- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Installment sale information Form 6252 absent in Final 2024 Tax Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Installment sale information Form 6252 absent in Final 2024 Tax Return

I have reported installment sales of an inherited property in my 2024 Turbotax return for which the gain will be realized in 2025. In the "Forms" view in Turbotax, it shows Form 6252 with the proper details. But the final return does not have this form. How come? Is this a bug?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Installment sale information Form 6252 absent in Final 2024 Tax Return

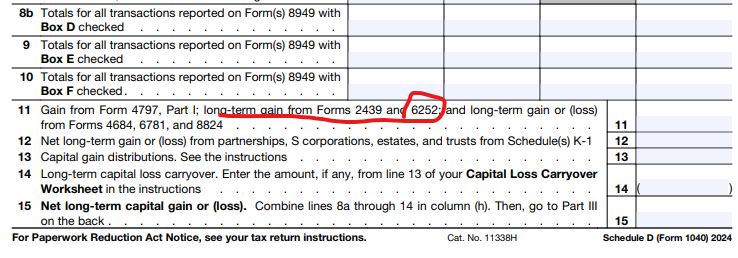

Is the gain reported on line 11 of IRS Schedule D Capital Gains and Losses? Or is the gain not reported at all?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Installment sale information Form 6252 absent in Final 2024 Tax Return

It's not reported on Schedule D at all.

The gain is not materially available to me until mid 2025. So, this is reported on Form 6252 - which shows up in the Turbotax data (2024 Windows 10 desktop version software), but even this data does not flow to Schedule D. When I print the full tax return with all the forms and calculations, Form 6252 and 6251 are not printed, neither are CA 540 Forms 3805E. But these forms do show up in the tax data.

By IRS rules, as per https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-is-irs-form-6252-installment-sale-in... , I am required to report this sale in 2024 on Form 6252 even if I have not received the payment.

Please help and advise if you have knowledge of any bug in 2024 Turbotax software for Window10 Desktop.

Thank you.

S

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Installment sale information Form 6252 absent in Final 2024 Tax Return

What do you have for the date of sale? If the sale date is not in 2024, it will not be reported in 2024. @semicurious

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Installment sale information Form 6252 absent in Final 2024 Tax Return

Hello MaryK4,

The date of sale is Nov 2024.

Kamalesh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Installment sale information Form 6252 absent in Final 2024 Tax Return

Hello MaryK4 and JamesG1 -

I found a workaround for the bug in Turbotax. When I show that I received $1.00 as "payment" in this tax year 2024, the software prints and submits the required forms 6252 (federal) and 3805E (state).

Unfortunately, Turbotax support experts on the phone (support line) could not resolve the issue I faced. The software would not submit Fed Forms 6252 and State Forms 3805E for my installment sales in 2024. They kept me on hold for 2 hours and then disconnected. Glad to have found a workaround for the bug and resubmitted my returns (Fed and State) as amendments.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

davemoser22

New Member

dave

New Member

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Dan S9

Level 1