in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Child's college tuition 1098T - can't enter in deduction. why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child's college tuition 1098T - can't enter in deduction. why?

My child graduated last year, May 2019. We paid the last semester's tuition. Some portion of the tuition was paid by 529 funds that we withdrew in 2018 (then we closed the account since she was graduating in Spring 2019) and the remaining balance was from our out of pocket. So we had no 1099Q for 2019. We received 1098T for the tuition we paid for the last semester. Attempting to enter the amount on 1098T on our tax returns since we are claiming her as a dependent since she still lives with us after graduation and didn't support herself more than50%. But Turbo Tax won't let me enter the 1098T amount telling us it's not deductible. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child's college tuition 1098T - can't enter in deduction. why?

If the Box 5 amount on your daughter's 1098-T is larger than the Box 1 amount, you don't qualify for an Education Credit, which may be what TurboTax is telling you.

There are also Income Limitations to claiming Education Credfits.

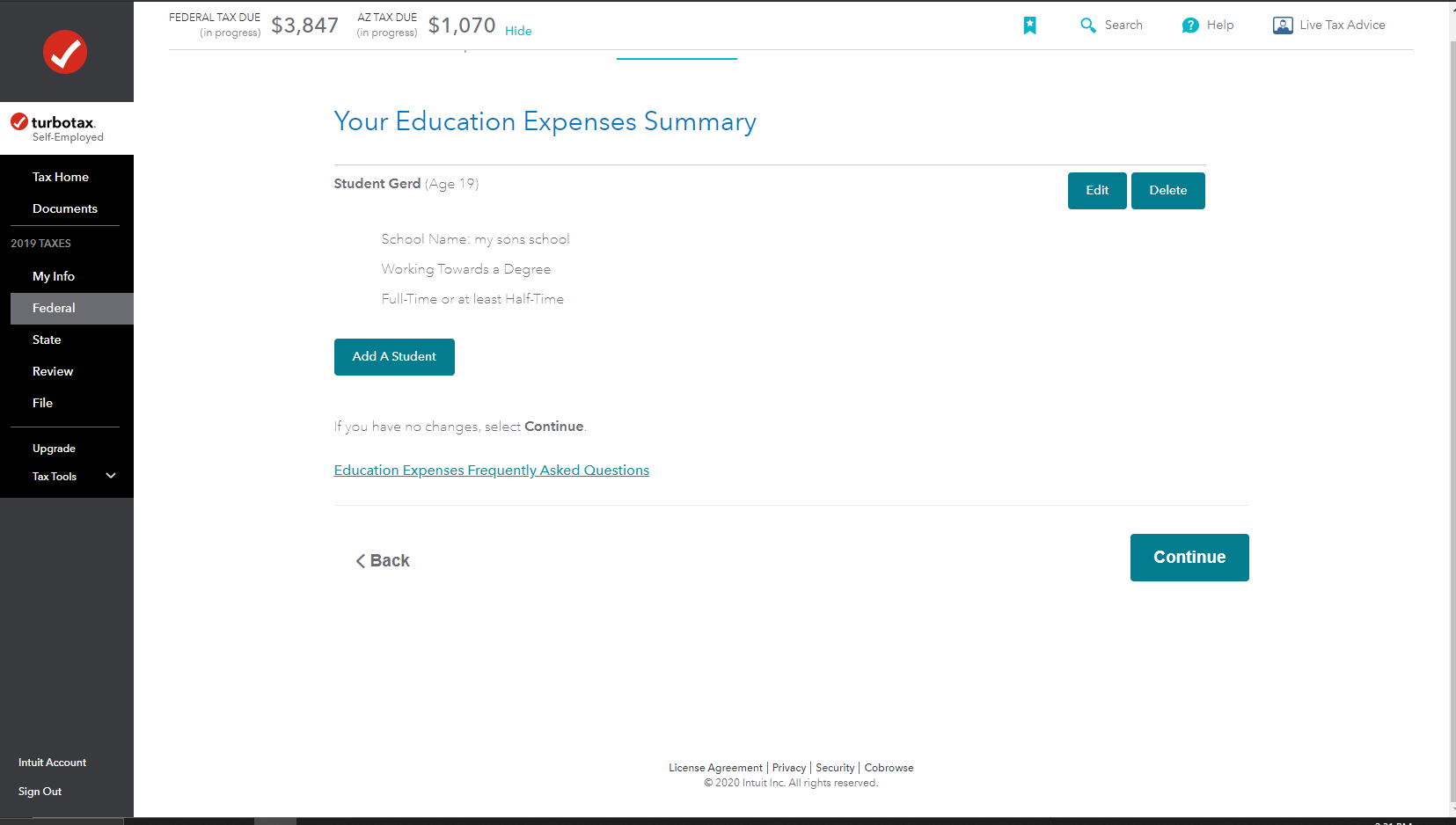

At the end of the Education section, EDIT your Student to be sure all entries are correct (hasn't claimed AOC four years, at least half-time, etc.).

Then EDIT the School and go through the 1098-T entries again (or delete/re-enter).

If the 1098-T is not correct, you can check the box 'this is not what I actually paid the school' to enter the out of pocket expenses you paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child's college tuition 1098T - can't enter in deduction. why?

my daughter entered college in August 2022 why can't i enter tuition into turbo tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child's college tuition 1098T - can't enter in deduction. why?

In the Search menu, type "1098-t" no spaces and with the dash, then click the blue icon jump to link and it will take you to the form, select yes to "Do you want to enter your higher education expenses?"

If she is claimed on your return and qualifies as your dependent, you select your daughter as the one who received the 1098-T and report all boxes where indicated in the interview section. Almost like entering a different form (for example, a W2). When done entering all her expenses for required materials and other educational expenses, it will give you your deduction/credit amount, if applicable.

@lrs56

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Majk_Mom

Level 2

anonymouse1

Level 5

in Education

ericbeauchesne

New Member

in Education

willowpoe

New Member

tenacjed

Returning Member

in Education