- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Claiming a child as a dependent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

We are trying to claim my stepdaughter as a dependent for our 2020 return, but the software is not allowing her to qualify. We are entitled to claim her this year per the separation agreement but the system is not allowing me to designate us to make the claim. It just states she's eligible for the EIC/Dependent Care. What can I do in the system to allow us to claim her?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

Maybe you answered a question incorrectly in the interview. If you are entitled to claim your stepdaughter, try going back and revisiting the interview questions in My Info, and choose to Edit your stepdaughter.

Review your answers, particularly to the questions on how many months she lived with you and the screen Do you have an agreement with Stepchild's other parent about who can claim her? Make sure that you said yes, you do have an agreement, and on the next screen Is Stepchild's other parent claiming Stepchild per your legal agreement? that you checked no, the other parent will not claim her for 2020 per the legal agreement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

You answered one or more of the questions wrong. Go back and start over.

The only parent with the automatic right to claim the child as a dependent is the parent where the child lives more than half the nights of the year. The custodial parent can release the dependent to the non-custodial parent by giving them a signed form 8332 dependent release. That allows the non-custodial parent to claim the child as a dependent and get the tax credit. But the ability to claim EIC, dependent care credit and head of household status always remains with the custodial parent and can't be waived, transferred or shared. (The IRS follows federal law which is superior to any state court order. There is no such thing as 50/50 custody, you have to count the number of night where the child lived and it can't be exactly equal in a normal year with an odd number of days.)

If the child lived with you more than half the nights of the year, you are automatically eligible for all the dependent benefits including the child tax credit and EIC/Dependent care. If the child is only eligible for EIC/Dependent care, that means you answered that you were going to release the child dependent claim to the other parent by signing form 8332.

If the child lived with you less than half the nights of the year, you have to indicate this by choosing "5 months" or less in the program. Turbotax will then ask if you have a signed form 8332 from the other parent. When you say yes, Turbotax will assign the child tax credit but not EIC or the dependent care credit. You must mail the original signed 8332 to the IRS within 3 days after e-filing.

If the other parent refuses to sign for 8332 for you, you can't claim them as a dependent. The IRS will not enforce your custody order. But you could go to family court and have the judge order the other parent to sign.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

Isabella,

Thank you for the response. The answer to the question about the custody agreement is marked for "I have a custody agreement, divorce decree or other written agreement with Jessica's other parent". The next screen does not come up with the question about the other parent claiming the stepchild. It automatically goes to stating she doesn't qualify as a dependent. I'm not sure the software is working properly for this particular item.

Even if I were to mark that the other parent waived their right to claim as a test it still goes straight to telling me she doesn't qualify as a dependent.

Maybe there is an upcoming update?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

What are you indicating for how long the child lived in your home?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

I didn't answer any questions incorrectly. I did not answer we were releasing the claim by signing the form. The software doesn't seem to be providing me all of the correct questions. It's not asking me if the other parent can claim the child this year or if we are claiming her. My stepdaughter lives with us, the divorce decree provides the alternating dependent claim but the software isn't giving me the option to state we get to claim her this year. It automatically goes to state she doesn't qualify as a dependent. We have not had this issue in the past.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

Full time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

@mwar99 wrote:

Full time.

If living with you full time, the program should ask "do you have an agreement with the other parent" and if you answer "yes", the next question should be, "are you releasing the dependent claim" to which you would answer "no" this year and get the dependent credit. There could be a bug in the program, we can refer it for investigation.

What happens if you answer "no" to the question about is there a custody agreement? That should give you the dependent credit immediately.

Also, it is probably not this issue, but is the child's birth date correct and does the child have a valid social security number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

Yes the birth date and SS# are correct. It's the same data we used in 2018 to claim her. Step by step here is what I have selected and answered under her data:

- Blank is my child

- Filled out her info in the Tell us about your child section stating she is our daughter and none of the above for adopted or foster child

- Then US citizen, living with us the whole year and not disable or passed away in 2020

- No to her being married

- My wife as her legal parent

- No the child didn't pay for more than half of her living expenses

- I have a custody agreement with the child's other parent

After selecting there is an agreement it goes straight to not providing the qualification as a dependent.

Even if I select there is no agreement it doesn't provide qualification it states she doesn't qualify. Same thing if I select that they waived the legal right to claim her. It doesn't provide me with the option to select that we are able to claim her this year. Can you refer it for investigation? Thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

Ok, sounds like a bug. By the way, a step-parent is also a legal parent and has the same rights to claim a dependent as a biological parent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

What happens if you say there is no custody agreement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

It is a bug.

It does not matter. The desktop version will not allow a qualifying child dependent at all unless both parents are the biological parents. If you indicate that only one parent is the biological parent then it always ends up being a non-dependent no matter how the questions are answered and part of the interview is skipped altogether. It is broken bad.

The online version is correct so I am assuming that the upcoming 1/7 update will fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

Same thing, no additional choices and she doesn't qualify. As noted in the other post by macuser, if I say both my wife and I are her legal parents than it allows her to qualify, but if I chose that it doesn't create the forms needed to show that we can claim her this year under the agreement. Can't file yet anyway so I'll wait to see what an update does.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

If the child lives with you full-time, or at least more than half the year, then you don’t need any extra forms to claim the child as a dependent. You don’t submit anything related to your custody agreement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming a child as a dependent

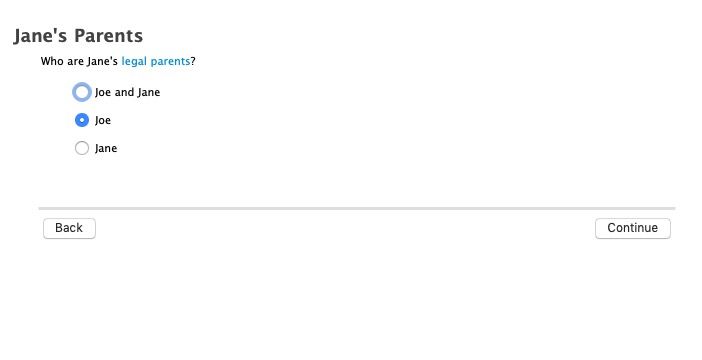

@Opus 17 - It makes no difference. the problem is this question. Unless the question can be honestly answered "Jane & Joe" the child is ALWAYS a non-dependent if answered Jane OR Joe.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy_meckley

New Member

AE_1989

New Member

g456nb

Level 1

stephanie-dotson

New Member

berniek1

Returning Member