interest for the remaining 2/3's.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance under $375,000 with cash out

What process would I follow. How do I enter refinance information and receive credit form old mortgage and new?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance under $375,000 with cash out

it depends. Did you take cash out at the refinance?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance under $375,000 with cash out

I have a question along these lines also.

We refinanced our original mortgage in 2020 with the same lender. So, I have a 1098 from the original loan and a 1098 from the refinanced loan both from the same lender. I entered my 1098 from the original loan first. When it asks me "Was this loan paid off or refinanced with a different lender in 2020?" should I answer Yes or No? The loan was refinanced but it was refinanced with the same lender.

In our refinance we did get cash out that was not used for home improvements. So when I enter my second 1098 from the refinance do I just make sure that when it asks what money was used for the home - I just put the amount that was used to pay off the original loan?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance under $375,000 with cash out

1. Yes, paid off.

2. Yes, only money for buying and improving the house count.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

timeflies

Level 1

hurtadovega

New Member

javahounds

New Member

sltantlinger

New Member

slurpiescorp

New Member