- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

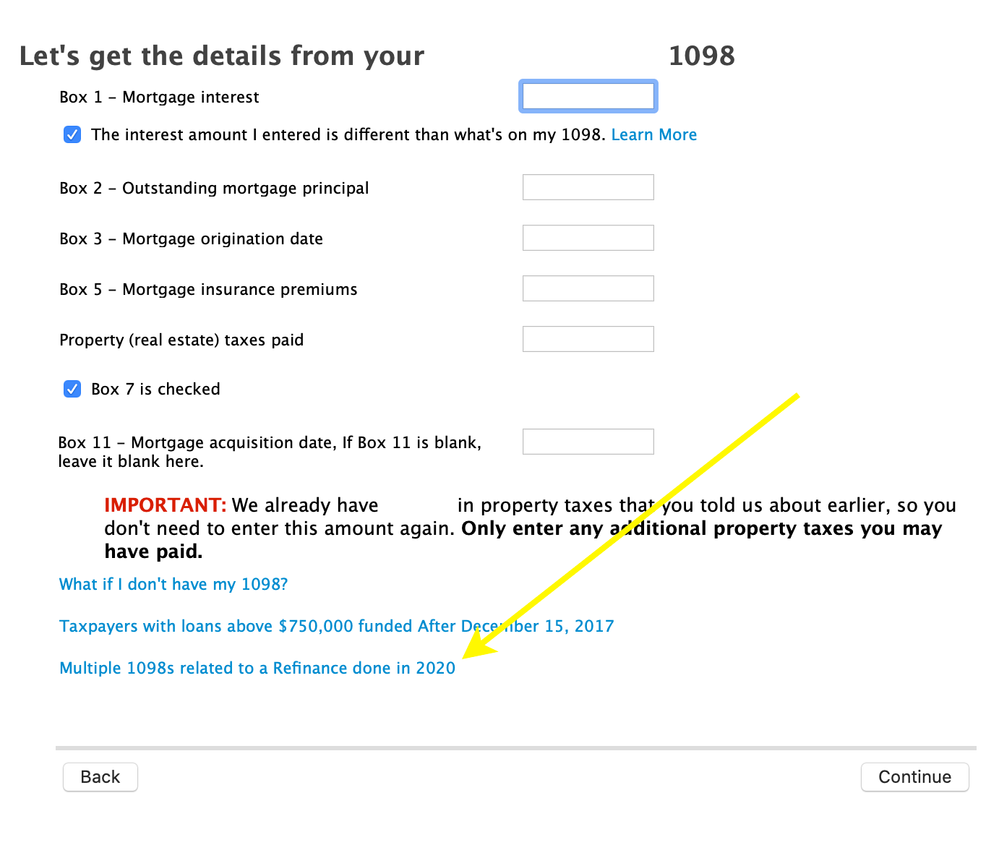

I ran into this same problem. It turns out TurboTax has instructions on this. I uploaded screen snapshots of

the instructions as well as pointing out the link to get to the instructions.

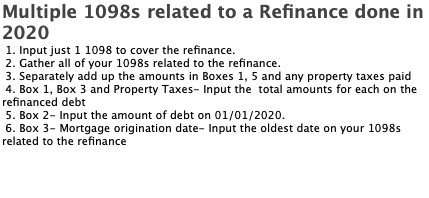

Instructions overview:

1. Input just 1 1098 to cover the refinance

2. Gather all of your 1098's related to the refinance

3. Separately add up the amounts in Boxes 1, 5 and any property taxes paid

4. Box 1, Box 3 and Property Taxes - Input the total amounts for each on the refinanced debt

5. Box 2 - Input the amount of debt on 01/01/2020.

6. Box 3 - Mortgage origination date - Input the oldest date on your 1098's related to the refinance

February 6, 2021

3:53 PM