- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: IRS Form 8936 - EV Car Incentive

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

When will Turbo Tax use the new Form 8936 so that Tesla owners can claim their tax incentive? Turbo Tax uses the old form which makes Tesla not eligible. However, according to IRS, ... the vehicle's manufacturer suggested retail price (MSRP) can't exceed:

- $80,000 for vans, sport utility vehicles and pickup trucks

- $55,000 for other vehicles

This makes Tesla Model 3 new owners eligible.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

Form 8936 in TurboTax is up to date.

For the tax year 2022 and new vehicles purchased and placed in service in 2022, there are no Tesla models that qualify for the electric vehicle tax credit. All Tesla models had been phased out before 1/1/2020.

However, if you purchased your vehicle in 2023, then it may qualify for the tax credit. If so, the credit would be claimed on your 2023 tax return.

Take a look at the following information from the IRS with regard to claiming a tax credit for an EV in 2022:

Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

@AnnetteB6 , can you take another look at the form? According to IRS guidance and the new Form 8936, I should be able to claim a credit in my 2022 tax filing for a car I purchased in 2023. Form 8936 specifically says that it could be used for “new clean vehicles” placed in service after 2022. IRS guidance states you can take the credit the year you purchase the vehicle or year before. However, when I try to include a 2023 purchase date, TurboTax detects an error and won’t let me e-file! TurboTax needs to be updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

I can see where the wording can be unclear, but a vehicle purchased in 2023 will be credited on the 2023 tax return that you prepare in 2024. At the top of form 8936 it states:

Note: This credit is for qualified plug-in electric drive motor vehicles placed in service before 2023.

Purchase date vs. delivery date. Electric Vehicles Purchased in 2022 or Before

"If you entered a written binding contract to buy a vehicle before August 16, 2022, but took possession on or after August 16, 2022, and before January 1, 2023, you may claim the credit based on the prior rules and disregard the assembly requirement.

If you purchased a vehicle between August 16, 2022, and December 31, 2022, but don't take delivery of the vehicle until 2023,

see Credit for New Clean Vehicles Purchased in 2023 and After. "

@PGarciacaba

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

In support of IRS guidance that the credit may be taking the year BEFORE the purchase of the vehicle (if AGI is lower), Form 8936 clearly includes “new clean vehicles” purchased AFTER 2022. The definition of a “new clean vehicle” is one that is purchased after 2022 and meets the new criteria including:

Has a gross vehicle weight of less than 14,000 pounds;

Had its final assembly within North America;

Has a manufacturer's suggested retail price of not more than $55,000 ($80,000 for a van, sport utility vehicle (SUV), or pickup truck); and

Meets certain additional requirements discussed under New Clean Vehicle Certification and Other Requirements , later.

(See, https://www.irs.gov/instructions/i8936#en_US_2022_publink100011167)

So, it seems like you can take the credit the year before you purchased the vehicle provided the car meets the new, more stringent criteria of a “new clean vehicle “. Would you agree?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

For EVs placed into service after December 31, 2022, the Inflation Reduction Act extended the up to $7,500 EV tax credit for 10 years—From January 2023 until December 2032. This is the reference to 2023, but it represents the tax law change for 2023 through 2032, not that you can take a credit for a 2023 vehicle on your 2022 taxes.

The tax credit is taken in the year that you take delivery of the EV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

I believe the treatment is a little different for “new clean vehicles” (which are defined and treated differently than qualified plug-ins). IRS guidance pertaining to those vehicles clearly states “You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit.” This coincides with the added language on Form 8936 and the definition of a “new clean vehicle”.

See IRS guidance here: https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

TurboTax agrees with my premise. The program will not allow you to use a date after 12/31/2022.

There are circumstances where you can use the 2021 AGI for the purchase of a 2022 vehicle, but the vehicle is still posted to the 2022 tax return.

There may be a similar provision in 2023 that would allow you to use the 2022 AGI, but if the car was placed in service in 2023, it will go on the 2023 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

@JohnB5677 and TurboTax can be wrong. Would you please read my responses and let me know if it’s probable? And if not, why not? Is it even possible to use an AGI from a prior year on a form used in a subsequent year’s tax filing? I’m asking bc Form 8936 doesn’t include a space to specify what tax year the AGI pertains to, so if I included my AGI for 2022 on the form and file it with my 2023 taxes, wouldn’t that appear as a discrepancy????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

First and foremost, this update to the credit begins Tax Year 2023.

This expansion of the EV credit can only be used NEXT YEAR when you file your 2023 tax year return.

“If you buy a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a clean vehicle tax credit.”

“You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032.”

(Note- there are still available credits for tax year 2022, just not for a Tesla because Tesla hit their allowed quota in 2019)

NEXT YEAR when you file for Tax Year 2023 and you apply for a EV credit for a vehicle purchased in 2023, ( and starting in 2023 Tesla is now again eligible since the limit on eligible manufacturers is eliminated for 2023) you may have the option of using your modified AGI for Tax Year 2023 OR Tax Year 2022.

"You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit."

This link is ONLY for vehicles purchased in 2023 to 2032.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

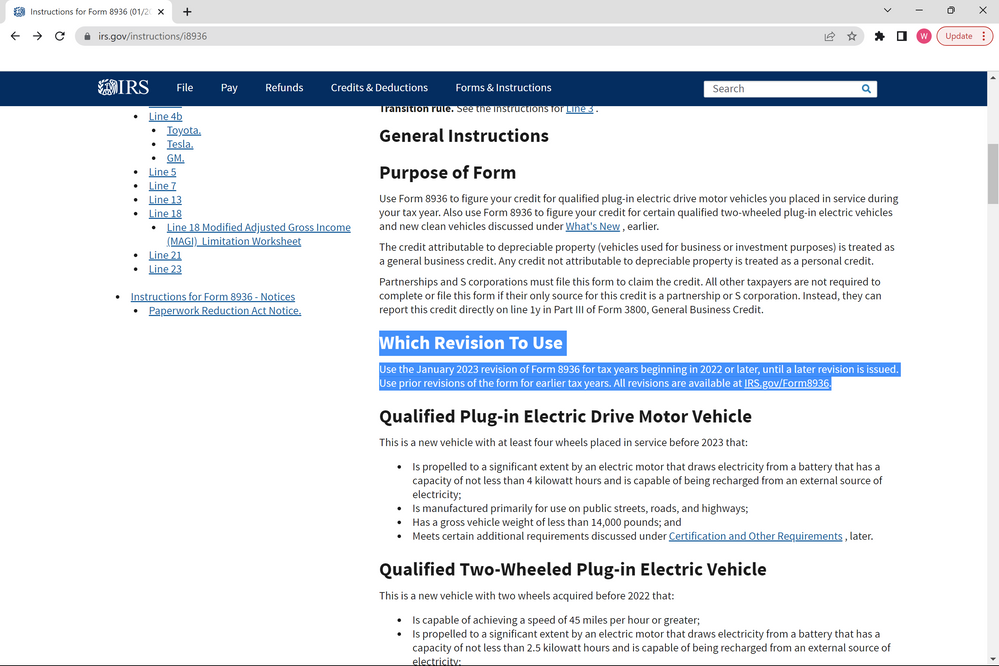

IRS claims clearly to use the January 2023 revision of Form 8936 for tax years beginning in 2022 or later at https://www.irs.gov/instructions/i8936 (screenshot attached), so TurboTax needs to support the January 2023 revision of Form 8936 for 2022 Tax Return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

TurboTax does use the 2023 revision of the form itself, but certain credits like the credit for Teslas or for vehicles not placed in service until 2023 aren't allowed in 2022. Just because this version of the form is capable of reporting some of those credits (for 2023) doesn't mean the law allows them to all be claimed in 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8936 - EV Car Incentive

@joann44 is correct. Just because the form has been updated, does not mean the law has changed. The change in law for the Tesla is for vehicles placed in service in 2023, not 2022. So unfortunately, for people who bought a Tesla in 2022, they are not eligible for the credit. If you traded it in this year on a 2023 model that is eligible, then you would be able to claim the credit when you file your 2023 return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

XEN0

Level 2

123parent

Level 1

Blahdidah

Returning Member

mia123

New Member

Anonymous

Not applicable