- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Energy-efficient (solar) improvements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy-efficient (solar) improvements

In 2022, I purchased two Powerwall solar batteries and additional solar panels... in TurboTax can I lump all costs together under "Solar electric costs" or do I have to separate the two costs (i.e., a cost for the Panels under "Solar electric costs" and another for the two Powerwalls under "Fuel cell property cost")? Are there examples or screenshots that can be viewed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy-efficient (solar) improvements

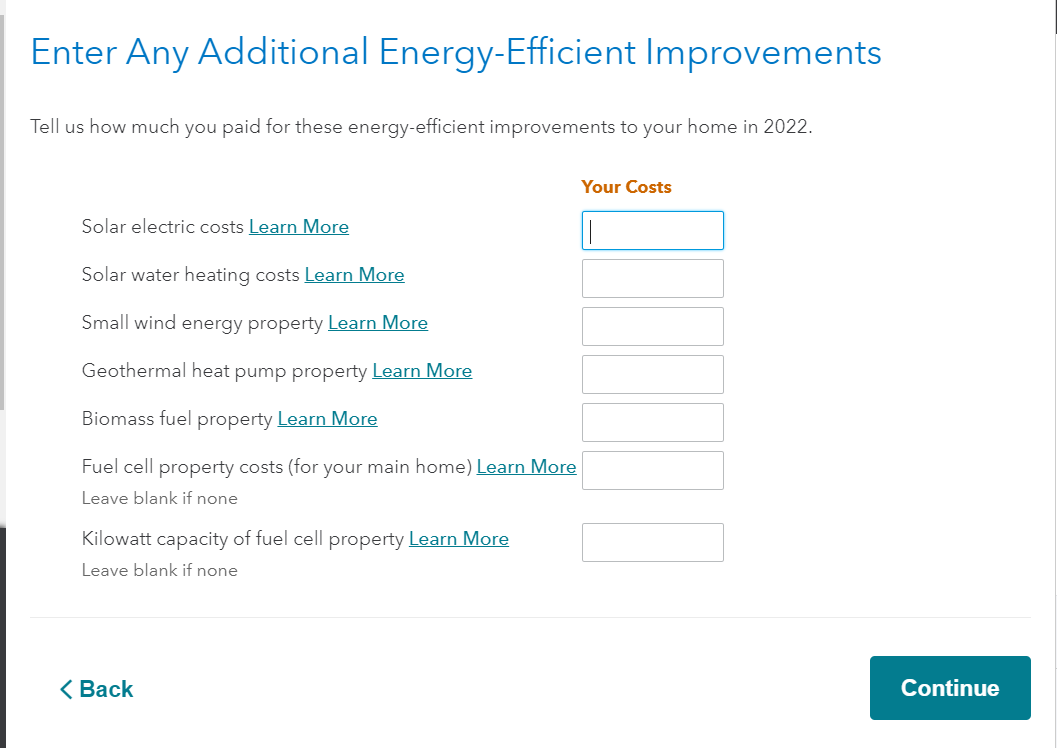

You will have to separate the costs (see below). The maximum qualifying costs that can be taken by all joint occupants is $500 for each one-half kilowatt of capacity of the property. Keep in mind that TurboTax will calculate this credit for you. All you need to do is enter your portion of your costs and the total kilowatt capacity of the property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy-efficient (solar) improvements

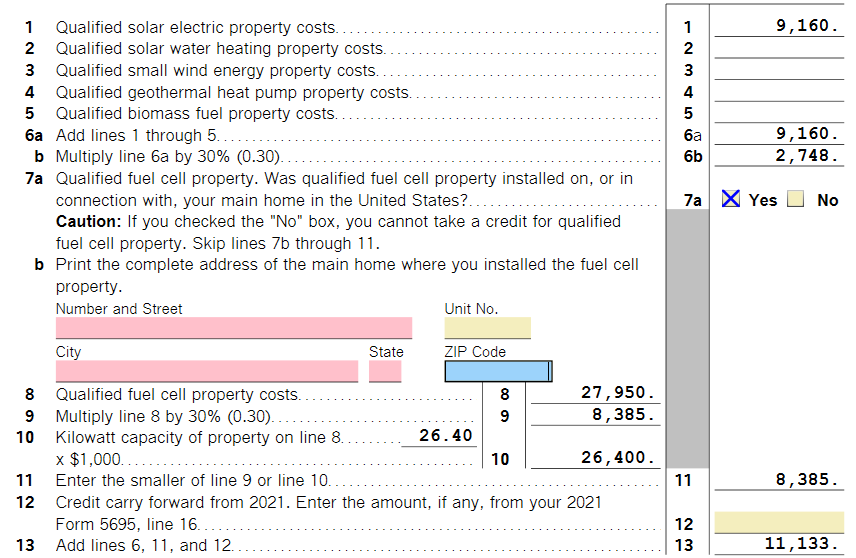

So, just confirming... for my $37,110 total cost, $9,160 was for Solar Panels (captured under "Solar electric costs"), and $27,950 was for Battery Storage (captured under "Fuel cell property cots") with a 26.4 kWh of storage capacity (captured under "Kilowatt capacity of fuel cell property"). Does this look correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy-efficient (solar) improvements

Yes, here is the calculation I got using those numbers: @Breh

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tdenby70

Returning Member

gjgogol

Level 5

HollyP

Employee Tax Expert

jmtoback

New Member

Lou7

Returning Member