- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Section 199A Deduction Turbo Tax 2019

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Deduction Turbo Tax 2019

I entered the W2 wages information in the interview box, but it didn't make any difference to the tax refund amount.

I am using Turbo Tax deluxe.

Could someone confirm if the Turbo Tax update for 199A income works for Turbo Tax deluxe or whether I need to update to a higher version ? Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Deduction Turbo Tax 2019

Yes, you can use Deluxe for the 199A, The W2 wages do not always change your tax refund. For purposes of calculating W-2 wages for the QBI deduction limitation, the term “W-2 wages” refers to the total amount of compensation paid to an employee, including salary-reduction contributions to retirement plans (elective deferrals) and designated Roth contributions to retirement plans.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Deduction Turbo Tax 2019

For Box 17, do I just enter "V" and leave the amount blank instead of the QBI?

My S-Corp already calculated the QBI in the Schedule K1. Do you know where I should enter the QBI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Deduction Turbo Tax 2019

Yes, you enter the code V and leave the box blank, but it is very important to Continue through the K-1 interview after you have entered your code V on the box 17 screen. There is a screen near the end of the interview titled "We need some more information about your 199A income or loss". This screen must be completed with the box 17 code V Section 199A Statement or STMT that came with your K-1, in order for your QBI deduction to be calculated.

And, depending on what is reported on your Section 199A Statement/STMT, you may need entries on the next "Let's check for some uncommon adjustments" screen as well.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

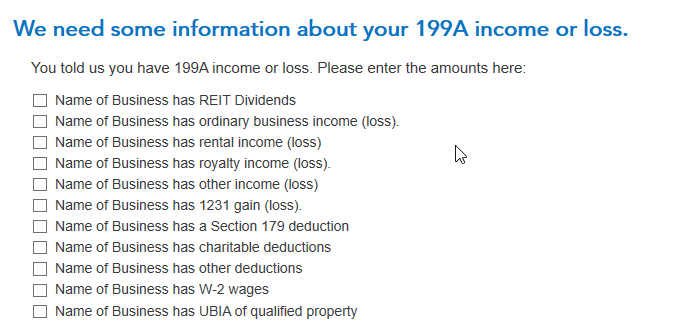

Here are screenshots of the two screens to enter your Section 199A Statement/STMT information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Deduction Turbo Tax 2019

I'm having the same problem. I've wasted several hours trying to get TurboTax to calculate the QBI deduction for rental real estate. I left V blank, filled in Z, still nothing. Very frustrating. I have used this product for years, but this is the last time. I no longer trust it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Deduction Turbo Tax 2019

Check to make sure your K-1 entry included entry on the separate screens to enter your Section 199A/QBI information provided with your K-1. These screens are described and show in screenshots later in this post.

For a partnership Form 1065 Schedule K-1, the Schedule A QBI information is entered into TurboTax as box 20 with a code Z.

For an S-corp Form 1120S Schedule K-1, the Schedule A QBI information is entered into TurboTax as box 17 with a code V.

Form a trust Form 1041 Schedule K-1, the Schedule A QBI information is entered into TurboTax as box 14 with a code of I (as in India).

You'll need to put the information on each of the K-1 statements into the categories shown in the "We need some information about your 199A income or loss" and (if applicable) the "Let's check for some uncommon adjustments" screens (see two screenshots later in this post).

Enter the code Z or V or I when you enter the K-1 box 20 or 17 or 14 screen, but you don't need to enter an amount on that screen. Continue on, and you'll find the two screens. When you check the box next to a category, a place will open up to enter your amounts. These screens (if applicable to the amount(s) on your statement) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Cat_Sushi

Level 2

CLL9999

New Member

katehailey

New Member

VB27

New Member

azivnurse

Level 1