- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I refinanced and have two 1098 forms

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Intuit, do you have a plan here? When will it get fixed? I put in a refinanced mortgage with zero cash out, and thousands of dollars dropped off my refund. This is a serious problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

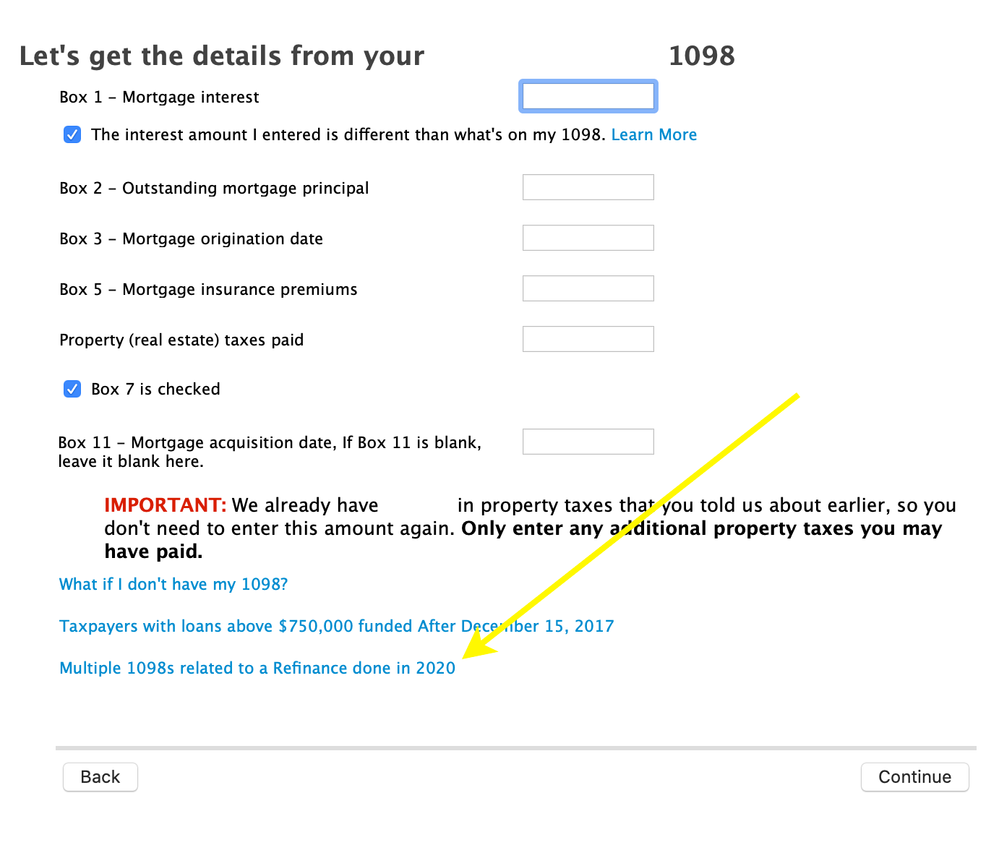

I ran into this same problem. It turns out TurboTax has instructions on this. I uploaded screen snapshots of

the instructions as well as pointing out the link to get to the instructions.

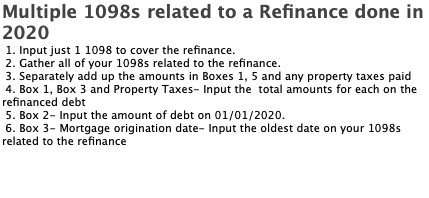

Instructions overview:

1. Input just 1 1098 to cover the refinance

2. Gather all of your 1098's related to the refinance

3. Separately add up the amounts in Boxes 1, 5 and any property taxes paid

4. Box 1, Box 3 and Property Taxes - Input the total amounts for each on the refinanced debt

5. Box 2 - Input the amount of debt on 01/01/2020.

6. Box 3 - Mortgage origination date - Input the oldest date on your 1098's related to the refinance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

So the data won't match what was filed with the IRS. I wonder how that'll go?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I appreciate this, but it seems rather dodgy to enter multiple 1098s as a single 1098. It won't match what the IRS gets and seems like it'll generate a red flag.

They are currently working on resolving the software issue, from my understanding. I think it's probably better to wait for that. If not, there is an ability to override on the desktop version and enter the average mortgage debt. I think if they can't resolve the software issue, I'll opt for the desktop version and just simply override their calculation, which in turn should make all the numbers correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

They have supposedly been working on this since last year tax returns. So I wouldn’t hold my breath. I agree with not combining the 1098s. Just adjust at the end and override their calc. It’s a pain but it keeps the forms correct and everything legit. I did that last year and will do it again this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

What number are you adjusting at the end? Can you describe what you’re doing to fix it in detail? It seems like whatever you do the data you input won’t match the forms.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I agree. I don't think that sheet with the calculation is submitted to the IRS, but even if it is, the estimate is accurate. I can manually calculate my mortgage average using the IRS' worksheet guidance. And by entering that amount, everything that is automatically calculated, including my return, becomes correct.

TurboTax really needs to get on their game and fix this, because the sad part is, while there are some of us who are aware of this issue, there are just so many others who won't be aware and will in turn file a return with a lot less mortgage deduction return than they should be getting. That's terrible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

There is a line on the mortgage deduction worksheet that lists your average mortgage indebtedness. That is what is causing the issue. On that line, it is simply adding all of our refinances, instead of taking the average. If you override it and enter your actual calculated indebtedness, instead of what TurboTax automatically populates, all the calculations become correct and the issue is resolved.

It is that line that is causing all the issues.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Yeah thanks for the info. I went ahead and switched to taxslayer. Cheaper and works as expected. Amazing to me that this bug still exists over a year in tt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

There is one way to make the online version correct.

1. Enter 0 in box 2 for 1098, except for the original mortgage

2. After entering the 1098s, click "Continue". At the "Let's wrap up your mortgage interest deduction" screen, for the original mortgage, in box "Enter your loan balance as of January 1, 2021, or the final principal balance if you paid off this loan in 2020.", enter the balance of the final refinance mortgage at the end of the year (12/31/2020).

This will cause TurboTax to

1) only account for balance of the original mortgage and not any refinance(s)

2) compute the average mortgage balance correctly with formula (beginning balance + ending balance)/2.

The deduction works out as expected compared to hand calculations. I also downloaded the worksheet to double check the calculation. In my case the mortgage that was refinanced in 2020 originated before 12/14/2017, and in the worksheet it shows 0 for mortgage balance after 12/14/2017 and the correct amounts for before 12/14/2017.

This is basically equivalent to overriding the average mortgage balance on the desktop version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

FWIW I tried on H&R Block’s service as well to see how they did the troubleshooting for this and if I should just switch. They’re instructions suggest entering a number in BOX 2 that is different from what your lenders inputted, suggesting this might not raise flags with IRS. I don’t *think* H&R Block would steer me wrong? They seem to suggest you take the box 2 number from the oldest 1098 and divide it by the number of 1098s you received and just enter that number in EVERY box 2.

Would rather stick with TurboTax but it’s infuriating they haven’t provided any guidance to rely on.

“Sometimes, your home mortgage loan might be sold to another lender. When this happens, you'll usually get one Form 1098 from your old loan servicer and a different Form 1098 from your new loan servicer. In this case, you'll need to make some adjustments to the info you enter:

- Divide your Form 1098, Box 2 amount (which is your loan balance as of Jan. 1, 2020 or your original loan balance) by the number of 1098 Forms you have for the loan. Use this number for your Outstanding Mortgage Principal.

- If the Box 2 amount is slightly different on each Form 1098, use the amount from the first lender you had in the year.”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Does Taxslayer also file CA returns, and did the mortgage interest transfer to State correctly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Some TurboTax customers are experiencing an issue with their home mortgage average balance. This can cause the home mortgage interest to be incorrectly limited. This may be affecting your tax return.

Please sign up for email notifications when an update related to this issue is available here.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

If I enter both I end up OWING almost 4k! Something is not right here. I don't owe nearly 2 million in mortgage, just 700k. I am using TT online and this has never happened to me before, I've refinanced in the past and had two 1098's before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Then how does it explain going from a refund to OWING nearly 4k on my taxes?? Something is not right here at all.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Cat_Sushi

Level 2

aecook4-yahoo-co

New Member

corpuscalossum

New Member

bobbydangelo

New Member

jasmine2323-

New Member